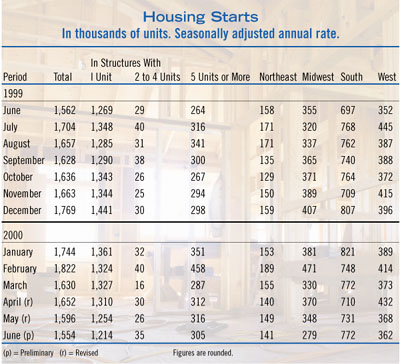

Looking at single-family housing starts, the June number was at a rate of 1,214,000 units, which is 3% less than the May figure of 1,254,000. For buildings with two to four units, the June rate was 35,000. For buildings with five units or more, the June rate was 305,000.

The June regional breakout shows the Northeast, Midwest, and West down compared to May, with the South gaining solidly. Compared to June 99, the South and West are up while the Northeast and Midwest are down.

For the first six months of the year, 817,900 housing units were started. This is 1% below the 824,000 units that were started in the first half of 99.

building Permits

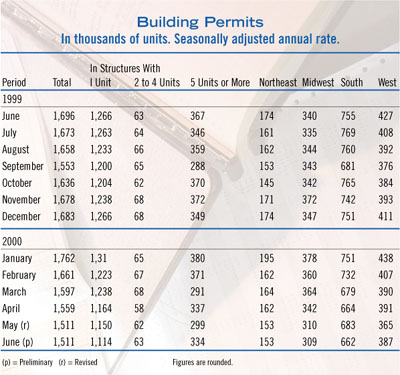

June’s seasonally adjusted annual rate of housing units authorized by building permits was 1,511,000. This is unchanged from the revised May rate of 1,511,000; however, it is an 11% dip below the June 99 number of 1,696,000.

Permits for single-family housing in June were at a rate of 1,114,000. This level is a 3% decline compared to the May figure of 1,150,000. Permit authorizations for buildings with two to four units stood at 63,000 for May. Authorizations for buildings with five units or more were 334,000 in June, which is 12% above the May estimate of 299,000.

The regional distribution for June has the West up, the Northeast unchanged, and the Midwest and South down vs. May. Compared to June of last year, all four regions are down.

During the first half of this year, 802,600 units were authorized by building permits as opposed to 841,200 units for the same period of 99. This represents a drop of 5%.

Building Permits

June’s seasonally adjusted annual rate of housing units authorized by building permits was 1,511,000. This is unchanged from the revised May rate of 1,511,000; however, it is an 11% dip below the June 99 number of 1,696,000.Permits for single-family housing in June were at a rate of 1,114,000. This level is a 3% decline compared to the May figure of 1,150,000. Permit authorizations for buildings with two to four units stood at 63,000 for May. Authorizations for buildings with five units or more were 334,000 in June, which is 12% above the May estimate of 299,000.

The regional distribution for June has the West up, the Northeast unchanged, and the Midwest and South down vs. May. Compared to June of last year.

Economy Accelerates But Indicators Are Mixed

WASHINGTON, DC - The economy that won’t slow down was at it again, with gross domestic product (GDP) growing at an annual rate of 5.2% for the second quarter, announced the Department of Commerce. This rate is about 1% higher than many economists had forecasted.Combined with the revised rate of 4.8% for the first quarter, the U.S. economy is still flying high and performing much stronger than expected.

Although growth was faster than expected, a key inflation measure dropped. The personal consumption expenditure index increased 2.3% in the second quarter, slower than its 3.5% rate of the first quarter.

Other economic indicators, however, showed mixed signals. After two months of modest growth, consumer spending was up strongly in June. However, second quarter growth of 3% is less than half the 7.6% growth seen in the first quarter.

The Conference Board’s index of leading economic indicators was unchanged in June. After declining 0.1% in May and being unchanged in April, this was the third straight month without an increase.

The Commerce Department also announced that construction spending was down 1.7% in June. The new seasonally adjusted annual rate is $800 billion compared to May’s $813.8 billion. However, the June figure is a 6% increase over June 1999.

And for the first six months, the value of construction put in place is 7% ahead of the same period last year.

Finally, F.W. Dodge reported that the value of new construction starts climbed 3% in June to $446.8 billion. Nonresidential building rebounded, while residential building continued to lose momentum.

Overall, there appears to be more positive numbers than negative numbers, and the economy keeps playing the role of the little engine that could.

New Home Sales at 21¼2-Year Low

WASHINGTON, DC - According to the Department of Commerce, sales of new homes declined 3.7% in June, reaching the lowest annual rate since December 1997, showing that the Federal Reserve’s interest rate hikes are having an effect on the housing market.Sales of single-family homes dropped in all regions except the West. June’s annual rate is 829,000 units, down from 861,000 units in May.

Due to the slower sales, the median price of a new home decreased 1.4% in June to $159,000. The supply of new homes is now the highest since December 1996.

However, despite slower sales in the second quarter, the overall sales level is still strong enough to come close to 1998’s mark, which was the second-best ever. So although last year’s record looks safe, new home sales are still hovering at a relatively high elevation.

The Key Word for Hvacr is Momentum

During this long-running economic expansion, the one word that economists keep repeating over and over is “sustainable.” Is this sustainable growth? Does the Federal Reserve need to make further adjustments to maintain sustainable growth?And despite economists’ worries, we continue to experience relatively rapid growth, very low unemployment, and a modest inflation rate. What’s going on here?

A better key word at this time, for the hvacr industry and industry at large, may be momentum. The economy has built up a full head of steam and no amount of tinkering by the Fed is going to put out the fire.

Some signs of a slowdown have presented themselves but they’ve always been accompanied by signs of even greater growth. For example, the Air-Conditioning and Refrigeration Institute (ARI) reported that April unitary air conditioner shipments were down slightly, followed by May shipments that were equal to last year.

Sidebar: New home sales at 2 1/4 year low

WASHINGTON, DC - According to the Department of Commerce, sales of new homes declined 3.7% in June, reaching the lowest annual rate since December 1997, showing that the Federal Reserve’s interest rate hikes are having an effect on the housing market.Sales of single-family homes dropped in all regions except the West. June’s annual rate is 829,000 units, down from 861,000 units in May.

Due to the slower sales, the median price of a new home decreased 1.4% in June to $159,000. The supply of new homes is now the highest since December 1996.

However, despite slower sales in the second quarter, the overall sales level is still strong enough to come close to 1998’s mark, which was the second-best ever. So although last year’s record looks safe, new home sales are still hovering at a relatively high elevation.

Publication date: 08/21/2000

Report Abusive Comment