director of applied VRF sales

LG Air Conditioning Technologies USA

There’s probably no bigger trend in the ductless and variable refrigerant flow (VRF) segment of the HVAC market right now than the transition to A2L refrigerants.

The phaseout of HFC refrigerants such as R-410A and R-404A is well underway. The amount of new HFC refrigerant, whether imported or produced domestically, that can be used in the U.S. was cut by 10%, from a baseline set by the Environmental Protection Agency (EPA) for 2023, then cut by 30% more for this year. The goal is to reduce the amount of new HFC refrigerant to 15% of the baseline by 2036 while introducing refrigerants with a GWP of less than 700.

Equipment is next: After this year, manufacturers will be barred from making new residential systems that use HFC refrigerants. (Manufacturing components to service existing systems will be allowed.) The sell-through period for residential systems that use HFCs was recently extended through 2025.

Daikin is ahead of the game. The company in 2021 introduced Daikin Atmosphera, a single-zone ductless system that uses R-32 refrigerant. It was the first such system in available North America, though Daikin has sold R-32 systems in other countries since 2012.

“We’ve already got the experience behind us,” said John Schwartz, marketing and communications manager at Daikin Comfort Technologies North America Inc., during the recent AHR Expo. “Not only is it proven here in the United States, but it’s proven throughout the world.”

All new Daikin systems will be transitioned to R-32 by the end of the year, Schwartz said. The company is “reengineering every product we have, reengineering it to take advantage of the benefits of R-32,” he said.

“We know that our product, our R-32 product, is going to be superior and more desirable for our contractors than our R-410A because the refrigerant is more efficient, has better capacities,” Schwartz said.

PRECISE CONTROL: The Samsung DVM S2 is a variable-refrigerant flow (VRF) system with technology that allows the compressor to precisely control a small amount of refrigerant. It is compatible with Samsung indoor WindFree cooling. (Courtesy of Samsung HVAC)

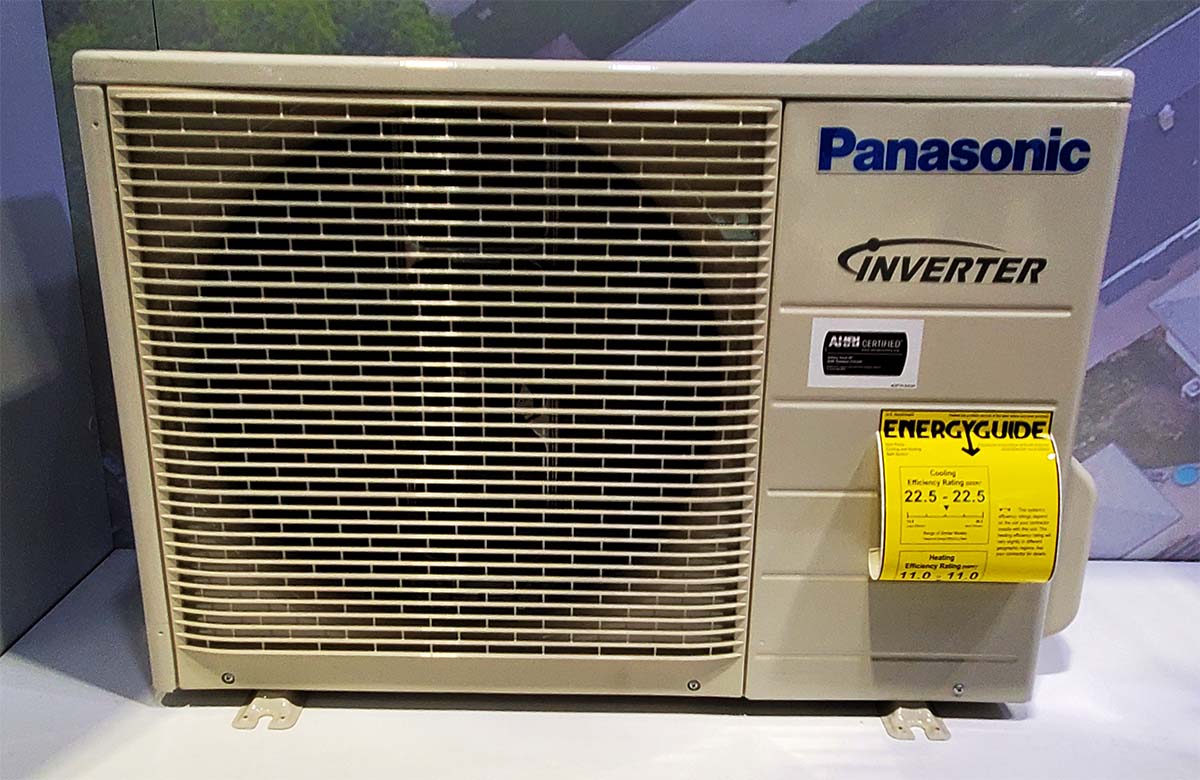

Other ductless/VRF system companies are following suit. Representatives of Panasonic, Fujitsu, LG, and Samsung at the AHR Expo all said their companies plan to switch to manufacturing products that use R-32 in order to meet federal mandates.

“R-32 has higher capacity, better efficiency, lower total emissions because of its indirect emissions, and a lower charge,” said Doug Bougher, director of applied VRF sales at LG Air Conditioning Technologies USA. “And it’s a single refrigerant, it’s not a blend, OK? So why would you use something else?”

“One of the big drivers there was the fact that we had some experience prior experience in Europe with R-32,” said Rick Nadeau, vice president of training and operations at Samsung HVAC. “Having that experience in the real-world operation of some of that equipment ... obviously reduces the R&D time.”

In “Europe, Asia, Australia, we’ve been using R-32 for about 10 or so years,” said William Russell, product planning manager for air conditioning at Panasonic. “We have the product knowledge, safety track record.”

Here are some of the other trends that were discussed at the Expo by ductless/VRF experts.

Advanced Controls

Fujitsu took the opportunity at the Expo to introduce its Airstage Cloud, a BMS-as-a-service platform that can help users monitor and manage the company’s VRF and mini-split systems, as well as any thermostatically controlled HVAC equipment, regardless of its manufacturer.

UNIVERSAL APPLICATIONS: The Fujitsu Airstage Cloud, using a Schneider Electric controller, is a cloud-based BMS that’s compatible with any thermostatically controlled equipment. (Staff photo)

Airstage Cloud, using a Schneider Electric controller, sets up a cloud-based BMS that’s cheaper and less intrusive than having a traditional BMS installed, said Derrick Paul, director of sales for Airstage VRF at Fujitsu General America Inc. The company says it’s ideal for smaller commercial buildings, which are less likely to have a BMS than larger facilities.

“Because it’s cloud infrastructure, it’s continuously being updated,” Paul said.

Airstage Cloud partners well with both the refrigerant transition and the trend toward higher-efficiency equipment, Paul said, because of its remote scheduling capabilities.

Fujitsu’s Refrigerant Cycle Monitor app for the Airstage Cloud is used to monitor VRF systems and diagnose any issues and is primarily used for the installation and commissioning of VRF systems. The Site Manager app allows Airstage Cloud to manage multiple sites, something that’s important to many Fujitsu clients, Paul said.

“We have customers that do a lot of VRF with us that are looking to have a BMS that covers multi-site,” he said. “This gives us the ability to go in there and offer not just the replacement VRF system, but the controls platform.”

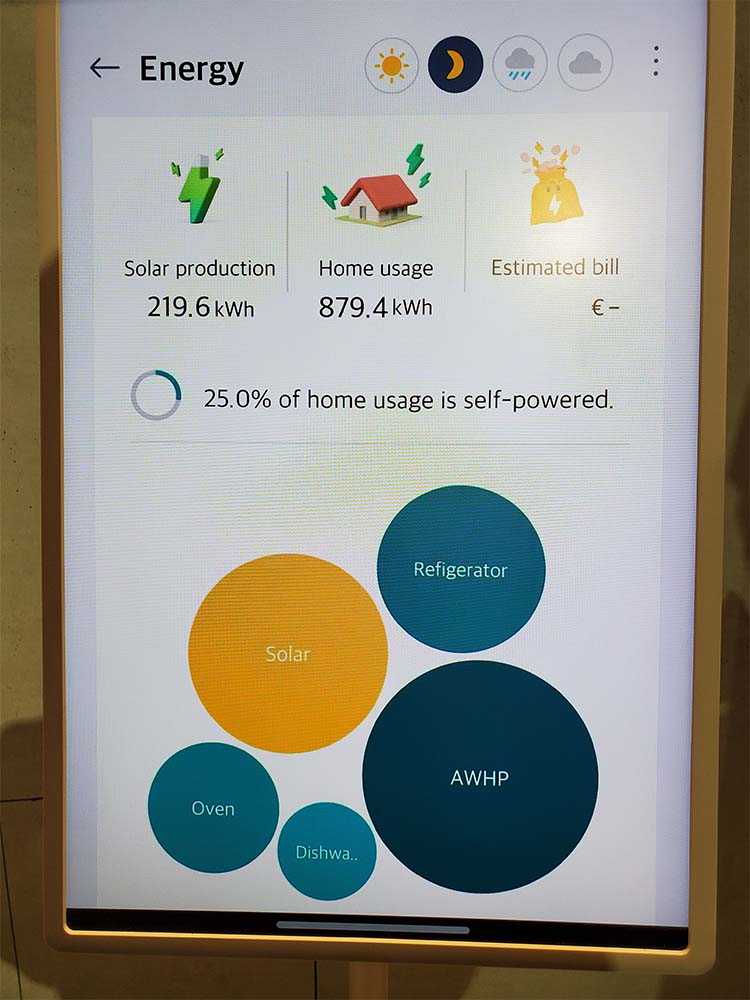

MAPPING ENERGY: This mockup of a smartphone display for the LG ThinQ platform, a management tool for LG ductless systems and other LG appliances, shows the proportion of electricity that's being used by specific pieces of equipment in a home, and also (the orange dot) the proportion coming from the home's solar power system. (Staff photo)

At LG, the ThinQ platform can monitor and manage LG VRF and ductless systems and a host of other LG products, including televisions, washing machines, and dryers, as well.

“It’s an entire whole-home communication solution for you,” said Phillip Kriegbaum, manager of contractor development at LG Electronics HVAC Solutions.

“All of your products can now talk to one single app,” he added. “It can monitor energy usage on different appliances, in reports. So, ‘Hey, this is where your energy is going.’ So just being able to incorporate that into all of our product lines has been a really cool advancement.”

Cleaner Air

At Panasonic, the focus was on improving IAQ. The company’s nanoe X technology, which generates hydroxyl radicals contained in water by capturing moisture in the air and applying voltage to it, has been incorporated into its ClimaPure XE series ductless heating and air-conditioning systems.

CLEAR THE AIR: Panasonic’s nanoe X air-purification technology has been incorporated into its ClimaPure XE series ductless heat pump systems. (Staff photo)

The hydroxyl radicals droplets, which can destroy contaminants, are dispersed by the fans on a ClimaPure system’s indoor unit.

“These hydroxyls will be created, loaded into the air, and will inhibit odors, bacteria, mold, viruses,” said John Sneyd, Ontario regional sales manager for Panasonic Canada. “It will also not just purify the air, but will also purify surfaces.”

Consumer Incentives

As they do across the HVAC industry, incentives for the installation of high-efficiency equipment, particularly electric equipment like heat pumps, play a big role in the ductless/VRF sector.

Ductless experts say their companies are working to keep up with the standards that equipment must meet to qualify for high-efficiency HVAC incentives, such as rebates and tax credits, including those in the federal Inflation Reduction Act, not all of which are yet available.

“What we’re doing is, we’re making sure that as we produce units, as we have model changes, that we’re meeting those efficiency requirements to get the Energy Star certifications that we’re looking for to meet these rebate requirements,” said Kriegbaum, at LG.

“We’ll look at those and try to anticipate the various trends and the energy requirements to satisfy some of those rebates,” said Samsung’s Nadeau. “Because, obviously, any money that they get back to a consumer, that’s a great thing, and it’s going to help drive sales and move people in that direction.”

Report Abusive Comment