According to a recent New York Times article, while more Americans are buying heat pumps, the pace of the equipment’s installation has slowed over the past year. The article attributes the slowing of sales to rising interest rates and inflation, coupled with a slow and confusing rollout of federal government incentives for the purchase of heat pumps.

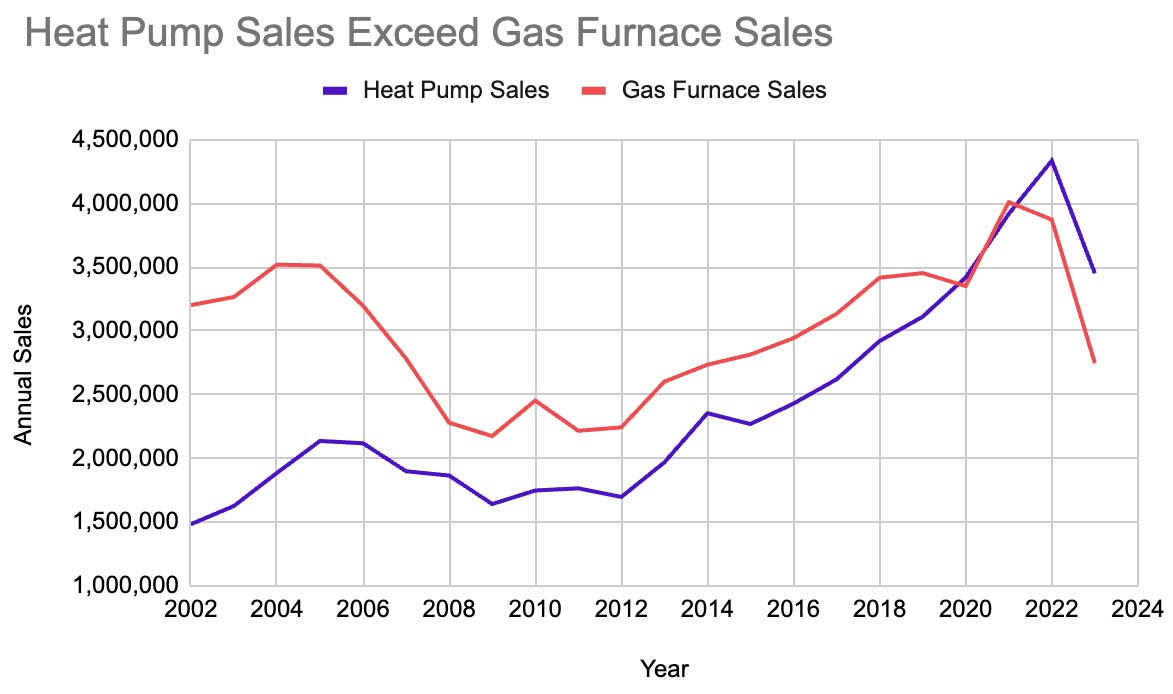

Yet heat pump sales did outsell gas furnaces in 2023, by 27%. Despite the sales numbers, Trever Houser, a partner at the Rhodium Group, an independent research firm, was quoted in the New York Times article as saying, “The level of incentive for heat pumps in the Inflation Reduction Act (IRA) is not large enough to overcome the effect of higher interest rates on HVAC installations.”

In other words, the cost of a heat pump is usually significant enough that most homeowners may need to borrow money in order to purchase one, especially when considering the other purchases inflation may affect like a mortgage, according to David Bixby, Air Conditioning Contractors of America (ACCA) manager of codes and standards.

“It will be interesting to see if this opinion proves to be correct, or if the market decides to go ‘all in’ for heat pumps,” Bixby said.

Heat Pump Adoption Challenges

The assumptions of slowing heat pump sales may or may not come to fruition. In fact, Rewiring America, an electrification nonprofit focused on electrifying homes, businesses, and communities, challenged the overall narrative of the New York Times article.

“Heat pumps have constituted 57% of year-to-date sales of heat pumps and gas furnaces combined, up from 53% last year and up 50% the year prior,” said Cora Wyent, director of research at Rewiring America. “Since the heat pump proportion of total heat pump plus gas furnace sales continues to grow, the data should be seen as a slowdown in all HVAC sales, not a slowdown in heat pump sales.”

Updated version of a chart used by the New York Times in an article last year, where the 2023 numbers are extrapolated from August AHRI data.

Since all HVAC equipment saw a jump in growth during the pandemic, Wyent said it’s possible that the slowdown in all HVAC sales, which the industry is seeing this year, could be attributed to the normalization after the pandemic (along with rising interest rates and inflation, of course).

The new efficiency standards per the Department of Energy (DOE) also play a role in heat pump sales.

“As a result, 2023 was an unusual year for the residential market due to stocking and destocking as manufacturers, distributors, and contractors adapted to the new efficiency standard and changing inventory needs,” said John Hurst, Lennox vice president of government affairs and sustainability. “The industry now sells more heat pumps than gas furnaces, and the trend toward electrification and decarbonization will continue.”

Heat pump sales will continue to grow so long as consumer education continues. (Courtesy of Lennox)

This isn’t to say that there aren’t factors plaguing the overall adoption and installation of heat pumps specifically. For starters, whether or not homeowners can even afford the purchase of a heat pump in the first place is a key factor in the adoption of this technology. Additionally, poor installation of heat pumps pose a threat to those consumers willing to make an energy-efficient change.

“The installation of more heat pumps can eventually be beneficial when more renewable energy comes online, but the likelihood that consumers will experience higher energy bills and decreased comfort is very high,” Bixby said. “Poorly installed heat pumps and unnecessary use of electric supplemental heat can lead to much higher winter utility bills. Also, those same poorly installed and oversized heat pumps could lead to excessive humidity in the summer, which can make your home miserable to live in.”

Federal Funding Fallouts

The 25C tax credit, which offers up to $2,000 a year for the purchase of a qualifying heat pump, has been available since January 2023 and is expected to continue for the foreseeable future. Since the rebate programs and funding associated must be administered by each state’s energy offices, it’s really up to each state as to when they’ll be rolled out.

“We expect the first states to roll out their programs by the second quarter of the year,” said Wyent.

Hurst said the rollout of additional incentives for low- and middle-income consumers has been slow.

“We anticipate some states being ready by mid-year, while others will take longer,” Hurst said.

Energy experts expect that interest in heat pumps will pick up once states begin rolling out their rebate programs. The DOE expects rebates to become available in much of the country in 2024.

“Which will immediately lower costs and will not require people to wait for tax filing season to claim a credit,” Bixby said. “The rebate programs provide a total of $8.8 billion for various home energy efficiency and electrification projects.”

Right now, it’s too soon to tell whether or not this timeline is on track with what the HVAC industry hoped for initially.

“We won’t know in any data-centered way about uptake of the tax credits (that came online in January 2023 and run through the decade) until people file 2023 income taxes in 2024, and we won't know about rebate uptake until state energy offices roll them out state by state in 2024,” said Wyent.

Hurst said that since the funding initially followed President Biden invoking the Defense Production Act, the expectation at that time was that the funding would be available much sooner than it actually was.

To get the rollout “back on track,” Bixby said, like with most changes, there needs to be education to raise consumer awareness, especially on the rebate programs that are being submitted to DOE by state energy offices to get their funding.

“ACCA has provided its contractor members with tools for engaging those energy offices, especially on contractor qualifications and what to look for regarding heat pump design and installation,” said Bixby.

Incentives

But are the incentives enough to encourage heat pump adoption?

Hurst said it depends on the Biden administration’s goals. If the goal of the incentives was to, as quickly as possible, put as many heat pumps as possible into as many homes as possible, then the incentives would do some good. But ultimately, they’ll miss the mark.

“Incentives targeted at the minimum energy conservation standard would have made the existing incentives more compelling to cash-strapped consumers who are already dealing with the impacts of higher interest rates and inflation,” Hurst said.

Wyent said it’s important to view the incentives holistically, including appliances like heat pump water heaters. Between the new DOE efficiency standards and the tax credits, that equipment is poised to explode onto the market and push electric resistance water heaters into oblivion.

“As for heat pumps specifically, the rebates are crucial for affordability and equity,” said Wyent. “The rebates will take longer to roll out, since they are run through DOE but are individually overseen and implemented in each state and territory, and it will take time to get it right. But once they come online, they will be a big and important additional boost beyond the $2,000 from the tax credits.”

The rebates were designed to make up the difference between installing a heat pump and replacing current systems, and based on upfront cost estimates, Wyent thinks they do that effectively. However, new heat pump installations sometimes come with “hidden” costs, beyond the cost of the equipment and labor.

“Although there are rebates for weatherization of existing homes, including their duct systems, there may not be a sufficient electrical supply available to a home to support an electric air-source heat pump, including removing the existing fossil fuel heating system,” Bixby said. “Again, the total expense may be too much for lower-income homeowners, even though there are rebate programs available in the IRA for those populations.”

To capitalize on the 25C tax credit, homeowners are required to report the amount they spent on a qualified heat pump to the IRS when they file their taxes using Form 5695 (Section B, Line 29). While the process has been reported to be relatively easy, figuring out whether or not the installed heat pump qualifies per CEE standards is a bit trickier.

“It requires knowing either the Air Conditioning, Heating, and Refrigeration Institute (AHRI) number of the heat pump system, or the model numbers of all system parts (e.g., the indoor coil, outdoor coil, and air handler for a ducted system),” Wyent said.

Bixby said that among ACCA contractor members who have installed heat pumps, those who talked to their customers, managed consumer expectations, and followed ACCA standards have reported success.

Increasing Heat Pump Sales

In order to continue the growth of heat pumps and even speed up their adoption, it really comes down to education on both the incentives and correct heat pump installation.

“While we certainly want to see installations go up, our biggest concern is that the heat pumps that do get installed are designed correctly, installed properly (to include setting up the controls — but that’s another topic), the duct systems are tight, and the building is well insulated,” Bixby said.

The rebates rolling out will also help with building momentum surrounding heat pump sales and installations, but they don’t do any good if consumers or contractors don’t understand them.

“We also think helping people understand the incentives will encourage heat pump installations,” said Wyent.

In order to help people understand these rebates, Rewiring America recently released a personal electrification planning tool, which helps homeowners navigate the home electrification process.

Lennox has sold heat pumps for decades, and the industry is already selling millions of heat pumps every year.

“Continuing consumer education helps with heat pump adoption and contractors, distributors, and OEMs are doing their part to provide consumers with economical options for their specific applications,” Hurst said.

Report Abusive Comment