Erin Richards, an account executive for Federated Insurance,

spoke about worker’s comp “mod factors” at the Florida Refrigeration and Air

Conditioning Contractor’s Association (FRACCA) annual conference in Orlando.

Fortunately there are ways for employers to reduce the high insurance premiums. “There are a lot of things you can do to keep insurance costs down,” said Erin Richards, an account executive for Federated Insurance. Richards was a guest speaker at the Florida Refrigeration and Air Conditioning Contractor’s Association (FRACCA) annual conference in Orlando. “You are not forced to say ‘this is not working’ and unable to do anything about it,” she added.

“Insurance can be a controlled business expense or an unnecessary profit leak.”

Richards talked about the Experience Modification Factor, which is an adjustment to the insurance premium based on historic loss and payroll data. She said the “mod factor” has been trending down in recent years, resulting in lower insurance costs.

According to Richards, the industry-wide modification factor dropped from 1.5 in 2002 to 0.98 in 2007. In order to explain that, she used the following $100,000 premium:

• $100,000 x 1.00 experience mod = $100,000

• $100,000 x 1.51 experience mod = $151,000

• $100,000 x 0.98 experience mod = $98,000

• $100,000 x 0.73 experience mod = $73,000

She said the industry averages for small-sized businesses is a mod factor in the 0.90s, medium-sized businesses in the 0.80s, and large-sized businesses in the 0.70s.

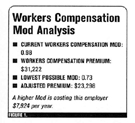

Figure 1. (Click on the image for an enlarged view.)

KEEPING THE MOD FACTOR LOW

Richards believes that the best way to keep mod factor ratings low is to track all of the worker’s compensation insurance claims. That requires a dedicated staffer to analyze claims on a regular basis, usually monthly.Some of the things that should be analyzed include current workers compensation premiums and deductibles. She said that a higher deductible lowers the mod factor and gave an example of how a lower mod factor can save insurance costs (see Figure 1.)

One FRACCA contractor at the seminar asked Richards if he should fire an employee due to how he is a possible accident risk. Her reply was “Cut him.”

She also added some other ways to lower the mod factor, including:

• Recalculate mod by removing certain types of recurring injuries, such as back or eye injuries.

• Prompt claims reporting. Claims reported after seven days result in 17 percent higher costs.

• Send employees to doctors in the health care network, which can result in an average of 15 percent savings on medical portions of claims.

• Have a light-duty return to work program and ensure it is managed correctly.

• Watch for hidden costs in insurance premiums. Richards said, “For every dollar in direct costs there are one to four dollars in hidden costs.”

Richards added the industry average for hidden insurance costs is $29,052 per year. “If a business operates on a 2 percent profit margin it would need $1,452,600 in sales to offset those hidden costs,” she said.

For more information, visit www.federatedinsurance.com.

Publication date:05/19/2008

Report Abusive Comment