More than two-thirds of homeowners find a discount an appealing payment term when paying for HVAC equipment in full. That’s according to a recent survey by Clear Seas Research, the research unit of BNP Media, parent company of The ACHR NEWS. The survey also found that more than half of homeowners also found a discount to pay in cash, or a 12 month no-interest loan, appealing. Additionally, it found that if a homeowner’s HVAC equipment is financed, they’re willing to pay between $100 and $300 a month.

And HVAC contractors are on top of these trends. The survey found that a third or more of contractors are already offering these types of payment terms. Not only are contractors offering discounts to pay in full or in cash, but they are also offering low fixed APR loans, standard installment loans, or specific loans or payment terms to meet a specific need of a customer.

What payment terms does your company offer for new residential HVAC equipment purchase and installation? (Select all that apply)

Sample size: 2023 = 104

Contractors are currently offering homeowner's preferred payment options. (Courtesy of Clear Seas Research)

Diversify Options

sales manager

Jacob and Rhodes

Jacob and Rhodes, located in Kennewick, Washington, is among those HVAC contractors offering a smorgasbord of payment terms to their customers.

“We want to be able to fit the customer's needs,” said Kevin Gunn, sales manager at Jacob and Rhodes. “That’s our biggest thing. Whether it's product or financing, we work for the customer.”

Whether it’s a six-month or a 12-month no-payment loan, a no-interest loan, or even if a customer needs a 15-year loan, Jacob and Rhodes has those options available to them.

“HVAC doesn’t cost $5,000 to $7,000 anymore; it’s $15,000 to $25,000 … so we have to be able to have tools in place for somebody that has a mobile home, and somebody that has a 5,000-square-foot home,” Gunn said.

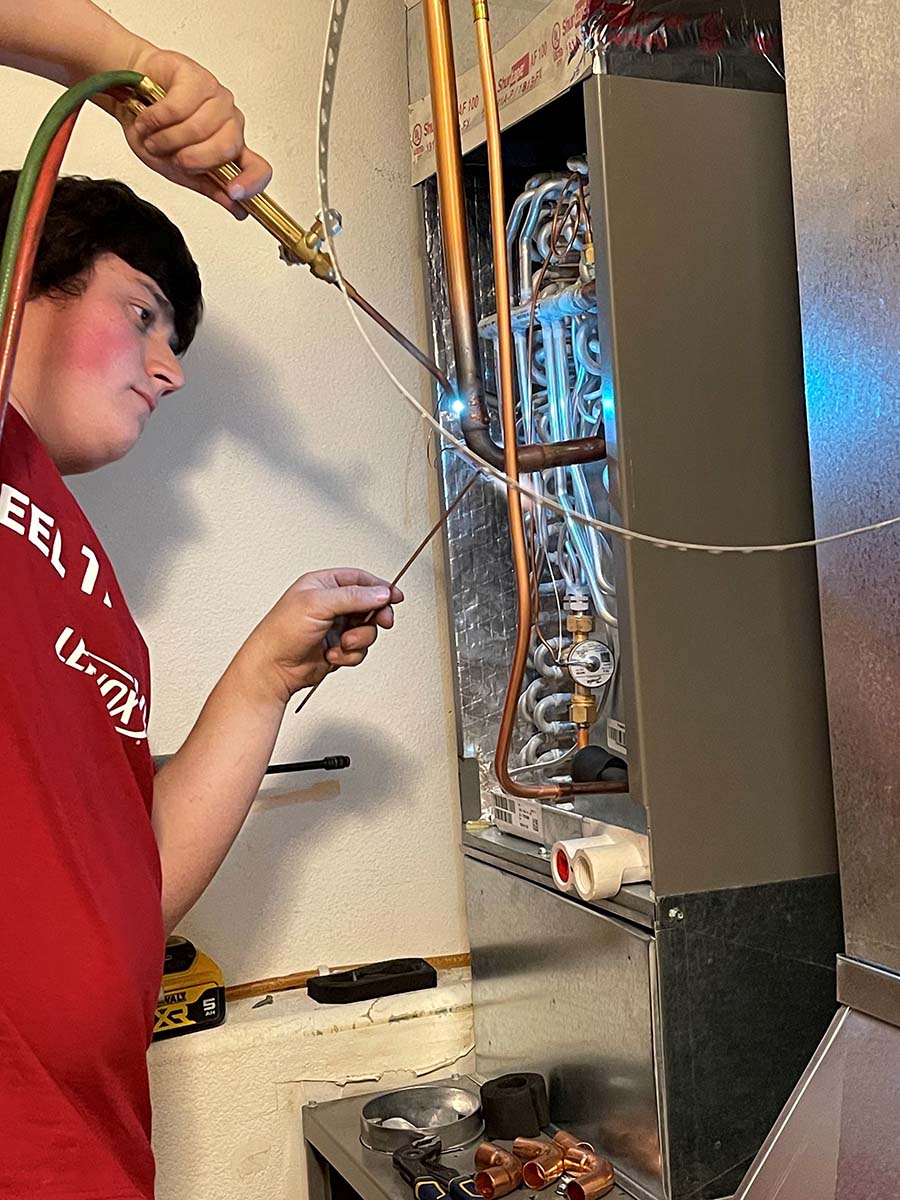

SPECIFIC: Each customer may require a specific type of payment term for the HVAC equipment. (Courtesy of Jacob and Rhodes)

While the company uses a local credit union that has HVAC specific loans, they took the process a step further and also uses the financing programs and incentives available through their manufacturer’s options.

“One size doesn't fit all, and with the credit unions, they're pretty much just a stable percentage rate and a stable environment for financing, but they didn't have any bells and whistles like 0% financing … or they did and it was only on special at certain times of the year,” Gunn said. “So what we did is we expanded into manufacturing financing. One of the ones we use is Optimus Financing, and the other is Service Finance.”

Peterman Brothers in Greenwood, Indiana, works to offer the lowest possible monthly payment for customers through no-interest or no-payment, standard installment loans — or what Chad Peterman, president and CEO of Peterman Brothers, calls a “mid-ranged fixed APR” over short- and long-term payment options. The options provide a range to any type of homeowner, whether they can only afford to choose the lowest monthly payment possible, or they choose a no-interest finance option to leverage that money elsewhere.

“We look at it as there's three types of buyers: the payment buyer, the leverage buyer, and the cash buyer — and having options for everybody puts us in a good spot to really cater to any type of buyer,” Peterman said.

In addition to the standard payment options, Beltz Home Service Co. in Findlay, Ohio, offers multiple options: six months same as cash, which has proven to be a popular option for those with stable credit history; and special loans through Eagle Loan for things like an emergency situation when someone’s in need of a system but simply can’t qualify for regular credit loans. Additionally, it is the only home service contractor to offer AfterPay, a buy now, pay later program consisting of four installment payments over a six-week period (every two weeks), with no credit check.

“Buy now, pay later is an exponentially growing platform of all age groups and economic demographics alike,” said Lara Beltz, vice president and co-owner of Beltz Home Service Co.

The company also offers a sort of HVAC service subscription.

“A worry-free lease HVAC equipment/systems and plumbing (water heaters) through our Premier Program,” she said. “Think of it the same as any other subscriptions service you currently pay for now like Netflix, a car lease, cell phone device payments, etc., except now we can provide this for your HVAC and plumbing needs as well.”

What payment terms are most appealing to you in purchasing new HVAC equipment? (Select all that apply)

Sample size: 2023 = 400

Homeowners prefer a discount to pay in cash the most appealing payment term. (Courtesy of Clear Seas Research)

Presenting Financing

As the survey and the contractors’ experiences demonstrate, homeowners tend to take advantage of the many financing options offered by contractors, and even find them to be a relief. And more and more homeowners are taking advantage of the options available.

As of recent, Beltz said they’ve seen a surge in their AfterPay method.

“And the popularity is growing; many customers also take advantage of same-as-cash offer if they qualify,” Beltz said. “We see people are tending to spend the same overall amount of money as ‘norm,’ but they are just purchasing in smaller transactional amounts.”

DOLLAR AMOUNT: Contractors may have to take into account how much financing will cost them when deciding on what to offer customers. (Courtesy of Jacob and Rhodes)

Once Jacob and Rhodes really started to hone in on financing, Gunn said their percentage of ticket price went up $3,000 to $5,000.

“[Financing] started gaining momentum, and we were helping the customer and they were buying more because if you go from $189 to $199, that could be $3,000 to $5,000 more dollars, depending on the finance program that you're using — for $10, you could have $5,000 worth of product,” Gunn said. “So now, indoor air quality comes into play, duct cleaning comes into play … and our revenue is expanded by financing.”

A major part of getting homeowners to take advantage of these offerings is presenting them in the first place. For example, a contractor might want to point out the money saved through the lower utility bills a new financed HVAC system will bring.

“A lot of our equipment can save you 15% to 20% on your electric bill, so if you have a $300-$500 electric bill, and you do the math, it'll pay for half — if not more — of the payment for your new equipment,” Gunn said. “And then what's nice is that guarantee falls in place: your warranty. You don’t have to worry anymore about the thing breaking down and it costing you more money. You’re making a payment that is all inclusive, for up to 12 years.”

Today, Peterman Brothers, in some fashion, finances a little over 80% of all new system installations on the HVAC side. Peterman said this may be due to how they present the options.

“You want to take away kind of that fear, embarrassment that a customer may have when it comes to financing by saying, ‘Hey, the majority of our customers use a financing option to pay for this purchase,’” Peterman said. “We try to use financing as a tool, not as like a fallback.”

Though there’s usually a broad range of pricing offered by most contractors, customers of Jacob and Rhodes, Beltz Home Service Co., and Peterman Brothers all fall into that $100-$300 range for a monthly payment on their financed HVAC equipment found by the survey.

Specifically, Peterman Brothers is seeing the vast majority of customers fall within $150-$200 a month on loans that are stretched out 15 years or so. Beltz Home Service Co. customers, on average, are paying $100-$150 a month for financed electrical projects and financed plumbing projects, and $200 to $250 a month for a full system HVAC.

There is a lot for HVAC contractors to consider when offering financing. In this video, the president of FTL Finance explains the complex topic.

Choosing Financing

When it comes to offering financing, contractors have to be willing to offer a wide range of options that fits every current and potential customer’s needs.

“Consider being and offering diverse and unique platforms,” Beltz said. “The finance world is one of the most fast-paced, evolving market sectors, so successful navigation of this sector requires a truly proactive approach to stay competitive.”

This goes hand in hand with keeping the customer in mind first, which Peterman said is the right way to decide on what payment terms they should offer.

“It kind of goes back to that three types of buyers — if there's three types of buyers, what is my solution for each type of buyer?” Peterman said. “How do I allow them to pay in a fashion that works for them?”

Additionally, Peterman advised finding a plan that doesn’t burden the company with fees.

“There's a number of plans out there that look great, but it’s not a win, win, win,” Peterman said. “It may be a win for the customer, but it's not a win for the company, and you've got to make sure that everybody's winning when you're offering these options.”

“Many business owners are surprised to learn there are ways achieve these offerings without spend significant amounts of money, and in many cases the startup cost of offering is $0 if you are specific and persistent in your vendor partnerships,” Beltz said.

Gunn said sometimes it has to do with the dollar figure.

“If you’re a smaller company, it's harder to absorb some of the fees that it costs to take on financing … But when you get in the right buying market with your manufacturer, they start offering you incentives to offset those costs …” Gunn said.

Overtime as a contractor grows in their financing journey, they’ll figure out what options best benefit both their customers and their business.

“As you go, you get stronger so you can help the customer better,” Gunn said.

Report Abusive Comment