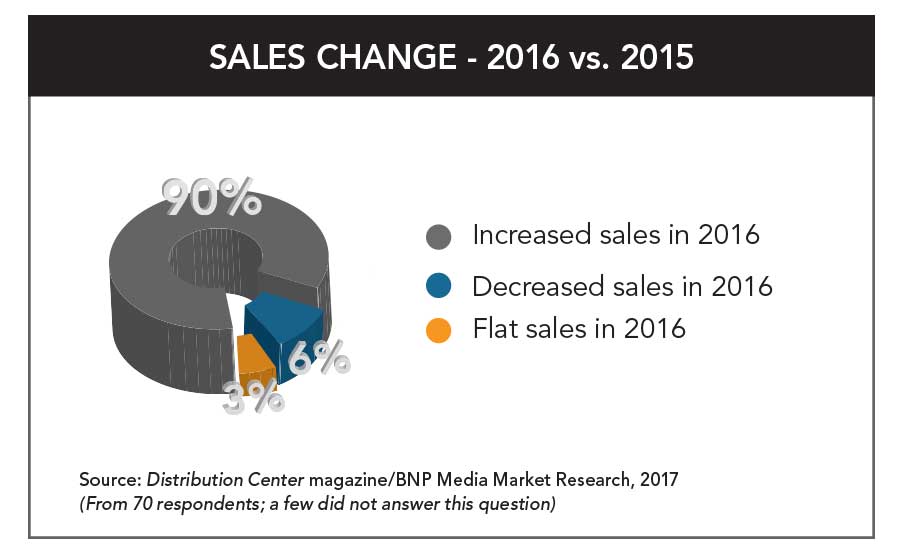

The percentage of HVACR distributors who reported sales increases in fiscal year 2016 was the highest since fiscal year 2013, when 96 percent enjoyed higher sales. In fiscal year 2014, 75 percent saw a rise in sales; while 2015 brought an additional rise to 77 percent. The 90 percent of distributors who said their 2016 HVACR sales were up reported an average increase of 10.4 percent compared to 2015.

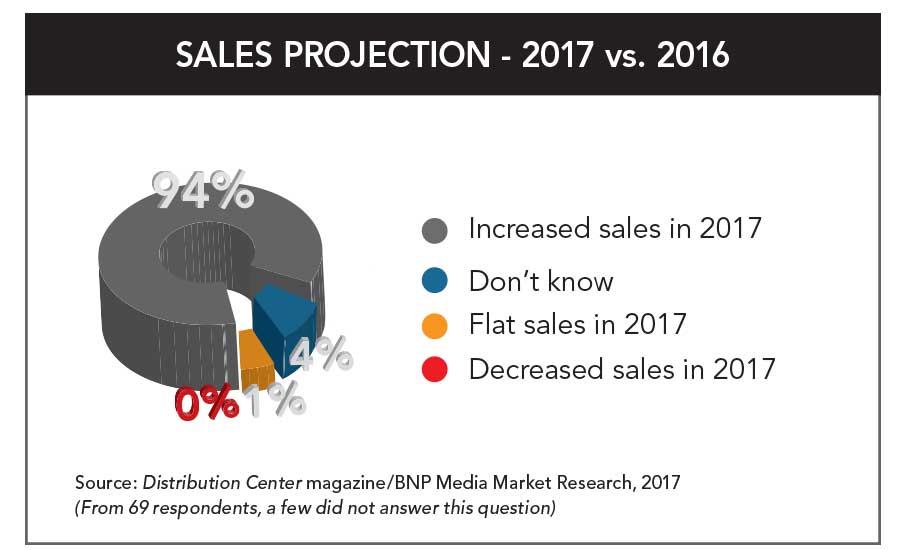

Meanwhile, this upward trend in sales is expected to continue, according to 94 percent of all respondents. The average HVACR sales increase projected for 2017 was 9.4 percent.

The 2017 edition of the survey received responses from 73 distributors, up from the 61 who responded in 2016, but down from earlier years when 80 to 90 of distributors typically responded.

Looking just at the Top 50 companies, 92 percent said their HVACR sales increased in 2016, with an average increase of 8.8 percent, while 6 percent said sales decreased, with an average decrease of 3 percent. Among the Top 50, 94 percent said they expect sales to increase in 2017 at an average of 7.9 percent above 2016 sales. Another 2 percent projected flat sales.

The 5.7 percent annualized growth for the 12 months through December 2015 jumped to 9.2 percent annualized growth for the 12 months through December 2016, according to data revealed in the Heating, Air-conditioning & Refrigeration Distributors International (HARDI) monthly TRENDS report. This marks the strongest annual pace since 2011 when compared with the end of The Great Recession, according to HARDI. The annualized growth for 2014 was 6.1 percent and 7.3 percent for 2013.

A dozen HVACR distributors on this year’s Top 50 list reported double-digit percentage increases in sales: Ferguson, Century Air-conditioning Supply/Century Holdings, Auer Steel & Heating, American Refrigeration Supplies, Lohmiller & Co., AC Pro, Shearer Supply, O’Connor Co., Corken Steel Products, Williams Distributing, Conklin Metal Industries and APR Supply.

Additionally, Top 50 distributors who projected double-digit percentage sales increases for 2017 included Century Air Conditioning Supply/Century Holdings; Standard Supply & Distributing Co.; Insco Distributing Inc.; Value Added Distributors; Lohmiller & Co.; Shearer Supply; Refrigeration Sales and APR Supply.

HVACR sales reported to this year’s survey totaled $16.9 billion. Among all respondents, 8 percent had sales of $500 million or more; 11 percent ranged from $200 million to $499.9 million; 61 percent ranged from $50 million to $199.9 million; 8 percent ranged from $35 million to $49.9 million and 12 percent had sales of less than $35 million.

New Faces

This year’s Top 50 list also had three new additions: ABCO HVACR Supply + Solutions, Long Island City, New York; Williams Distributing, Grand Rapids, Michigan and HVAC Distributors Inc., Mount Joy, Pennsylvania.

ABCO shared a holiday greeting with customers in December, reminding them of its “extensive inventory, unsurpassed customer service and unmatched delivery capabilities.” Among the heating and comfort solutions the company offers are products from Mitsubishi, HyperHeat, Luxaire furnaces, Honeywell thermostats, Dunkirk boilers, NTI boilers and Reznor unit heaters. ABCO was established in 1949 and the company describes itself as the largest full-line distributor of HVAC and refrigeration systems and supplies in the Northeast United States. After a review of the Top 50 HVACR Distributor studies, starting from the first one published in May 2012 through 2016, this is the first time ABCO has appeared on the list.

Williams Distributing was No. 50 on the list in 2015 and ranked No. 51 in 2016. Seventy-seven percent of the company’s total business is in HVACR. It reported substantially higher HVACR sales in 2016 compared with 2015, and attributed the double-digit percentage increase to the inclusion of hearth sales in its figures.

HVAC Distributors is a full-service wholesale distributor and manufacturer’s representative of residential and light commercial heating and air-conditioning equipment and accessories. The company serves the residential new construction, residential replacement and light commercial segments of the HVAC industry in Pennsylvania, Maryland, Delaware, Northern Virginia and western New York. HVAC Distributors last appeared on the 2012 Top 50 list, ranked at No. 46.

Three distributors who appeared on the 2016 Top 50 list just missed this year’s list: Charles D. Jones Co., North Kansas City, Missouri; Wallwork Group, West Caldwell, New Jersey and American Metals Supply, Hazelwood, Missouri. All three had double-digit HVACR sales increases in 2016. Other distributors who did not make the Top 50 list but reported HVACR sales increases of 10 percent or more were: Dunphey & Associates Co. (DASCO), Whippany, New Jersey; Dealers Supply Co., Forest Park, Georgia; Weathertech Distributing Co., Irondale, Alabama; Climatic Comfort Products, Columbia, South Carolina; Total Home Supply, West Caldwell, New Jersey and Opelika Supply, Opelika, Alabama.

The Top Three

Every year since the first study in 2012, the same three companies have occupied the top three positions in the ranking chart in the same order:

No. 1, Watsco Inc., Miami, Florida; No. 2, Johnstone Supply Inc., Portland, Oregon and No. 3, Ferguson, Newport News, Virginia.

In a presentation to investors last year, Watsco estimated the size of the North American HVAC distribution market at $35 billion, highly fragmented, with more than 2,000 family-owned distributors. Watsco also shared its long-term goals:

enhance profitability, margins and cash flow;

operate the most innovative suite of technology in the industry;

create and maintain the industry’s deepest repository of information regarding products, markets and customers;

accelerate sales growth and market share gains for its supplier partners; and

extend Watsco’s reach into new geographies and sales channels.

Johnstone Supply celebrated the opening of its 400th location in June 2016. The Kenilworth Group, one of the cooperative’s leading members, opened a 12,500-square-foot branch in Toms River, New Jersey. It includes 4,000 square feet of showroom space and an 8,500-square-foot warehouse. Johnstone Supply said its members cover every major metropolitan area, with locations in 47 states across the country. In addition to equipment, the cooperative wholesale distributor supplies repair and replacement parts for residential, commercial, refrigeration and facilities maintenance contractors.

Wolseley, Ferguson’s parent company, announced John Martin as its new group chief executive in September, following the retirement of Ian Meakins in August. Additionally, David Keltner, who spent more than 10 years as CFO of Ferguson, took on the role of interim group CFO. According to Wolseley, Ferguson is the largest business in the Group; accounting for 84 percent of the Wolseley Group’s profitability. Wolseley also announced a name change for the Wolseley Group to Ferguson plc, subject to shareholder approval.

“We are proud to have the Wolseley Group adopt the Ferguson name,” Ferguson CEO Frank Roach said in a statement. “We have built a very strong brand over the last 64 years and are known for our performance reputation. The Ferguson name best represents the Group today and will help create greater shareholder interest in the U.S.”

Business Breakdown

For all respondents, heating (air)/cooling accounted for 83 percent of HVACR sales; this has been the case since the 2014 study; earlier studies reported it at 80 to 81 percent. Hydronic heating represented 5 percent of total HVACR sales and has done so since 2014. This year’s study found that refrigeration generated 6 percent of total HVACR sales for all respondents; this is up from 5 percent in 2016, and down from 7 percent in 2015.

Twenty-seven of the Top 50 distributors said 100 percent of their sales come from HVACR. Eight said 80 to 99 percent of their total sales come from HVACR and seven reported that 50 to 79 percent of their total sales come from HVACR.

Meanwhile, the average number of branches/locations reported by all respondents was 30 that carry HVACR only; 24 that offer HVACR and other products; and 14 that offer non-HVACR products.

Respondents also reported the average breakdown between residential and commercial sales as being 71 percent residential and 29 percent commercial.

Lastly, 74 percent of respondents reported that they expect to hire more employees in 2017; 20 percent said their employee count would remain flat; and 6 percent said they didn’t know.

Respondents’ Comments

N.B. Handy moved up the ranks in the Top 50 this year, and Tom Mills, executive vice president, said he projects the company will have a very strong performance for 2017. He attributed expected growth to the leadership of the company’s new CEO, Rosana Chaidez, who has led a renewed sales effort.

Twenty-seven of the Top 50 distributors said 100 percent of their sales come from HVACR.

This year’s study also asked respondents what factors they expect to most impact HVACR sales in 2017.

Renata Morgan, marketing manager, Century Air Conditioning Supply/Century Holdings, said, “E-commerce and potential EPA changes.”

“The election is the biggest factor,” added Jim Fabricatore, vice president, Dunphey & Associates Supply Co. (DASCO). “I feel that this president is going to enable huge job growth and be very friendly to business.”

Patrick Newland, marketing director, Hercules Industries, said, “Increased productivity and minimal customer interruptions.”

Richard Cook, president of Johnson Supply, listed several factors. “No 1, refrigerant pricing and choices; No. 2, HR - talent, insurance costs and compensation; and No. 3, technology costs and adoption.”

“Strong political focus on economic growth and increased consumer confidence,” noted Eddie Anderson, CEO, M&A Supply Co.

Tommy Hadaway, owner, Opelika Supply said the factor to most impact sales this year will be regulations.

“Potential changes in federal tax law,” said Lanny Sigler, vice president, Sigler Wholesale Distributors.

Frank Nisonger, president and CEO of Slakey Brothers, added, “New construction and consumers able to spend more money on replacement.”

Gene Boos, senior vice president, S.W. Anderson Sales, said high efficiency heating and cooling systems replacing lower efficiency systems and a strong movement toward ductless mini-splits would most impact HVACR sales in 2017.

Other anonymous responses included:

Flooding last summer should boost business.

Competition with Amazon and other e-commerce entities will be stronger.

Technological advances.

Steel prices.

Taxes, reduction of federal tax rates.

Reduction of government regulations.

Phase-out of R22; the economy, weather and legislation.

Housing starts.

Utility rebates; employee retention and recruitment.

Economic uncertainty.

The end of dry-ship R22 units.

The economy’s growth pace, residential and commercial construction growth.

Increasing interest rates will begin to slow residential construction, but the Trump Bump in consumer optimism will offset it.

Construction starts have continued to rise in recent years, allowing for confidence in a solid HVACR distribution market throughout 2017. The overall strength of the U.S. economy, in terms of job and wage growth, also bodes well for 2017 as disposable income will be available for homes in need of repairs or upgrades. Lastly, government policies, including limiting hydro fluorocarbons and tax incentives for energy-efficient equipment, should also provide a boost to the industry (particularly newer, greener and more efficient equipment).

Other respondents expressed concern over the competition with online retailers, especially low-ball pricing that hurts margins. Another distributor commented that as HVACR products become more computerized, their life span shortens, comparable to a computer or car. Yet these new HVACR products will be more efficient and user-friendly. Techs will be more than mechanics, they will have to be engineers.

Total HVACR sales have increased for the Top 50 distributors every year since the survey was started.

2012: $10.3 billion+

2013: $11.5 billion+

2014: $12.8 billion

2015: $13.8 billion

2016: $14.8 billion

“It’s tremendous to see the growth of these Top 50 distributors, and the overall HARDI membership, at a significantly greater rate in 2016 than most anticipated,” said HARDI CEO Talbot Gee. “Seeing new companies join this respected list is exciting; many of whom think and act strategically to put their companies on a long-term growth plan. Federal policy should not be a headwind to distributors’ growth for the first time in many years so I can’t wait to see how these strong companies perform in 2017.”

Click here to view the 2017 Top 50 Distributors chart.

| 1 | Watsco Inc. | 95% |

| 2 | Johnstone Supply Inc. | 63% |

| 3 | Ferguson | 79% |

| 4 | Sigler Wholesale Distributors | 100% |

| 5 | R.E. Michel Co. LLC | 84% |

| 6 | Winsupply Inc. | 93% |

| 7 | Mingledorff's Inc. | 100% |

| 8 | US Airconditioning Distributors | 100% |

| 9 | The Habegger Corp. | 95% |

| 10 | Temperature Equipment Corp. Inc. | 100% |

Source: Distribution Center magazine/BNP Media Market Research, 2017

| 1 | F. W. Webb Co. | 54% |

| 2 | Ferguson | 13% |

| 3 | Johnstone Supply Inc. | 3% |

| 4 | Sid Harvey's | 25% |

| 5 | R.E. Michel Co. LLC | 6% |

| 6 | Winsupply Inc. | 7% |

| 7 | Goodin Co. | 47% |

| 8 | The Granite Group | 44% |

| 9 | First Supply LLC | 36% |

| 10 | APR Supply Co. | 22% |

Source: Distribution Center magazine/BNP Media Market Research, 2017

| 1 | Johnstone Supply Inc. | 12% |

| 2 | Watsco Inc. | 5% |

| 3 | ABCO HVACR Supply + Solutions | 35% |

| 4 | Gustave A. Larson Co. | 24% |

| 5 | American Refrigeration Supplies Inc. | 50% |

| 6 | Young Supply Co. | 50% |

| 7 | Sid Harvey's | 25% |

| 8 | F. W. Webb Co. | 11% |

| 9 | Ferguson | 2% |

| 10 | American Hardware and Tool Supply | 45% |

Source: Distribution Center magazine/BNP Media Market Research, 2017

Not all of the Top 10 Distributors in our segmented list were in the overall Top 50.

Click here to view the 2017 Top 50 Distributors chart.