Over the weekend, a drone attack took out the largest crude oil production facility in Saudi Arabia. This attack took out 5% of the world’s daily production of crude oil, roughly 5.0 million barrels/day.

This attack and subsequent production outage caused the largest, one-day, oil price surge since 1991. As of this writing, crude oil pricing is at $60.43, up 10.17% from Friday. This is the highest crude has been since May.

Initial reports have states that both OPEC and Russia are going to hold off on boosting production, a sign pricing could climb even further from.

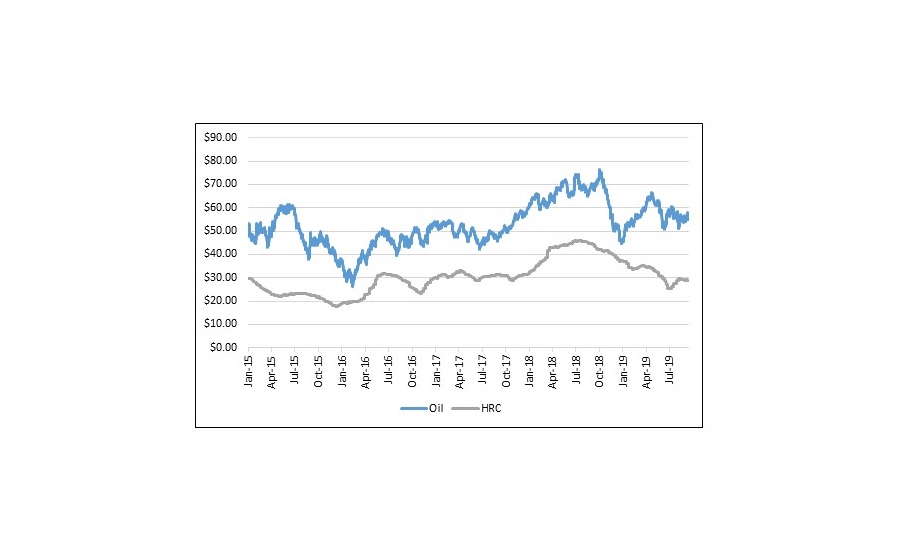

This price spike is a double-edge sword for the US steel market. While the correlation between crude oil pricing and HRC pricing is strong (+77.4%) since January 2015, it also comes at a time when the worry of higher gas prices could slow the steam engine that has been the US consumer.

President Trump has already given the go ahead to open the massive US reserves, which, along with the factors listed below, should help insulate the US from sharp price increases.

Also helping is:

- Energy only makes up about 2.5% of household consumption in 2019; this compares to about 8% in 1980.

- New production techniques (fracking) have jump-started US production, pushing it ahead of Saudi Arabia as the top global producer.

The chart below shows US HRC pricing and spot crude oil pricing over the past 4+ years.

Report Abusive Comment