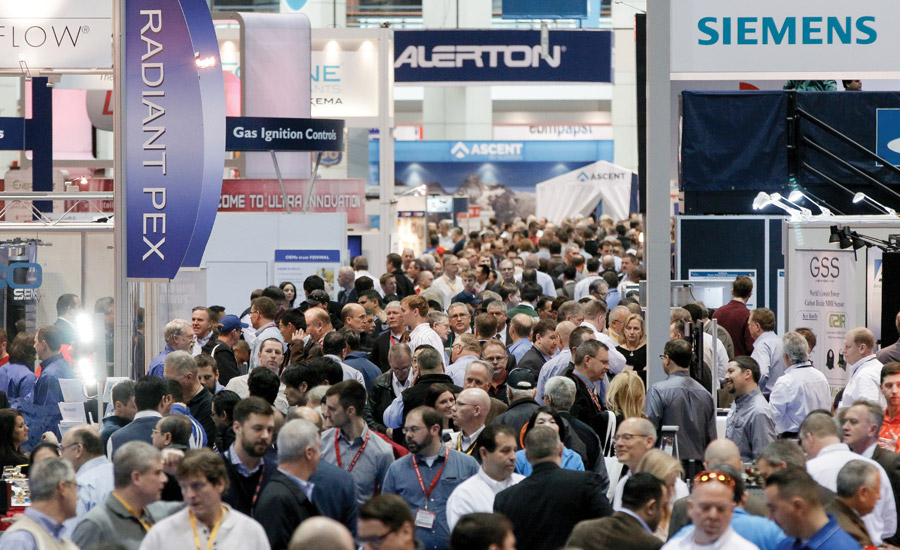

ORLANDO — The annual Air-Conditioning, Heating, Refrigerating Exposition (AHR Expo) Expo is anticipating more than 60,000 attendees and 2,000 exhibiting companies covering all facets of the HVACR industry at this year’s event. Responses from a recent joint survey sent to 1,300 2016 AHR Expo exhibitors by ASHRAE Journal and International Exposition Co. revealed optimism for the coming year in the HVACR industry.

The survey asked HVACR equipment manufacturers to consider what they anticipate the business climate will be for the industry regarding their sales, market segment activity, and overall expectations for 2016.

According to the survey, 86 percent of exhibitors are confident about their business prospects in 2016, with 14 percent answering “excellent” and 62 percent selecting “good.” Only 14 percent rated conditions poor or offered no opinion. These numbers, particularly the percentage of “good” answers, are fairly consistent with 2015’s survey, which showed significant growth in optimism from previous years.

Exhibitors also expressed positive outlooks when asked about their expectations of sales growth in 2016 based on prospective clients. Eighty-one percent expected to see an increase in sales. Of those, 21 percent predicted 10 percent growth while 33 percent anticipated 5-10 percent growth.

In keeping with the positive outlook for industry growth in 2016, 67 percent of HVACR manufacturers responding to the survey said they plan to introduce a new product at the 2016 AHR Expo. Of those new products, 53 percent aim to improve energy efficiency.

The survey question asking: “In general, how much are government and/or utility incentives helping to increase the adoption of energy-efficient products and technologies?” leant additional insight in this regard. Fifty-eight percent answered “some,” 28 percent said “very little,” and 5 percent responded “not at all,” while 9 percent said “a lot.” This feedback shows the industry would welcome and appreciate more help from incentive programs in the coming year.

When manufacturers were asked about their viewpoints on various market segments in the new year, data and telecom centers, hospitals, and health care facilities all tied with the residential market for best overall outlook. All were rated “excellent” or “good” by 65 percent of respondents. Data and telecom centers and residences were both rated “excellent” by 10 percent and “good” by 55 percent; meanwhile, 16 percent and 49 percent of hopitals and health care facilities, respectively, were rated “excellent” or “good.” respectively. Closely following in ratings were light commercial and office buildings with 62 percent each and heavy commercial with 60 percent “excellent” or “good” ratings. These percentages are a sign of stability in the industry, as they are on par with last year’s survey results.

When it came to the anticipated best potential for business in 2016, responses skewed from those of 2015’s survey. Forty-two percent of respondents selected “retrofit and renovations” as the most opportunistic area of the industry, up 14 percent from last year. Thirty percent selected “new construction,” which was last year’s No. 1 response. “Maintenance and replacement” decreased from 32 percent in 2014 to 28 percent in 2015.

“Numbers like these represent the ever-changing needs of this vast, complex industry,” said Clay Stevens, president of International Exposition Co. “Yes, the market segments have stayed consistent, but their needs haven’t. We are seeing less new construction and a jump in demand for renovations in existing structures. Much of this comes from a market-wide push for energy efficiency and conservation of resources, which I am pleased to see. The trend of improved energy efficiency in products lends hope to the future in regard to streamlining energy usage worldwide.”

Publication date: 1/25/2016

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!