2017 was an incredible year for wholesale HVACR distribution. Seventeen of Distribution Center's Top 50 Distributors reported double-digit sales increases for fiscal year 2017. That surpasses last year’s survey, when 13 of the Top 50 distributors enjoyed double-digit growth in fiscal year 2016.

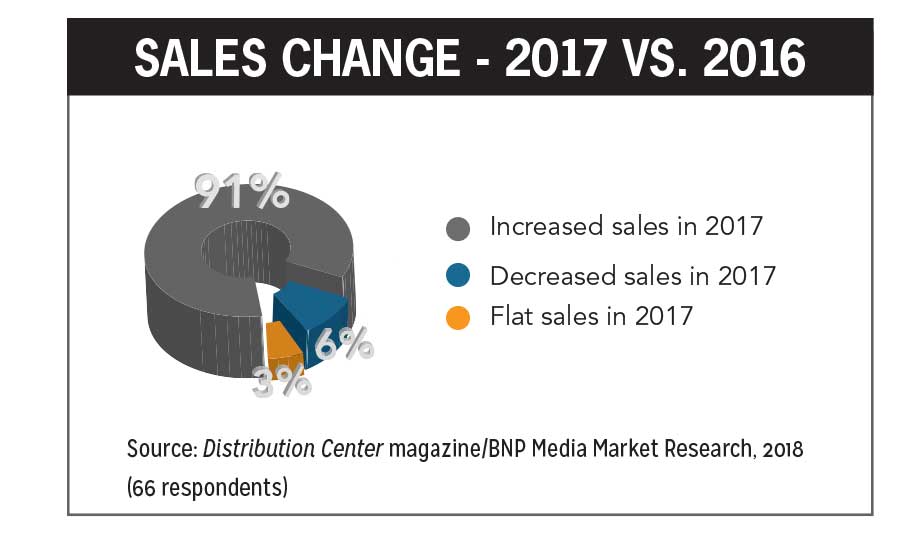

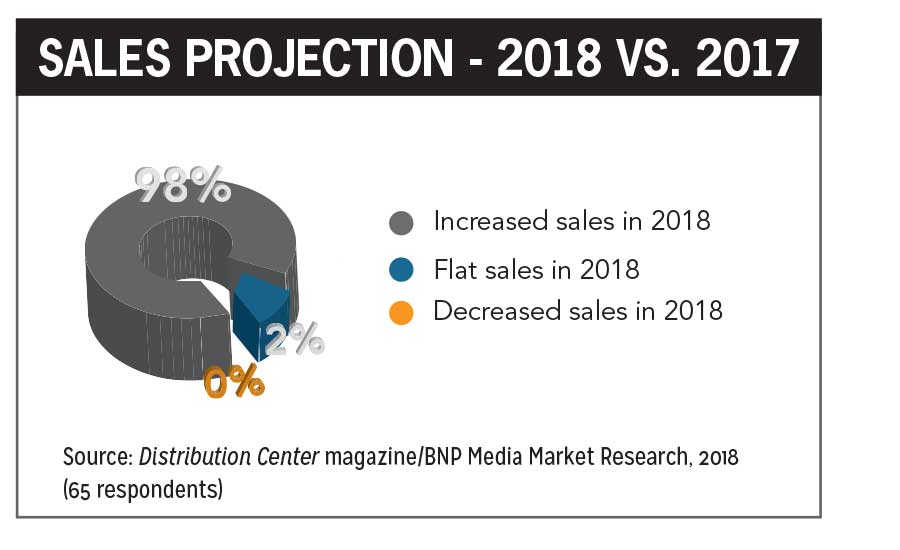

Of the 67 companies that responded to this year’s survey, plus the two for which we estimated, 91 percent had higher sales in fiscal 2017, up again from 90 percent in fiscal year 2016. The average increase in fiscal year 2017 was 8.5 percent. A record 98 percent of distributors surveyed are projecting a sales increase for fiscal year 2018, averaging 8.9 percent.

In 2014, the survey found that 96 percent of the 80-plus respondents reported an increase in HVACR sales for fiscal year 2013 and 91 percent projected increases for the next fiscal year. Since our 2015 survey, when 75 percent of respondents declared higher sales for fiscal year 2014, there has been steady growth in the percentage of distributors with sales increases year over year.

This year’s survey respondents represented a total of $17.7 billion in HVACR sales, which is a significant increase over last year's total of $16.9 billion.

Among the 67 companies responding, 9 percent had sales of $500 million or more, 1 percent had sales of $400 million to $499.9 million, 3 percent had sales of $300 million to $399.9 million, 9 percent had sales of $200 million to $299.9 million, 33 percent had sales of $100 million to $199.9 million, 30 percent had sales of $50 million to $99.9 million, and 6 percent had sales of $35 million to $49.9 million.

HARDI members accounted for 98 percent of all respondents, further demonstrating the influence of the organization.

“It is such a fantastic indicator of strong, sustained growth in our industry when we look at the past year’s performance in these Top 50 Distributors,” said Talbot Gee, CEO, HARDI. “We see that many out of this group saw double-digit growth, which also points to a strong economy and receding regulatory encroachment. I am excited to see the impact the recent tax cuts that went into effect this year will have for these top performers in 2018.”

Star Performers

On the Top 50 list, Winsupply, Munch’s Supply, Lohmiller & Co., Century Holdings, Ferguson, Hercules Industries, Conklin Metal Industries, MORSCO, Goodin Co., U.S. Airconditioning Distributors, F.W. Webb, AC Pro, Shearer Supply, Hunton Distribution, S.G. Torrice Co., Hajoca (estimated), and Standard Supply & Distributing Co. (estimated) all experienced double-digit sales increases in 2017. Two companies that ranked just outside the Top 50 — VP Supply Corp. and Thrifty Supply — also achieved double-digit growth.

Munch’s Supply jumped from No. 21 in 2017 to No. 12 in 2018. Munch’s acquired Lenexa, Kansas-based O’Connor Co. in December 2017, which was No. 38 in the 2017 Top 50 list, thus O’Connor Co. no longer appears on the list.

Other companies that moved up in the ranks this year include MORSCO from No. 27 in 2017 to No. 22 in 2018, Hercules Industries from No. 30 to No. 24, Goodin Co. from No. 45 to No. 39, Conklin Metal Industries from No. 46 to No. 40, and Lohmiller & Co. from No. 34 to No. 28.

American Metals Supply and Charles D. Jones Co. just missed being ranked among the Top 50 in 2017. American Metals Supply ranked No. 45 in 2018, and Charles D. Jones settled in at No. 47.

Other distributors new to our list include Hunton Distribution, debuting at No. 27; Locke Supply Co. at No. 36; Epting Distributors at No. 48; and S.G. Torrice Co. at No. 50.

Two companies that are listed in the Top 10 segment charts did not appear in the overall ranking chart of the Top 50. First Supply was ranked No. 8 on the Top 10 Hydronic Heating chart but in terms of the overall top 50, it ranked No. 55. Duncan Supply Co. ranked No. 8 on the Top 10 Refrigeration chart but in terms of the overall ranking, it finished at No. 57.

Other Changes

In June 2017, Watsco Inc. announced its Carrier Enterprise business unit, a joint venture between Watsco and Carrier, had acquired 35 percent ownership of Russell Sigler Inc. Now operating as Sigler Wholesale Distributors, the company ranked No. 5 on this year’s Top 50 list.

“The Sigler organization has our respect, admiration, and commitment to provide ideas and assistance to build on its historical success,” said Albert Nahmad, chairman and CEO, Watsco, in a statement.

In its announcement, Watsco noted this investment continues its strategy to partner with well-established businesses and represents an investment in the Western U.S. The company also said it has exclusive rights to purchase ownership interests from current shareholders that may elect to sell in the future.

N.B. Handy Co., ranked No. 15 last year; Insco Distributing, ranked No. 24 in 2017; and Robertson Heating Supply, No. 49 last year, did not participate in this year’s survey. M&A Supply Co., No. 48 in 2017, just missed ranking in the top 50 this year.

A Closer Look

Watsco reported record operating results for the fiscal year that ended Dec. 31, 2017. The company attributed this to its continued investment in technologies designed to make it easier to do business and to help customers grow their businesses more profitably. The digitization of Watsco’s marketplace via e-commerce through iOS/Android-enabled apps and websites with an in-depth database of product information made significant progress in 2017. Contractors are able to interact with Watsco 24/7 to find products, place orders, and obtain technical support, which has increased customer adoption.

Also, employees are empowered with better data, processes, and capabilities to serve their customers’ needs.

Watsco also noted the following sales results for the year: a 3 percent increase in sales, 4 percent increase in HVAC equipment (67 percent of sales), 1 percent increase in other HVAC products (28 percent of sales), and flat sales in commercial refrigeration products (5 percent of sales).

Johnstone Supply announced in May 2017 it had reached $2 billion in annual sales. Founded in 1953 and converted into a member-owned cooperative in 1981, its members currently operate 410 locations that are supported by six regional distribution centers. Members serve both urban and rural contractors with locations in 47 states across the U.S., Guam, and Canada. In addition to HVACR equipment, the company supplies repair and replacement parts for residential, commercial, refrigeration, and facilities maintenance contractors and carries OEM parts for nearly every major equipment brand. It also maintains an industry-leading website and mobile app and offers additional technology-based efficiency programs to provide contractors with time- and money-saving conveniences.

Ferguson, No. 3 on the list, distributes HVAC equipment, parts, and supplies to commercial contractors, HVAC contractors, industrial contractors, plumbing contractors, site work contractors, and utility contractors. The company provides products to multiple market segments, including residential, commercial, new construction, repair parts, sheet metal, refrigeration, aftermarket parts, hydronics, and machinery. Ferguson HVAC operates 131 locations in 19 states with each location dedicated to keeping product inventories relevant to each individual market. In addition to the Ferguson brand, the company does business nationwide as Ferguson HVAC/Lyon Conklin, Ferguson HVAC/Air Cold, Ferguson Heating & Cooling, and Ferguson HVAC/EastWest Air. Each location has designated territorial distribution agreements from top manufacturers.

Hunton Distribution is one of Trane’s largest global residential distributors. It also is part of The Hunton Group, a conglomerate of synergized companies that deliver energy-efficient HVAC products and systems as well as building integration and control systems. In July 2017, Hunton Distribution announced the development of a 75,000-square-foot distribution center in the Houston area that is scheduled to break ground in October. This will be the third residential center in the Houston area for Hunton Distribution and the fifth location for the Hunton Group.

Locke Supply is a growing employee-owned distributor of plumbing, electrical, and HVAC products located in Oklahoma City. It was founded in 1955 by Don J. Locke and Wanda Locke, who opened the wholesale plumbing supply outlet in Bartlesville, Oklahoma. Today, the company has a 45-acre distribution center that supplies more than 165 stores in five states. In 2017, The Oklahoman named Locke Supply one of the top workplaces in the area. Locke Supply considers itself one of the most progressive supply houses in the Southwest.

Epting Distributors was founded in 1964 by Bill Epting as a small family-operated business serving heating and air conditioning contractors in the Columbia, South Carolina, area. Over the years, the company has grown to include 13 branch offices and 250 HVAC dealers throughout North Carolina, South Carolina, and Georgia. Epting offers Tempstar residential HVAC equipment, commercial and specialty products, and innovative marketing and training services.

S.G. Torrice was founded in 1958 in Wilmington, Massachusetts, by Samuel G. Torrice, who started the company with two employees in a small warehouse.

The company's current 100,000-square-foot corporate headquarters includes a training center, customer service counter, fully stocked warehouse, and a sheet metal shop.

Stephen Torrice, president, is the son of the founder. The company is a multi-branch, full-service distributor of heating and cooling products.

Business Breakdown

Segment sales for all respondents was 84 percent HVAC heating (air)/cooling, 5 percent hydronic heating, 5 percent refrigeration, and 6 percent other.

When asked about staffing, 84 percent of respondents said they planned to increase the number of employees in the near future, while 16 percent said they intend to maintain the same number of employees.

The average number of branches/locations for all respondents was 32 for those that only carry HVACR, 25 for those that carry HVAC and other categories, and 15 for those that are non-HVACR.

Among all respondents, 69 percent of their businesses are residential and 31 percent are commercial, on average.

Industry Outlook

In the survey, respondents were asked what factors they expect to have the most impact on HVACR distribution in 2018. Their responses ran the gamut from the economy to government regulations to pricing and more.

Carlton Harwood, vice president of HVAC, Ferguson, said product availability and pricing, growth in e-commerce and omni-channel sales, an increase in ductless and variable refrigerant flow (VRF) sales, and a budding interest in connected home products are expected to have the greatest short-term impact.

“Strong U.S. employment and higher disposable incomes are expected to continue, which will lead to increased consumer spending, a stronger demand for home improvements, and increased housing starts,” he said. “The HVAC distribution industry will face the challenge of competing directly with HVAC manufacturers. Potential increases in interest rates may impact both construction activity as well as home affordability. The push for environmental sustainability will drive increased HVAC replacements and, in turn, will aid industry growth.”

Lanny Sigler, vice president, Sigler Wholesale Distributors, believes the American economy is going to absolutely explode in 2018.

“The personal tax cuts will help consumers — our ultimate customers — and the corporate tax cut will help us grow our business to meet this increased demand,” he said. “I am pleased that we are seeing a more business-friendly attitude, at least in some government circles.”

Robert Cesiro, chief marketing officer, ABCO HVACR Supply + Solutions, said increased competition is a major factor as today’s HVACR needs are available from more suppliers.

“It’s imperative to have expanded inventory, delivery capability, and tech support,” he said. “Education and training is also critical for both customers as well as employees with all the advancements in technology, smart controls, and changing regulations. The required knowledge goes beyond equipment sales and servicing, as it must also include a complete understanding of the business challenges HVACR companies face with their customers. This would include long-term versus short-term solutions, cash flow, financing, and emerging opportunities in the marketplace. As an industry, we must do more to make younger people with old-school perceptions of HVACR more aware of the careers and opportunities that exist. We have to help them see that we are now about electronics, computer sciences, and business entrepreneurs all while doing more than any other industry to make our food safer, the world greener, and people more comfortable.”

Tim Brooks, president, Lohmiller & Co., believes attaining and retaining labor will continue to be a challenge.

“The unemployment rate in our market is 2 percent,” he said. “Employees who want to work are already employed today. This is not a plug-and-play industry. Distributors that add value on a consistent basis will always have a place in this market. I do not see a drone delivering a furnace or rooftop unit that was purchased online for a homeowner or building owner to find the labor to install.”

Mike Muzny, executive vice president, Locke Supply, said economic growth potential per market as well as a substantial increase in cost of goods, at least for all metal products, will be impactful in the near future. He also predicts the phaseout of permanent split capacitor (PSC) motors will have a significant influence on pre-buys of air handlers and furnaces.

James Luce, owner/CEO, Luce, Schwab & Kase Inc., which ranked No. 56, is optimistic the recent tax cuts will enable businesses to continue spending and upgrading their facilities and put more money in consumers’ pockets throughout 2018. Also, the changes in Section 179 now allow for depreciation expensing for HVAC equipment to go from 39 years to one year. This will have a very positive impact by encouraging commercial building owners to invest in new equipment.

Patrick Newland, marketing director, Hercules Industries, is concerned about steel pricing and labor shortages.

Jim Fabricatore, vice president, Dunphey & Assoc (Dasco Supply), No. 59, also has his eye on the steel tariffs, which he believes will continue to raise prices on everything the company sells; however, he is optimistic there’s enough commercial activity on the books to make 2018 and 2019 record-breaking years for the company.

Steve Bellar, president, Thrifty Supply, No. 63, is concerned about the lack of financial capital to support new construction.

Ben Curwin, corporate HVAC director, VP Supply Corp., No. 65, believes 2018 will likely further the trend of increasing the importance for distributors to have digital tools available to customers and an effective, engaged, and intentional sales force.

Other factors distributors mentioned include the threat of larger distributors, eroding margins, commercial construction, tax cuts, climate/weather, new construction, economy, steel and aluminum tariffs and impact on overall demand, declining price and demand for R-22, consumer confidence, internet sales/e-commerce, unitary and ductless manufacturer joint ventures, federal tax changes, the return of the geothermal tax credits, inflation, lack of qualified employees, single-family new construction, ductless VRF, new housing starts and significant construction of office space, lead times from factories, damaged inventory, changing customer expectations, recruiting and retaining people, utility rebates, cyclical economic slowdown, information technologies related to data collection/analysis and online processes, pricing environment with OEMs and the overall health of the consumer, raw material pricing, discretionary spending by consumers, and succession planning.

|

|

|

|

|---|---|---|

| 1 | Watsco Inc. | 95% |

| 2 | Johnstone Supply Inc. | 62% |

| 3 | Ferguson | 77% |

| 4 | Sigler Wholesale Distributors | 100% |

| 5 | R.E. Michel Co. LLC | 85% |

| 6 | Winsupply Inc. | 83% |

| 7 | Mingledorff's Inc. | 95% |

| 8 | US Airconditioning Distributors | 100% |

| 9 | The Habegger Corp. | 95% |

| 10 | Munch's Supply | 96% |

Source: Distribution Center magazine/BNP Media Market Research, 2018

|

|

|

|

|---|---|---|

| 1 | Ferguson | 14% |

| 2 | F. W. Webb Co. | 54% |

| 3 | Winsupply Inc. | 17% |

| 4 | Johnstone Supply Inc. | 3% |

| 5 | Sid Harvey's | 25% |

| 6 | Gooding Co. | 47% |

| 7 | R.E. Michel Co. LLC | 5% |

| 8 | First Supply | 35% |

| 9 | APR Supply Co. | 20% |

| 10 | CCOM Group Inc. | 18% |

Source: Distribution Center magazine/BNP Media Market Research, 2018

|

|

|

|

|---|---|---|

| 1 | Johnstone Supply Inc. | 12% |

| 2 | Watsco Inc. | 5% |

| 3 | American Refrigeration Supplies Inc. | 50% |

| 4 | Gustave A. Larson Co. | 22% |

| 5 | ABCO HVACR Supply + Solutions | 25% |

| 6 | Sid Harvey's | 25% |

| 7 | F. W. Webb Co. | 11% |

| 8 | Duncan Supply Co. Inc. | 58% |

| 9 | Young Supply Co. | 30% |

| 10 | Ferguson | 1% |

Source: Distribution Center magazine/BNP Media Market Research, 2018

Not all of the Top 10 Distributors in our segmented list were in the overall Top 50.

|

|

|

|---|---|

| 6 | 1% to 40% |

| 11 | 41% to 59% |

| 18 | 60% to 79% |

| 22 | 80% to 89% |

| 8 | 90% to 99% |

| Overall average % | 69% |

Source: Distribution Center magazine/BNP Media Market Research, 2018. 65 Companies responded.

|

|

|

|---|---|

| 13 | 1% to 14% |

| 17 | 15% to 20% |

| 18 | 21% to 40% |

| 14 | 41% to 75% |

| 3 | 46% to 99% |

| Overall average % | 31% |

Source: Distribution Center magazine/BNP Media Market Research, 2018. 65 Companies responded.

Report Abusive Comment