On Monday, Mojave Energy Systems announced its $12.5 million seed round of funding that will be used to launch its third-generation liquid desiccant air conditioning platform.

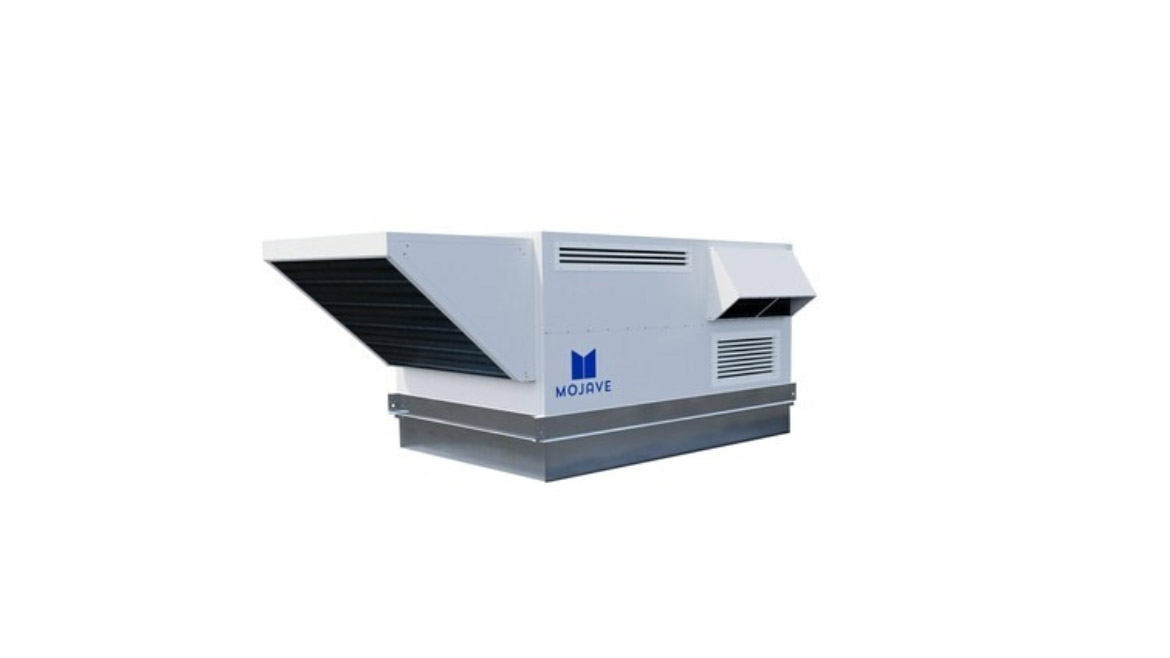

The novel Mojave product line cuts in half the energy required to provide buildings with fresh, cool and dry outdoor air, while using 20% less refrigerant than existing systems on the market.

The round is co-led by At One Ventures and Fifth Wall with participation from Xerox Ventures and others. The company spun out of the Palo Alto Research Center (PARC).

"The way we cool buildings hasn't changed much in over 100 years even though our buildings have," noted Philip Farese, Mojave's founder and CEO. "Today the story is about dehumidification, not cooling; in fact, we spend more energy dehumidifying air than we do cooling it. HVAC equipment improvements have focused on reducing the energy needed for things like heat pumps and fans, neither of which addresses dehumidification. Our first product, focused on providing cool, dry, fresh outdoor air, uses half the energy of other solutions and can reduce emissions by 100 million tons CO2e . It is especially helpful with buildings like schools, hospitals, and grocery stores, that have more demanding requirements," he explains.

Mojave uses a high concentration salt solution to passively pull water from air. The cool, dry air is then delivered to the building and, notably, the water-saturated liquid desiccant is reused by "regenerating" it (i.e., water pulled out and returned to its useful high salinity state) using only waste heat from the system: this eliminates the need for external sources of heating or cooling.

This process achieves double the moisture removal efficiency when compared to the traditional vapor compression approach, both reducing cost of operation for customers and helping them achieve Net Zero compliance with energy-efficient systems. The Mojave DOAS can "drop in" to existing HVAC infrastructure and requires minimal maintenance.

"In this technology we saw an opportunity to disrupt the $5B DOAS market as well as the broader markets encompassing cooling equipment, energy, and carbon that total over $600B and account for 10% of total global electricity and 4% of emissions," said Dilip Goswami, Venture Partner, At One Ventures. "But commercial building owners and operators need to see product benefits immediately to move away from traditional inefficient solutions. We are excited about Mojave's debut product because it offers massive energy savings, refrigerant reduction, drop-in installation, a quick payback, and $50,000 or more per unit in lifetime savings: it's an easy business decision."

"We are incredibly excited to support Philip and his entire team at Mojave as they continue to revolutionize the Dedicated Outdoor Air System market," said Greg Smithies, Partner & Co-Head ClimateTech Investment at Fifth Wall. "Their next-gen products will bring even greater energy benefits to the broader HVAC market imminently."

In addition to financial benefits, Mojave's DOAS can also improve indoor air quality. Mojave's units independently control temperature and humidity, allowing the user to select the ideal indoor air conditions. The biocidal properties of its liquid desiccant even purify the air from bacteria and viruses further improving air quality.

Mojave is already running several field pilots and has its commercial launch slated for January, 2024. The company will leverage the new capital for go-to-market and commercialization rollout, manufacturing of initial orders, and continuing to invest in research and development.

About Mojave Energy Systems

Mojave produces novel liquid desiccant systems targeting energy efficiency and reducing the climate impact of HVAC. Their first product, a Dedicated Outdoor Air System (DOAS) for commercial buildings, focuses on dehumidification, reducing energy consumption and refrigerant use, and improves indoor air quality. Mojave's liquid desiccant technology cools and dehumidifies the air, enabling the user to independently control dew point and dry bulb setpoints. Mojave DOAS has superior efficiency and lowest total cost of ownership when compared to alternative DOAS technologies. Further, technology currently in development has the potential to require 80% less energy than vapor compression systems and eliminate the need for refrigerants which would abate over one billion tons of CO2e. The company was founded in 2022 as a spinout of Palo Alto Research Center (PARC) and to date has received $12.5M in funding from At One Ventures, Fifth Wall, Xerox Ventures, and others.

About At One Ventures

At One Ventures invests in deep-tech startups catalyzing a world where humanity is a net positive to nature. The firm is highly technical and was founded by Tom Chi, former Head of Experience and founding member at Google X. At One Ventures finds, funds, and grows companies that are using disruptive deep tech to upend the unit economics of established industries while dramatically reducing their planetary footprint. To date, At One Ventures has invested in 35 startups, including battery recycler Ascend Elements, de-extinction company Colossal Biosciences, and biodegradable packaging supplier Cruz Foam. For more information, please visit https://www.atoneventures.com/.

About Fifth Wall

Founded in 2016, Fifth Wall, a Certified B Corp, is the largest asset manager focused on improving, futureproofing, and decarbonizing the built world. Since 2016, Fifth Wall has raised the third-most capital of any venture firm globally ($2.9B), according to SEC Form D filings. With approximately ~$3B in commitments and capital under management, Fifth Wall is backed by a global mix of more than 110 strategic limited partners from more than 15 countries, including BNP Paribas Real Estate, British Land, CBRE, Cushman & Wakefield, Hilton, Hines, Host Hotels & Resorts, Kimco Realty Corporation, Lennar, Marriott International, MetLife Investment Management, MGM Resorts, Related Companies, Starwood Capital, Toll Brothers, and others. This consortium represents one of the largest groups of potential partners in the global built world ecosystem, resulting in transformational investments and collaboration with portfolio companies to cut emissions, improve efficiency, and maximize returns. Founded in Los Angeles and headquartered in New York City, Fifth Wall's other offices include San Francisco, London, and Singapore. For more information about Fifth Wall, its limited partners, and portfolio companies, visit www.fifthwall.com.

Report Abusive Comment