HVACR distribution is a game of inches.

Each piece of inventory stocked and shipped is significant. Every transaction matters. All executive decisions must be meticulously planned and executed.

Distributors seeking a competitive advantage should look no further than Heating, Air-conditioning & Refrigeration Distributors International’s (HARDI’s) benchmarking programs.

Each of the organization’s four distinct programs — the Targeted & Regional Economic News for Distribution Strategies (TRENDS) Report, Unitary Market Share Report, Distributor Performance Dashboards (DPD), and the Compensation Survey — are designed to advance and improve distributors’ channel relations via comprehensive forecasting.

HARDI facilitates each benchmarking program via partnerships with four unique vendors. Members’ proprietary data is sent directly to the vendors, where it is securely stored and protected. At no time in the process does HARDI have access to the data that serves as the catalyst for each analytics report.

“Numbers have value,” said Brian Loftus, market research & benchmarking analyst at HARDI. “The more accurately distributors can predict labor requirements, space availability, workflow, and other administrative variables, the more effectively they can operate their facilities and organizations. Perhaps the best thing about HARDI’s benchmarking programs is that the data is free with the only cost being a distributor’s participation.”

TRENDS

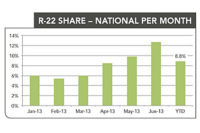

HARDI’s TRENDS Report is HVACR distribution’s definitive monthly sales report. HARDI’s vendor partner, ITR Economics, compiles members’ monthly survey responses to identify their monthly and year-over-year sales growth and insight into the underlying health of the channel with inventory insights and the day sales outstanding calculation.

The TRENDS Report has been a core benefit of membership for more than 10 years. More than 260 distributors participate in the program each month. Participants also receive a video analysis presented by Loftus, which highlights the variables influencing the report and its relevance to recent historic results as well as the regional economic forecast update each quarter from ITR Economics.

“The TRENDS program is a way to quantitatively and visually show how HARDI distributors are doing from a dollar-sales-growth standpoint,” said Connor Lokar, HARDI’s senior economist. “Through this program, participating distributors can determine where their employee figures are, what inventory changes are happening, and where their monthly and annual sales figures stand.”

The TRENDS Report also offers a comparative look at how members are faring against distributors in their regions and across the nation.

“This is a great way for HARDI members to see if they’re growing as quickly as they should be or could be, and if they’re meeting expectations based on how their peers are performing.”

Lokar said the data-submission process is fairly simple for members.

“Most of the effort comes the first time the report is completed,” he said. “Once those numbers are locked in, from the moment they log in to the moment they hit submit, the eight survey questions are completed in mere minutes.”

Unitary Market Share Report

HARDI’s Unitary Market Report is designed to help distributors allocate their scarce resources more effectively. The quarterly service allows participants to see their market share and relative growth rates for their equipment lines by efficiency levels within the states they operate.

Since 2013, HARDI has partnered with D+R Intl. to track sales of ducted air conditioners, ducted heat pumps, ductless heat pumps, ductless air conditioners, furnaces, boilers, and more. Data is based on D+R’s analysis of more than 20 million sales records.

“This data program collects point-of-sale data from distributors via an ERP [enterprise resource planning] download,” said Dan Vida, manager of data and analytics at D+R Intl. “Our participation coverage is approaching 30 percent of the market, and new distributors are participating each month. This coverage will really surge now that we are providing state-level estimates.”

Vida said there are a couple of ways distributors can best use this information.

“One of the questions we hear all the time is, ‘How big is the ductless market in my area?’” Vida said. “This report answers that question and more. Distributors can not only determine how large the ductless market is, they can keep tabs on its evolution and create a strategy based on the information they learn.”

Vida said the Unitary Market Report demonstrates how and why a market has gotten to where it is today.

“I’ve talked with several distributors that have changed their product mixes based on the reports they’ve received in order to capture new markets,” he said. “Contractors tend to be very sticky with their distributors. This helps distributors attract new customers by adding new equipment that’s becoming popular in their areas. They’re beating their competitors to the punch.”

The Unitary Market Report also helps distributors determine why revenues and product sales may differ from each other, Vida said.

“This helps a CFO understand why the company may be doing better on its inventory turns but is not necessarily seeing much in the form of revenues or returns,” he said. “Sometimes revenues may be up, but unit sales are flat. This helps explain the reasoning behind those scenarios.”

Compensation Survey

Every two years, HARDI offers an employee Compensation Survey designed to determine where individual wholesalers’ compensation plans fare within the distribution industry. Participating members answer survey questions regarding the wages and benefits for 25 specific job titles.

The 2018 Compensation Survey was introduced in late February, and the deadline for responses is March 31.

Previously available to HARDI members via a fee, the Compensation Survey is now included as part of HARDI’s annual dues, though members must complete the survey to receive a copy of the report. The survey is a compilation of many distributor associations.

With unemployment hovering near 4 percent, the survey’s importance has never been greater.

“The Compensation Survey may be used to define the appropriate compensation level for each salaried position within a distribution company,” said Scott Hackworth, senior vice president, Industry Insights, HARDI’s Compensation Survey vendor partner. “The program’s data tools may be used to filter the data down by job title. Also, if a distributor earns $75 million in annual revenue, you can filter the numbers to compare that data to others in that range. The data may also be filtered by region so that a distributor can fine tune his or her compensation levels and benefits packages so that they’re applicable in all aspects.”

Hackworth said the Compensation Survey provides answers to questions, such as, “What drives executive compensation?”

“Participants are sure to uncover some very interesting findings through this report,” he said. “The information behind the trends, factors, and attributes of HVACR distribution compensation are all here in the mix.”

Distributor Performance Dashboards

DPD is an annual operating performance benchmarking program designed to protect profitability and maximize distributors’ resources available for customer service. The program helps distributors identify where their performance differs from the mean, prioritize areas for improvement, and devise effective plans to achieve their goals. Learn more about DPD on Page 22.

Why Fly Blind?

All of HARDI’s benchmarking programs are offered free of charge to members; however, to receive the benefits, members have to participate in the programs.

“One of the greatest benefits of being a HARDI member is that you can come together as an industry to work and improve what you do individually and collectively,” said Paul Giudice, CEO, CoMetrics, which facilitates the DPD program. “You’re only as strong as your weakest link. Participation in the DPD was up 24 percent over the prior benchmarking platform; however, we’re only including data from one in four distribution members. By not participating, you’re doing yourself and your fellow members a disservice.”

The more participation, the more valuable the data, said Vida.

“We have an exceptional amount of data to offer, and those who aren’t participating are missing out on a huge opportunity to learn what’s actually occurring in the market,” he said. “As participation has grown, we’re now able to present data in the Unitary Market Report at the state level. Those receiving this information absolutely have a leg up on the competition.”

Hackworth said there is nothing else in the market that can compare to HARDI’s benchmarking offerings.

“Employees are quitting their jobs more frequently in today’s market because the grass is greener all over the place — at least that’s the perception,” he said. “Employers must be aware of that. You have to keep your eye on what others are doing, know the benchmarks, and plan for what’s going to happen in the near future. The Compensation Survey and HARDI’s benchmarking tools provide the answers.”

Lokar said the more data that is provided, the more useful the study.

“The more participation we receive, the more the data takes on a truer representation of what’s going on throughout the HARDI community,” he said.

ITR is anticipating a mild economic downturn in 2019, and those who participate in HARDI’s benchmarking programs will be better prepared for what lies ahead.

“Inventory management is everything to a distributor,” Lokar said. “Being able to understand when things are expected to slow down gives them the confidence and courage to make decisions proactively rather than reactively.”

In this day and age, if you’re not taking advantage of every piece of data available, you’re doing yourself a disservice, advised Lokar.

“By not consuming and utilizing this data, you could be making tactical errors that impact every level of your business,” he said. “These are not arbitrary figures; this is actual hard sales data from 250-plus HARDI distributors. This information is simply too valuable to ignore.”

For more information on HARDI’s benchmarking programs, visit http://hardinet.org/benchmarking.

Report Abusive Comment