"You could say we were surprised," said one York official at the initial announcement, who asked not to be identified.

"However, the general mood is that this will be an excellent fit. Johnson Controls is a very strong company and York will give them an air conditioning division, which they've never had. Change, as you know, is inevitable, and as company sales go, this should be good for all parties concerned."

On Dec. 9, York International voted in favor of Johnson Controls acquiring York, the final step in the transition. Johnson Controls assumes $800 million of York International's debt, while stockholders stand to receive $56.50 for each outstanding common share.

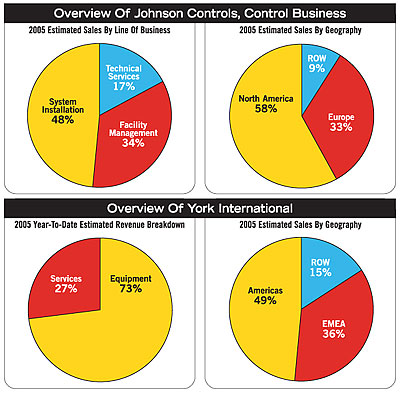

With the vote, York, with estimated annual revenues of nearly $5 billion, is now part of the Johnson Controls Building Efficiency Business, which generated sales of $5.7 billion in 2005.

Following the completion of the transaction, Johnson Controls board of directors elected former York CEO and President C. David Myers as a vice president and corporate officer of Johnson Controls. Myers was also named president of its Building Efficiency Business.

According to Johnson Controls, the combined business will serve customers in 125 countries from over 700 locations.

"The complementary capabilities of the two businesses create an offering that will reshape our industry and deliver benefits to our customers and shareholders," said Stephen A. Roell, Johnson Controls vice chairman and executive vice president.

"Since the acquisition was announced, a team of employees from both companies have been working together to plan for the quick and effective integration of our organizations.

"Because of our similar cultures and values, we've been able to work productively from the very start, and we are pleased with the progress we have already made.

"As we have moved through the integration planning process, we have become increasingly confident in our ability to deliver the expected $275 million in cost and growth synergies by 2008 as we outlined in our original announcement in August."

York International is already seeing changes at its headquarters. Nearly three weeks ago, the company announced 47 layoffs of salaried employees, including a chief financial officer.

Helen Marsteller, vice president of investor relations, whose position also is being terminated, said the jobs eliminated are ones redundant to those at Johnson Controls' headquarters. More layoffs are expected next year, but there is not yet a definitive number of further eliminations, said Darryll L. Fortune, spokesman for Johnson Controls' Building Efficiency division.

"We don't anticipate any more until the spring," he said.

York wasn't the only acquisition Johnson Controls made in 2005. In early November, the company announced its plans to purchase Detcon S. A., Buenos Aires, Argentina.

"We will continue to make niche acquisitions," said Alex Molinaroli, vice president and general manager, Johnson Controls, Controls Group-Americas, when the company acquired Cal-Air Inc. in 2004, and they have.

Publication date: 12/26/2005

Report Abusive Comment