Geothermal HVAC has proven itself to be a reliable, efficient, and renewable source for indoor comfort for decades. The alignment of government tax credits, climate activism, and technological advancements is making the technology hotter than ever before.

As network geothermal systems break ground in record numbers, the HVAC contractors responsible for installing and maintaining these systems are met with ample business opportunities.

“Network geothermal is an extremely lucrative opportunity for HVAC contractors,” said Jay Egg, president of Egg Geo LLC, and a longtime proponent of ground-source heat pump technology. “The market has exploded, offering a great opportunity for contractors, big and small, to take advantage.”

What Is Network Geothermal?

Network geothermal systems are ground-source heat pumps that deliver heating and cooling through a series of buildings. These heat pumps transfer heat via a liquid, commonly water, in a looped pipe system. In heating mode, a ground-source heat pump pulls heat from the ground and transfers it indoors. In cooling mode, the cycle is reversed.

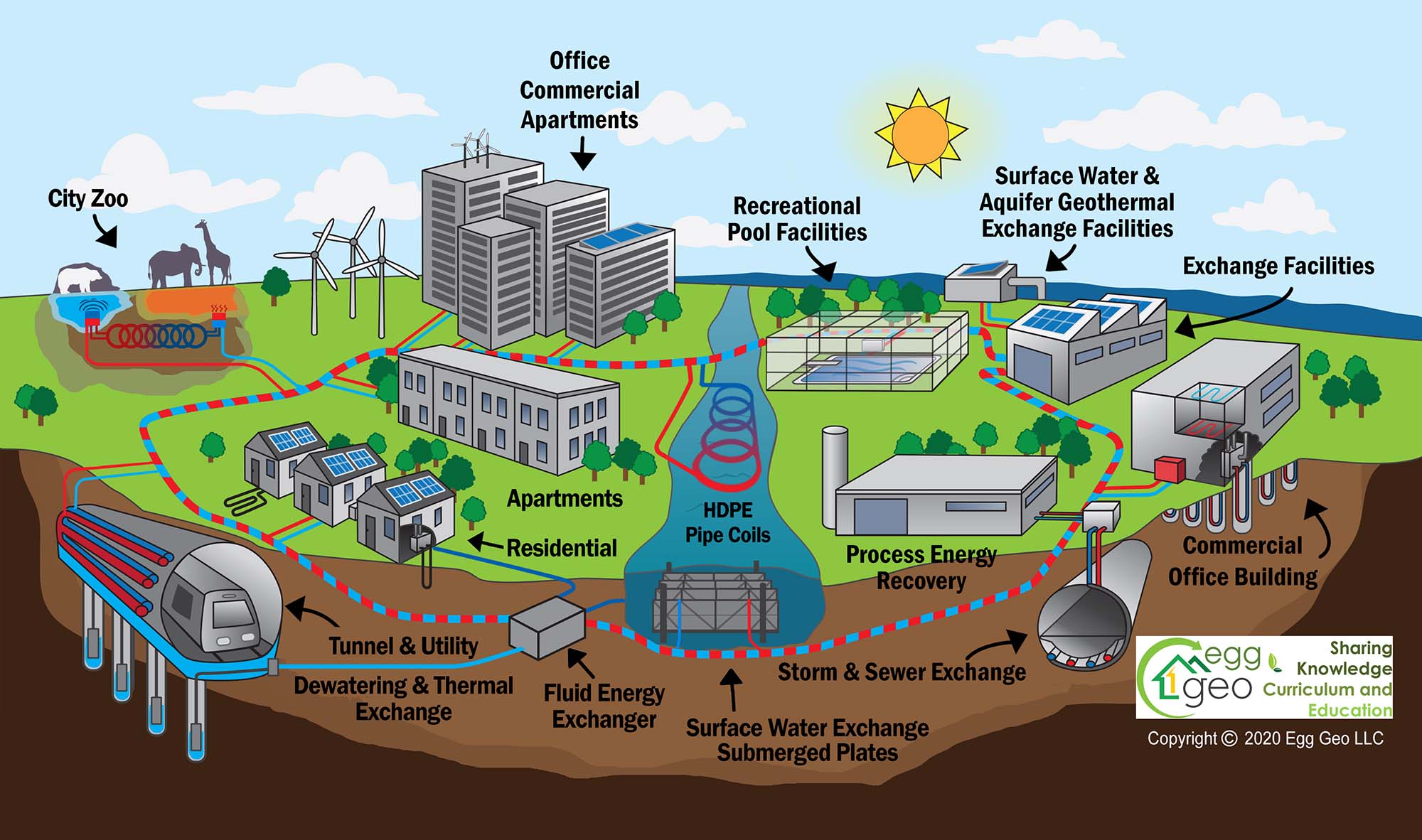

Click diagram to enlarge

BUILDING TO BUILDING: Network geothermal systems are ground-source heat pumps that deliver heating and cooling through a series of buildings. (Courtesy of Egg Geo)

The hot fluid that emerges from the earth may be used for a variety of different things, including electricity, heating, and cooling.

These network geothermal systems — commonly referred to as district geothermal systems, geogrids, or thermal energy networks — are often configured in one of two ways: those that use central plant systems to heat and/or cool buildings (generation four) and those that circulate geothermal water throughout the campus to comfort/HVAC systems located at the building sites (generation five).

Generation four systems are appealing to applications, such as college campuses, that have existing central plants because they can be retrofitted from a single location. Assuming the chilled and hot water piping is in good shape, it can be reused in the geothermal system infrastructure. Ball State University is one of several campuses using a generation four configuration.

The generation five configuration is easily expandable and suffers no distribution losses. These systems actually gain energy because their buried horizontal piping interacts with the ground. A generation five system utilizes a single set of uninsulated geothermal water pumps to push ambient, geothermal water through the system, requiring less energy than a generation four system, which has to push chilled water, hot water, and geothermal water, making it more expensive by comparison. Lake Land College is a great example of a generation five configuration.

GENERATION FIVE: A generation five system utilizes a single set of uninsulated geothermal water pumps to push ambient, geothermal water through the system. (Courtesy of Comfortworks)

When deciding which configuration is best, the cost of piping is a primary differentiator.

“For 24-inch, pre-insulated steel piping, a 1-foot length will cost $11,156 if there are four pipes involved, and that doesn’t include the trenching, that’s just the pipe itself” said David Traxler, associate mechanical engineer, Burns & McDonnell. “For a 24-inch insulated HDPE pipe, the cost is about $1,660 for foot. For 24-inch uninsulated HDPE pipe the cost is $354 per foot. When expanding or putting in a new generation five system, the cost for piping is going to cost a fraction of what you're going to pay for buried chilled and hot water piping.”

PAY THE PIPER: When deciding which configuration is best, the cost of piping is a primary differentiator. (Courtesy of Comfortworks)

president, Egg Geo

Contractor Considerations

Numerous geothermal credits were included in the Inflation Reduction Act, providing generous tax benefits for companies and business owners that pursue geothermal comfort, including a 30% bonus rate, 10% bonus rate for domestic content, up to a $5 per square foot tax deduction, and a five-year accelerated depreciation and one-year bonus depreciation (see sidebar).

“We're working on a 20 million-square-foot, $250 million project in Manhattan that’s going to provide heating and cooling for almost 5,000 families and about 40 high rises,” said Egg. “The original payback for this retrofit was just under eight years. But, when you figure the IRA rebates into this, that price tag was nearly cut in half.”

Network geothermal projects are advantageous to contractors due to their extended timelines.

“After completion, long-term service contracts are beneficial for maintenance contractors,” said Terry Proffer, geothermal manager, Major Geothermal. “Retaining the same contractor is an advantage to the end user because they are familiar with the design and upkeep of the system.”

Proffer has experience with two district geothermal installations — a government campus in Wyoming and the Josephine Commons low-income housing development in Louisville, Colorado — and is currently working on another, a campus-wide system at Montana State University.

“In these projects, the first thing a contractor has to determine is if the district geothermal system has a plentiful cost-benefit value,” Proffer said. “Then, multiple questions come up, including is there sufficient diversity of loads between buildings for load sharing, will pumping costs eat up any potential load-sharing advantages, is there any advantage of economy of scale for one or multiple bore fields versus dedicated fields for each building, can sufficient infrastructure be installed for a project-wide piping distribution and tie-in to various buildings, does a geothermal system resolve problems that dedicated fields cannot overcome, and more.”

Not all projects fit within the district geothermal template, and a contractor shouldn’t try to force it into place, said Proffer.

“A residential development rarely benefits from a district geothermal system,” said Proffer. “The loads for most residential applications are controlled by the climate. When one home is in heating mode, the rest are typically also in need of heat. The same can be said for cooling. So there really is no advantage for load sharing. In fact, the added district pumping cost is a further reduction in efficiency for the overall system where load sharing potential is low or nonexistent.”

While network geothermal systems may be rewarding for contractors, they offer challenges as well.

Traditionally, one of the tallest hurdles for contractors to overcome is gaining approval to install the underground infrastructure.

“Connecting the buildings is always a challenge,” said Egg. “Like a city water line, we have to have a way to move the fluid through the loop so the buildings can tap into it and connect with one another.”

In addition to gaining property owners’ permission and the physical challenges of burying the necessary pipes, many projects have been stifled by regulatory language that prohibited publicly regulated utilities from selling thermal energy that was created using renewable energy sources. Egg; his wife, Kristy; John J. Murphy, international representative, United Association of Journeymen and Apprentices of the Plumbing and Pipefitting Industry of the U.S. and Canada (UA); and others pushed for change.

“We took pipe trades union leadership, including John Murphy and several others, on a tour of our project at Penn South in February of 2022, and they were blown away,” Egg said. “They immediately initiated efforts to draft a bill with the Building Decarbonization Coalition (BDC), and other activist groups, called the Thermal Energy Networks and Jobs Act, which required every utility in New York to implement at least three thermal energy networks, granted them the right to sell thermal energy they did not create, and allowed them to cross property lines to implement such systems. Governor Hochul signed it into law in July, and several other states have drafted similar legislation since.”

David Hatherton, owner of Hatherton Co. and cofounder of WaterFurnace Intl., said burying geothermal pipe is no different than any other underground utility. If an administrator wants it badly enough, it’ll get done, he said.

“We can put in internet lines, fiber-optics, gas lines, sewers, water mains, etc., why can’t we install geothermal pipes,” he asked. “When retrofitting towns, cities, and campuses, you have to consider district geothermal. It’d be foolish not to.”

As a contracting company, if you have the resources available, Hatherton said network geothermal is a solid bet.

“It’s going to bring thousands of jobs to the industry,” he said. “From the site work to the geological surveys to the drilling and the HVAC maintenance that follows, this is an area that’s going to bring in a lot of money for contractors.”

Egg called the onset of district geothermal systems the final frontier in the monetization of energy.

“Network geothermal is like an energy recovery ventilator for an entire city,” he said. “These systems allow entire cities to recover energy that’s now being wasted through cooling towers, piping, and other applications. Every city now has the opportunity to install these systems. And once they learn of all the benefits, why wouldn’t they?”

Inflation Reduction Act - Geothermal Tax Incentives

Extension of the Renewable Electricity Production Tax Credit (Section 45)

Extends the existing production tax credit for applicable renewable energy sources. This tech-specific PTC ends in 2024 and is replaced by the new tech-neutral Clean Electricity PTC (45Y) which begins in 2025. The credit extends the date of construction for geothermal facilities to 2024.

Extension of Energy Investment Tax Credit (Section 48)

Extends the existing energy investment tax credit for applicable energy projects. This tech-specific ITC ends in 2024 for most technologies and is replaced by the new tech-neutral Clean Electricity ITC (48E), which begins in 2025.

- Extends date of construction in most cases to 2024 and maintains a 10% or 30% credit.

- Maintains 30% credit for geothermal property constructed before Jan. 1, 2025.

- 30% credit for geothermal heat pump projects constructed before Jan. 1, 2033. Credit reduces to 26% in 2033 and 22% in 2034.

Credit for Residential Clean Energy (25D)

- Extends credit through 2034 for residential solar, wind, geothermal, and biomass fuel.

Report Abusive Comment