Coronavirus containment and crashing economic demand present HVAC contractors and managers with a historic challenge. They face both enormous financial and operating difficulties, but at the same time, they have an opportunity to reshape their companies to produce vast benefits for years to come. With this in mind, downsizing is one of the most important factors that can either weaken or strengthen a company — both during and after a crisis — depending on how it is handled. Faced with rapidly diminishing resources, managers have to get started right away and move quickly. If they get this right, they will own the best customers and leave their competitors in the dust. If they get this wrong, they will face years of struggle trying to catch up.

Virtually without warning, many businesses today are being forced to deal with unprecedented, externally-driven sales declines without nearly enough time to bring expenses into alignment with available revenues. This combination is placing survival-threatening burdens on cash flow and financial reserves. The greatest danger in responding lies in the inability to focus reduced resources on targets that offer the greatest potential for success. Weakly-focused or unfocused broad-brush responses are almost certain to fail or to produce inadequate results.

Creative new approaches are essential. What worked in past will not work now. Here are three key principles to help provide a foundation for success: Focus on the profit core; emphasize people and relationships; and concentrate on practicality and rapid implementation.

Focus On The Profit Core

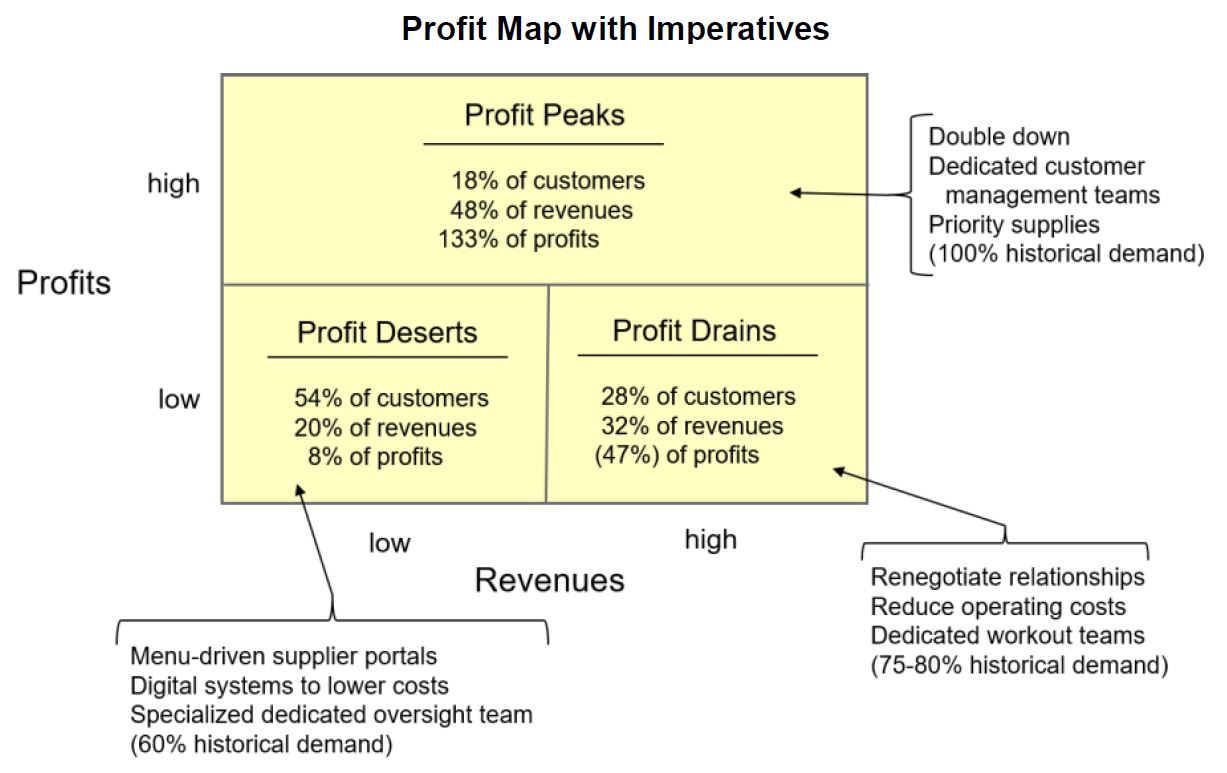

Businesses typically find that 10 to 20 percent of its customers, products, employees, and operational activities produce 150 percent or more of the profits. It is imperative that contractors identify and double down on this core strength. To do this, companies should divide their customers into profit peaks (large, high-profit), profit drains (large, low-profit/loss), and profit deserts (small, low-profit). Those items not producing the profits will fall into the 10 to 30 percent that are draining 40 to 50 percent of the profit; and the 50 to 80 percent of customers who are consuming over half of a company’s resources while producing no profits at all. (See Figure 1.)

The same profitability segmentation characterizes contractors’ products, employees, and operational activities. The most important thing business managers can do is to focus resources on their profit core by locking this business into place, converting profit drains into profit peaks, and matching the cost to serve profit deserts with their profit potential. This step can even be taken with a reduced workforce and shrinking revenues by managing the profit core using both more powerful metrics and sharply-focused efforts.

More powerful metrics are the essential starting point. To measure real profitability, contractors must be able to analyze their companies at the fundamental business level of each individual sales transaction (i.e. invoice line). Higher-level aggregations typically available today hide vital information about cost drivers and their interrelationships.

Cost-to-serve provides a good example of where most systems do not disaggregate major cost items, and so distort the true cost and profit picture. For example, in our experience analyzing tens of billions of dollars of client revenues, we have consistently found that gross margin, which is one of the most commonly used measures of profitability, seldom predicts net profits because operating costs are so important.

Emphasize People And Relationships

Crisis times require a renewed emphasis on people and relationships rather than the recent trend toward impersonal systems and related digital transformations. Systems may be more cost-effective in certain high-volume applications, but they cannot deal with the human concerns, questions, and complex intercompany coordination challenges that dominate in crisis. This can be seen clearly in three key areas: customers, suppliers, and operations and supply chain.

SMALL ROLE TO PLAY: Some profit desert customers are large companies for whom contractors are minor suppliers. Contractors may be able to offer to fully meet their needs in return for a larger share of wallet and long-term contract. These are prime prospects to be developed into profit peaks.

Effective customer management requires fundamentally different programs for profit peak customers, profit drain customers, and profit desert customers. With profit peak customers, HVAC contractors have two primary objectives. The first is to systematically build the efficiency of day-to-day coordination. The second is to take targeted steps to develop a more integrated operating relationship featuring win-win mechanisms like joint forecasting, focused vendor-managed inventory, and coordinated category management.

Contractors’ relationships with their profit peak customers are where they should invest their people and resources, especially in tight times. This investment cannot be done everywhere, so identifying and bonding with profit peak customers is a life or death issue.

With profit drain customers, contractors should focus on generating cash by plugging the specific problems that are causing the business profit and cash drains. They should also develop mutual operating cost reductions that increase these customers’ profits and convert these large customers into profit peaks. Offering access to secure supplies of scarce products can provide a strong incentive for these customers to re-negotiate their relationships with a business.

For profit desert customers, the objective is to reduce the operating costs and lower their priority for allocated product. This is where contractors’ downsizing should occur. It is critical to lower the company’s cost to serve to match their profit potential by moving them to more efficient engagement modes.

These customers comprise the segment that is most amenable to systems improvements. Here, you need to understand the cost to serve for these customers to be sure that you are charging correctly for the services you offer. Price discounting should be the exception, not the rule. Similarly, contractors need to use digital marketing to communicate with and manage these customers. It is prohibitively costly to attempt to develop personal relationships with the numerous customers in this segment.

The most effective program for transforming suppliers is directly parallel to the one that is best for contractors’ customers. A company’s profit peaks suppliers provide the most profitable products. These suppliers warrant dedicated teams of managers who are highly skilled at developing and growing productive relationships featuring both weekly coordination meetings and monthly forecasting and planning meetings (along with selected early steps to build integrated processes in supply chain management, category management, and product development). The systems required are relatively standard.

Profit drain suppliers have high enough revenues to warrant dedicated teams of managers who can partner with their supplier counterparts to reduce joint operating costs. It will likely take more work with these suppliers to maintain the supply, but it is crucial to long-term success, especially if the contractors’ customers prefer these products.

COMPANY DECISIONS: During crisis times, traditional supply chain decisions can no longer be made by supply chain managers alone.

This is a good opportunity to improve your relationships with your profit drain suppliers, and drive them toward profit peak behavior. Downsizing either of these sets of teams would be very counterproductive.

The profit desert suppliers are the long tail of a company’s supplier revenue distribution. A small team should manage these suppliers, and every effort should be used to get them on supplier portals with standard terms and low human resource requirements. Contractors will not have the resources to directly manage the bulk of their small, low-profit suppliers. This is where they will need systems to lower costs. This is also where aggressive downsizing will be most productive.

Beyond contractors’ core supply chain systems (e.g. warehouse management, transportation management, inventory management), highly skilled managers are much more essential than complex systems.

In tight supply situations, it is important that managers make decisions about customer product allocations in advance, and communicate them broadly. All too often, companies do this in real-time, leading to a scramble for inventory with everyone attempting to support their own customer priorities. This leads to the default situation: no priorities at all, and first-come first-served policies.

During crisis times, traditional supply chain decisions can no longer be made by supply chain managers alone. In product-constrained environments, these decisions are strategic and must be handled at the company level by the multifunctional teams overseeing and managing the company’s key segments: profit peaks, profit drains, and profit deserts.

The second component is particularly difficult, as it requires monitoring both supplier and customer status. Contractors’ profit peak suppliers probably will give them some preference, especially if they have taken measures to reduce their joint operating costs, making the company a profit peak customer to them. Looking downstream, contractors’ profit peak customers warrant full allocations of product, while their profit drain customers may only get 75 to 80 percent of needs, and the profit desert customers may get a mere 60 percent.

Practicality And Rapid Implementation

Profit segmentation must form the practical, critical core of the financial planning and analysis process. This starts with developing an understanding of businesses profit peaks, profit drains, and profit deserts. It continues with creating an integrated set of programs for each segment – with each reflecting the right balance of people and systems. Finally, the company needs to separately and carefully monitor the performance, and risk, of each profit segment – being thoughtful about where to build its human resource capabilities, and where downsizing will provide a net benefit.

This is the wrong time to manage by using aggregate metrics and broad across-the-board corrective measures like general downsizing based on “fairness” — in which each department takes the same percent force reduction. The companies that not only survive, but will lead in the post-coronavirus markets are those that use the right metrics and surgical decisions about resources to ensure that they have the cash flow and profits to capture the best customers while responding to this rapidly changing world.

In our experience, forming dedicated teams focused on each key profit segment – profit peaks, profit drains, and profit deserts — at both the upper-management planning and oversight level, and at the operational management and execution level, will help ensure that contractors deploy their resources wisely and maximize the company’s near-term survival and its long-term profitable growth. At the same time, it is important to balance this with selectively continuing strategic investments in areas like product development and new technology that will be critical to a business’ success after the current crisis abates.

Managers have no choice in terms of timing since the current crisis is externally-driven. The timeframe for effective action is short. Those who act quickly, before the situation takes over and the range of options swiftly decreases, will create life-preserving cash flow and harvest enormous market share gains from competitors who move too slowly to make a difference.

Jonathan and John are co-authors of the forthcoming McGraw Hill book, “Choose your Customer: How to Compete Against the Digital Giants and Thrive”.

Report Abusive Comment