The opportunity for increased adaptation of heat pumps remains strong. Consumer awareness and opinion are both improving, along with the technology. Manufacturers see a strong market ahead, although some challenges remain.

Heat pumps, both ducted and ductless, have experienced significant, double-digit growth year-over-year for more than three years, said Brandon Chase, senior product marketing manager at Lennox Industries. Although ductless growth has outpaced that of ducted heat pumps, the combination of the two has accounted for a large percentage of the industry growth seen in recent years.

There are a number of factors driving this growth. Consumer awareness is growing as a result of utility incentives, Chase said. Adding to that are the decarbonization push and changing building requirements. Looking to the future, heat pumps will experience continued growth and adoption, he said, especially if incentive programs continue.

“As the world becomes more conscious of environmental sustainability and as decarbonization regulations evolve, heat pumps will become the primary heating source,” Chase said.

The latest advancements have primarily been to the control boards and variable-capacity compressors that are applied to units to reach the recent cold-climate requirements adopted across the northern U.S. and Canada, Chasse said.The overall increase in variable-capacity usage has led to greater access to higher-efficiency options at more competitive price points, which in turn has boosted homeowner adoption.

Opportunities Increase with Efficiencies

However, consumer awareness has yet to experience organic growth driven by changing homeowner preferences, Chase said. Research from METUS backs this up. It indicates that while almost 70% of homeowners use electricity as their primary fuel source for cooling and heating their homes, less than 20% of those homeowners recently purchased a heat pump as their primary source of cooling their home.

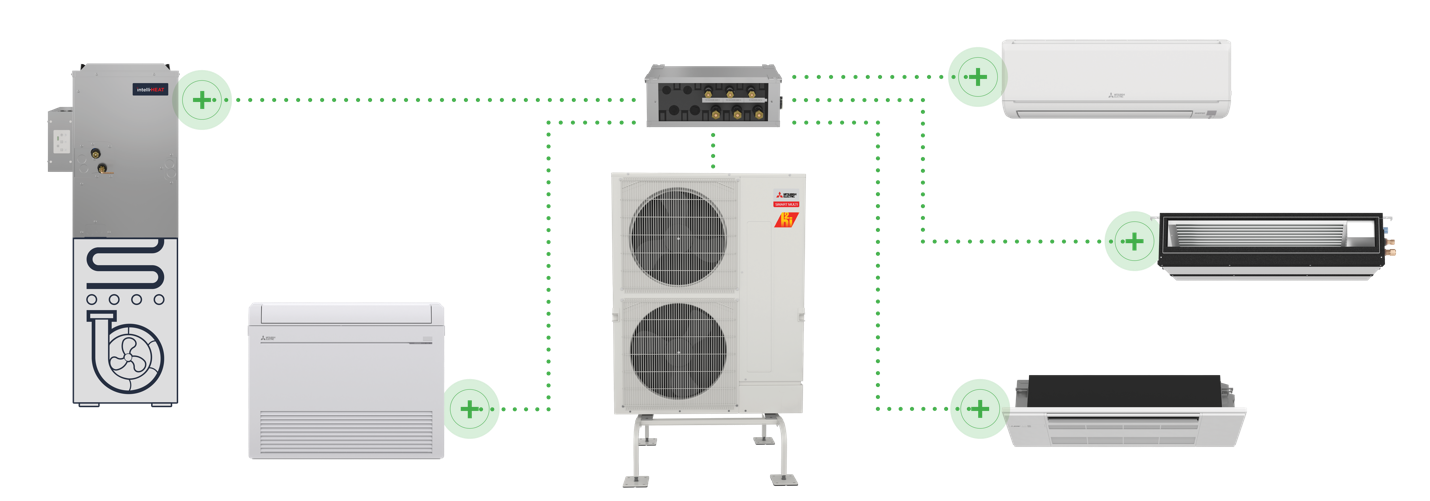

Click diagram to enlarge

BETTER TECH: Heat pump technology continues to improve. For example, the Intelli-Heat heat pumps from METUS allow consumers to improve their home’s comfort and sustainability by applying an electric heat pump to the furnace. The natural gas furnace remains available as a backup heating source for extreme cold events. (Courtesy of METUS)

Michelle Robb, senior director marketing for METUS, takes a positive view of those statistics. He said there is a great opportunity to decrease that margin.

“We foresee improved efficiencies and a greater acceptance of the capabilities of heat pumps, specifically their abilities to provide reliable, efficient heating in extreme cold temperatures, as the future for our industry,” Robb said.

In the commercial market, Drew Turner, global marketing manager for Danfoss Climate Solutions, sees significant growth in customer interest in heat pumps as a way to reach decarbonization goals set by progressive states and municipalities. The interest is higher than sales, but the sales growth is also starting to be realized, Turner said.

“The market is still figuring out how to implement large heat pumps in an efficient and resilient manner while minimizing operating costs and achieving a strong payback compared to the fossil fuel-based heating equipment it is replacing,” he said.

Director of public affairs, Danfoss

Heat Pumps Serve the Workplace, Wherever That Is

John Sheff, Danfoss’ director of public affairs, said decarbonization policies in certain areas, such as New York and California, are making commercial building owners increasingly aware of the need to replace fossil fuel-based heating with heat pumps. Sheff said they are currently in the process of learning the best ways to do so.

“They have recognized that this is critical to decarbonizing heating, with the corresponding growth of renewables in the power grid,” Sheff said. “As the technology develops, especially for cold climates, and commodity prices increase, I believe building owners will see the benefits of heat pumps and the awareness will grow.”

A factor driving heat pump adoption connects the commercial and residential markets, and that’s the popularity of remote work. Robb said consumers spending their workday at home now experience the pros and cons of their current heating and air conditioning systems.

“We expect to see a growing demand for heat pumps designed to improve comfort, indoor environmental quality (IEQ), and energy consumption,” she said. “Happy homeowners help prove how our modern, variable-capacity heat pumps deliver reliable heating in cold climates down to -13°F.”

Education Leads to Normalization

Robb said heat pump myths and misconceptions are obstacles the industry is overcoming with education programs and by helping contractors deliver comfortable homes. The industry is also working to debunk old notions linking efficiency and sustainability with poor user experiences. Robb said that when homeowners choose an all-electric heat pump, they’re getting combustion-free heating and energy-efficient air conditioning in a single system. Increasing efficiency and reducing fossil fuel use improve a home’s sustainability.

Sheff said that as heat pump technology continues to develop, its use will become normalized. Air-to-water heat pumps will become the norm in new construction, especially in milder climates, because ultimately they will be more efficient and cost-effective than burning natural gas, he said. The next step will be systems that utilize waste heat from a data center or commercial refrigeration systems as a heat source.

“These larger scale systems are incredibly efficient and we are already seeing them in Europe,” Sheff said. “Until we get to that future state, however, I do believe that hybrid or dual fuel systems are going to become more popular.

“We’ve already seen projects in which heat recovery chillers are used that are saving 50-60% on natural gas usage during the shoulder seasons. These are real savings — both in terms of emissions and money — that can be realized today.”

Renewables Provide Potential

On the consumer side, Turner sees growth potential in renewables, such as geothermal. He said the biggest challenge for expanding the heat pump market is the low cost and operating temperature flexibility of the fossil fuel-based heating equipment it is replacing. A boiler or a furnace is relatively inexpensive, and the cost to operate it is roughly the same at higher and lower heating operating temperatures.

This challenge sets up opportunities to make it easier for consumers to implement the most efficient heat pump-based heating system possible, Turner said. This is accomplished on the heat source side by showing how and where it is possible to implement water-to-water heat pumps using higher source temperature solutions, such as retrofitting a critical facility cooling system or utilizing geothermal energy to supply the same or a nearby facility heat load.

On the demand side, it is accomplished by retrofitting higher temperature constant-flow heating equipment to lower temperature variable flow. On the operating cost side, the other challenge and opportunity is ensuring a system that is resilient to the variable electricity costs that come with more power from renewables, Turner said. This is accomplished with larger-scale systems with built-in storage and resulting flexibility to react to those price signals.

Report Abusive Comment