Stephen E. Sandherr, the association’s chief executive officer, said, “The stimulus is clearly working, it just isn’t working fast enough for many construction workers in many communities. While the construction portion of the stimulus is having an impact, it is far from delivering its full promise and potential. With construction unemployment at almost double the national rate, it is disappointing to see so many stimulus programs getting off to such a slow start.”

One reason the stimulus is having a limited impact on construction hiring and purchasing patterns, Sandherr said, is that outside of the transportation arena, little of the authorized construction dollars have resulted in actual construction work.

The NEWSrecently spoke with more than 20 of the largest mechanical contractors in the United States, the majority of who concur that most of the stimulus funded projects affecting HVAC are in the pre-construction stage, rather than in shovel-ready mode.

Steve Poe, vice president of Critchfield Mechanical Inc., Menlo Park, Calif., said, “Most of the private money has dried up and the majority of projects are currently publicly funded institutional and military projects.” Poe said his company is now chasing the government-funded work along with everyone else.

Art Daniel, president and CEO, AR Daniel Construction Services, Cedar Hill, Texas, one of the panelist during the AGC press conference, said that so many general contractors chasing stimulus-funded work is having some adverse effects. “The number of bidders in the transportation industry has increased substantially, as bidders are coming in from other business sectors that are down. People are moving toward the money in markets that they have not historically worked in. Even though owners are getting a lower price on bid day, this may become problematic for owners who may not get the quality and reliability to which they have become accustomed.”

SAVING JOBS BUT NO HIRING

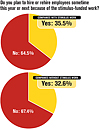

Sandherr did say the stimulus was doing a much better job at this point in helping construction companies save existing jobs. “What we’ve found through our members is that they are retaining their workforce in anticipation of the work that is to come, rather than laying them off.” According to the AGC survey, 60 percent of construction firms with stimulus-funded work report having saved or retained jobs because of the stimulus.However, the stimulus had been heralded as a tremendous opportunity for halting the virtual freefall in construction that has cost hundreds of thousands of jobs already. So far, very little project work has begun as a direct result of the stimulus program. Sandherr noted that while 36 percent of construction companies with stimulus-funded work report plans to hire new employees, an almost identical percentage of firms without stimulus-funded work also plan to make new hires this year or next.

The AGC’s chief economist Ken Simonson said, “I see the stimulus as a strong swimmer swimming against a very strong current. While there is an unprecedented amount of money, around $135 billion going into construction, unfortunately, it is not having enough of an impact on shovel-ready projects.”

SURVEY RESULTS

The survey revealed that 61.6 percent of construction firms who have participated in stimulus-funded projects expect a positive impact on the bottom line; of those not involved with stimulus-funded work, 86.7 percent said that if they were, they would expect a positive impact on the bottom line.Sandherr said, “Unsustainably high expectations can bring down a good policy and great programs. The stimulus will keep our industry alive, but it will not turn around a trillion dollar construction industry overnight.”

Of the companies not performing stimulus-funded projects, 50 percent said their companies do not do the type of work that is available, 46.1 percent said there are no or too few local projects available, and 17.6 percent said the reporting requirements and red tape were too onerous.

One panelist said that the stimulus program was working because it had begun to achieve its initial objective: Put people to work quickly. The transportation industry did benefit initially more than other sectors, and people are indeed working on highway projects.

Sandherr said there is still time for the administration to make sure the multi-year stimulus program delivers on its promise. He said the association was urging federal agencies to address critical shortages of contracting officials within key federal and state agencies overseeing stimulus construction dollars.

Publication date:12/21/2009

Report Abusive Comment