|

| Click here for a PDF of the R-22 allocation chart. |

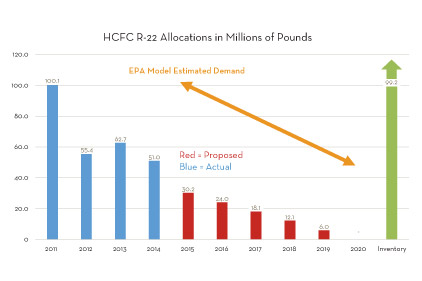

The U.S. Environmental Protection Agency (EPA) has proposed a final timeline for the phaseout in production of virgin hydrochlorofluorocarbon (HCFC)-22. The proposal picks up on a previous timeline in production that allowed 62.8 million pounds of new R-22 in 2013 and 51 million pounds in 2014.

What the EPA is calling its “preferred HCFC-22 consumption allocation for 2015-2019” shows an allowance of 30 million pounds in 2015, 24 million pounds in 2016, 18 million pounds in 2017, 12 million pounds in 2018, 6 million pounds in 2019, and zero in 2020.

“Under this approach, the annual decrease in allowances would be the same every year such that there is a constant annual decrease in allocation from 2015 to 2020,” said the EPA, in a statement.

Two Variations

The EPA also advanced what it’s termed two ‘variations’ to its phase down plan.

The first starts the final phase down at 27 million pounds in 2015, then drops it to 18 million pounds in 2016, and 9 million pounds in 2017, before ending all production in 2018. According to the EPA, this is being proposed to greater encourage reclamation of existing supplies of R-22 and retrofitting R-22 systems with alternative refrigerants.

The other variation, which is being labeled as an “estimation approach,” allows about 50 million pounds in 2015 and bases the phase down to 2020 on “estimates of servicing need, recovery, and reuse, which could also account for transitions to alternatives and any estimates of existing R-22 inventory,” according to a statement from the EPA.

A 60-day comment period takes effect once the proposed rule is published in the Federal Register. As of Dec. 16, 2013, the proposed rule had not been published, which means the comment period could extend into February 2014, at the earliest, thus a final EPA rule may not come until mid-2014.

Contractor Considerations

There will probably not be any short-term effect on a contractor’s ability to get R-22 when needed as the industry is currently sitting on an estimated 100 million pounds of inventoried R-22, based on input garnered by the EPA from large producers and importers.

This comes at a time in which no new R-22 systems are coming to the market. The air conditioning sector embraced HFC-410A over R-22 long ago. The refrigeration sector, especially in supermarkets, is rapidly moving away from R-22. In addition, end users are demanding, and contractors are utilizing, better leak-detection and tightening practices. In fact, the EPA, through its Greenchill program, is offering special awards and recognition to supermarkets utilizing alternative refrigerants and leak-tight systems.

Industry Comments

George Koutsaftes, business director, heat transfer products for Honeywell, said, “Honeywell recognizes and applauds the effort the EPA is making to understand industry concerns and develop a rule that is workable.

“It is generally understood the market was in a state of oversupply during 2013 and the EPA proposal suggests current channel inventories are now above where they were at this point in 2012. The resulting downward pressure on R-22 price has slowed the adoption of alternative products as many end users deferred or cancelled retrofit activity. Restrictions on allowances are required to restore the supply and demand imbalance, to resume forward progress in the conversion to alternative refrigerants, to increase recovery and reclamation, and to be prepared for no HCFC-22 allocation in 2020.”

Jay Kestenbaum, senior vice president of sales and purchasing for Airgas Inc., said, “The EPA offered several proposals as a way of focusing everyone on several specific options rather than leaving it wide open and subjecting them to so many different possible answers that they would have a bigger problem in deciding what to do. If they get a significant group of responses that favor one proposal, it would be much easier for them to decide on an action based on that response than if they get a wide range of responses across many different scenarios.”

Matt Ritter, director of government affairs for Arkema Inc., agreed with floating multiple options. “Considering that this will be the final HCFC rule, we believe it is indeed important to consider a number of scenarios before locking in on a final decision.”

Some companies are opting for the quickest phaseout possible.

“Of the options that the EPA has put forth for the 2015-2019 allocation, the smallest option — the three-year option with the smallest amount of allocation — is still too large,” said Gordon McKinney, vice president and COO, ICOR Intl. Inc. “Our opinion, based on the amount of product that we see in the market right now and the significant impact that alternative refrigerants have had on the industry, is that the R-22 service requirements are far smaller than what anyone ever imagined and that the R-22 allocation could be cut down to nearly zero for 2015 and we could still survive.”

Kevin Zugibee, chairman and CEO of Hudson Technologies Inc., believes that the EPA’s phaseout plans are not accomplishing its own goals of sustaining growth in recycling and reclamation.

“The best way to achieve those goals would be to provide no additional allowances after 2014, and that the reclamation industry could fully support the aftermarket starting in 2015,” he said. “However, of the options presented in the proposed rule, we believe that providing for final phase out by 2018 is the best option presented for achieving this goal.”

ACCA

Charlie McCrudden, senior vice president of government relations for the Air Conditioning Contractors of America (ACCA), said, “ACCA is pleased that the notice of proposed rulemaking was released early enough to allow the EPA time to take comments and finalize the rule before the regulatory period begins.”

He joined others in favoring a linear timeline. “A linear drawdown is preferred to the estimation approach, no matter the starting point for 2015. The estimation approach is less certain and relies on EPA’s ability to respond to what could be rapidly changing — and possibly incorrect — market conditions.”

McCrudden also noted that the proposed rulemaking allows for further resolution of matters related to dry-shipping of R-22 units and no venting enforcement.

The dry-shipping issue arose in 2010 with a perceived loophole regarding continued production of R-22 condensing units produced as components after a ban on shipping entire R-22 systems took effect.

McCrudden said, “ACCA welcomes the request for comments on whether EPA should consider banning the dry-shipped R-22 condensing units through a separate rulemaking process. A long-standing petition that looks to end the allowance to manufacture and install dry-shipped units as replacement parts after the 2010 milestone needs to be resolved.”

And, he noted, EPA is seeking to find better ways to enforce bans on venting refrigerants.

“ACCA is also pleased that the EPA is requesting comments on ways to maximize compliance with Section 608 requirements. While most HVACR technicians abide by the rules in place, the playing field is tipped in favor of the bad actors who are not certified or purposefully vent refrigerants when no enforcement exists,” he said.

Publication date: 12/30/2013

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!

Report Abusive Comment