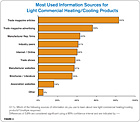

Figure 1.

Participating contractors report an average of $4.4 million in business annually and have been in business for about 28 years.

These contractors currently sell four light commercial brands. The number of available brands of light commercial unitary products is expected to decline by one-third during the next five years. Yet, the presence of import manufacturers is expected to rise.

The majority of attributes evaluated are of lesser importance when selecting light commercial unitary products relative to residential products. The one attribute that is considered to be “very important” significantly more often by more than one-half of respondents, when selecting light commercial equipment, is “ease of installation.” The three factors rated “very important” significantly more often in 2009 compared to 2007 are availability, competitive pricing, and warranty. (See Fig. 1)

Figure 2.

Advertising budgets for those focused on light commercial unitary equipment are about 40 percent less than for contractors focused on residential unitary equipment. About one-third of the advertising budget is spent on Yellow Pages® advertising. The role of the purchase decision maker is expected to change over the next five years, with HVAC contractors, building owners, and consulting engineers all having greater influence than they do today. (Fig. 3)

Figure 3.

Publication date:10/19/2009

Report Abusive Comment