In their March 31 Core Report, Majestic Steel USA analysts shared insights on the cost, supply, demand and economy of steel markets.

Cost

Iron ore pricing is up 16.5% over the last ninety days, and rebounded sharply this week to $128.00/m after dropping to $121.40/mt the week prior. Majestic Steel analysts wrote "demand recovered this week after news that China’s steel production cuts would be less harsh than initially expected."

China anticipates a 290 million metric ton, 8 year high in iron ore production.

Weekly zinc pricing

Zinc prices are at the lowest price since the week of Thanksgiving, but nonetheless ticked up slightly this week after a three week slide. Zinc pricing ended the week at $2,906/mt ($1.318lb), up from $2,898/mt ($1.315/lb) previously.

Analysts report slight decreases in zinc with three different warehouse measurements.

Coking coal

Coking coal hit its lowest price since Jan. 12 and continued sliding downward for the fourth consecutive week, having ended the week at $301/mt from $334/mt previously.

According to the Majestic Steel report, "a wave of new supply, combined with a weaker demand environment has helped to push coking coal pricing lower as of late."

Steel production

While steel production hit a six-month high the week prior to March 31, production did tick down. U.S. steel mills are operating at a 75.1% utilization rate, producing an estimated 1,679k tons compared to a 75.4% rate previously.

According to Majestic Steel analysts, year-to-date steel production is now down 6.9% compared to the same timeframe from last year.

As for global production, production has declined on a year-over-year basis for four months, with the world producing 5.084 million metric ton/day, up slightly from January, but still down 1.0% from the 5.134 million metric ton/day rate in February 2022.

Chinese production is flat, but the rest of the world is climbing, with ex-China production increasing to 2.225 million metric ton/day. This is the highest rate since June. Majestic Steel analysts also report U.S. production increased to a 216,000 metric ton/day rate.

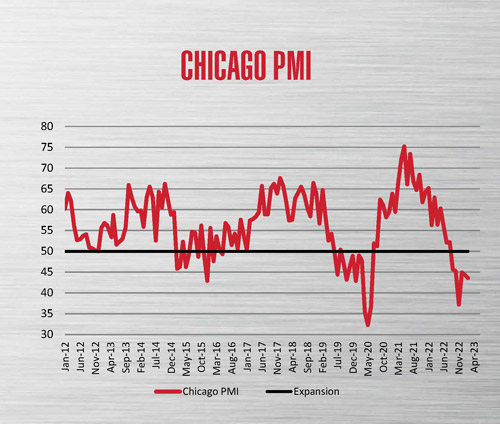

Chicago PMI

Manufacturers in the Chicagoland are recovering, although March still marked the seventh consecutive month of contraction. The March Chicago PMI is 43.8, up from 43.6 in Feb., but still down compared to 62.9 in March 2022.

According to the Majestic Steel report, any reading below 50 denotes a contraction in activity, while any reading above 50 shows an expansion.

Report Abusive Comment