As the pace of commercial HVACR industry consolidation increases, owners receive more and more letters, calls, and emails from brokers and potential investors. These inquiries have owners wondering why consolidation is happening again given that consolidation wasn't very successful the first time around.

Certainly, the first wave of consolidation in the 90s and early 2000s had some significant failures. There was Blue Dot, Encompass, and a handful of utility-backed consolidation efforts that fell flat. So, it certainly makes sense that owners are questioning why this is happening and wondering what is different about this second consolidation wave. Let's dig in to two key consolidation questions.

Who are the investors that are fueling the second consolidation wave?

Given its fragmented nature, commercial HVACR is ripe for consolidation. Private equity firms specialize in industry consolidation, so fragmented industries often draw their attention. But the lack of success in the initial wave of HVACR consolidation had many private equity investors spooked. That attitude has started to change due to the success of several companies, and now private equity firms are once again driving HVACR consolidation.

Two private-equity-backed HVACR consolidators that started in the mid 2000’s have grown to be large and profitable. One has $1 billion in revenue and the other $900 million. These firms quietly grew through the global financial crisis of 2008-09 and then picked up steam coming out of the recession. Around 2016 and 2017, other private equity firms noticed their success, which gave them confidence to invest in HVACR consolidation as well.

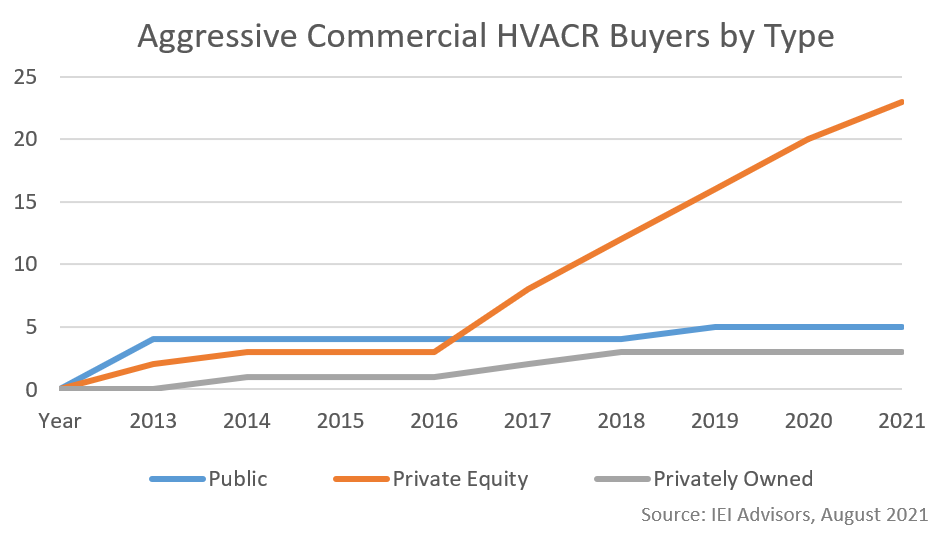

To monitor this trend, IEI Advisors tracks the number of aggressive commercial HVACR buyers in North America. IEI defines an “aggressive buyer” as any company that has already purchased at least one HVACR company and has at least one person full time dedicated to pursuing additional HVACR acquisitions. While there are public companies and privately owned businesses pursing acquisitions, the aggressive buyer list is predominately private-equity-backed firms. The number of private equity buyers (23) is almost triple the number of public and private acquirers combined (8).

The graph below shows the increase in the number of private equity buyers started in 2017.

Click graph to enlarge

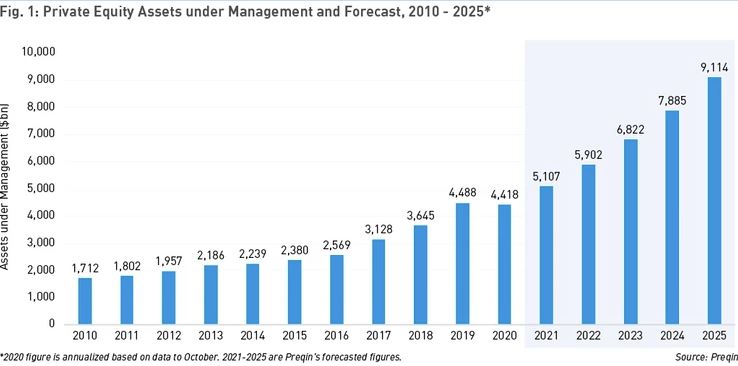

This sharp increase in the number of aggressive buyers is driven by proof of the HVACR consolidation model and also by the high growth of private equity as an investment vehicle generally. The amount of assets under management for private equity firms doubled from 2014 to 2020 and is expected to double again from 2020 to 2025.

Click graph to enlarge

This is good news for HVACR owners looking to exit over the next five years, as there will continue to be capital to fuel consolidation.

What is different about this second wave of consolidation?

Private equity today is more sophisticated. The 80s and 90s were the early days of private equity, and the industry made mistakes. HVACR consolidators were not immune to those mistakes, including poor change management, underappreciating local leadership, and undervaluing local brands and relationships. Investors learned from the mistakes of the first wave and for the most part are not repeating them today.

A few key differences of the second wave are:

Leveraging industry knowledge: Private equity firms prefer to buy a large HVACR company as a platform to start their consolidation effort. They then rely on the platform team’s knowledge and experience to learn more about building successful HVACR businesses. They also leverage their relationships to expand their acquisition efforts.

Better understanding of local markets: Investors better understand the local nature of HVACR businesses and are slow to introduce change to a business. They are respectful of local culture and processes. Private equity investors have also learned that local management teams understand the market and growth opportunities. They make it a high priority to keep the local team intact and are incentivizing them properly.

Focus on organic growth: Private equity firms now focus on both organic growth and growth by acquisition. The first consolidation wave largely ignored organic growth strategies. They favored growing revenue as quickly as possible through acquisitions. Today, private-equity-owners still heavily rely on acquisition for growth, but organic growth is equally important. After completing an acquisition, investors may even make significant investments in organic growth if local management presents a strong business case.

Still some concerns

Despite these changes in the private-equity model, HVACR owners need to be wary. Concerns still exist. Private equity firms may present inflated financial projections, wanting to tempt owners to sell their business and retain equity. If financial projections show that the retained equity will triple or quadruple in value over the next few years, an owner needs to take notice. The projections look great, but the owner needs to take the time to understand the assumptions of the financial model.

Another concern is the growth in the number of private equity firms over the past few years. Many of these firms have young, inexperienced teams who have decided to target the HVACR industry as their first investment. A seller needs to beware if it is the buyer’s first rodeo.

Overall a positive trend

The net result of the good and the bad is that overall, the second wave of consolidation is a positive trend for HVACR owners who are considering a sale in this strong seller’s market. The number of buyers competing for their business is at an all-time high. This creates a market that will often present multiple good options for owners and drive valuations higher.

Report Abusive Comment