Nearly all employees who were covered ended up paying more for health insurance while also forking over higher deductibles and co-pays. The expense of coverage for a family today is about $10,000 per year, which is almost equivalent to a minimum wage salary.

With spiraling premiums, employees and employers are looking for better options.

Most contractors believe there are limited options. Usually, if the contractor is running "lean and mean," the human resources department (if there is one) is small, which means the time invested in researching other options is limited. Compounding the problem, many insurance salesmen don't understand how a plan design change can benefit their customer.

Usually, the business owner will get a second quote, and often the two vendors' quotes are within a few dollars of each other. About half the time, the business owners change vendors, resulting in new cards, new doctors, coverage changes, and an overloaded human resources department. The entire process is normally painful, lengthy, and nonproductive.

A Better Approach

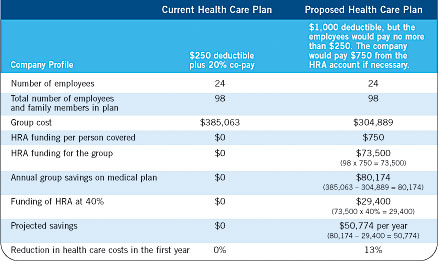

Health care reimbursement accounts (HRAs) are one solution for a growing number of businesses. HRAs can greatly enhance the way employers can structure health care benefits. HRAs are the solution when a contractor wishes to reduce health care costs by taking on some known risks. As shown in Figure 1, the company can reduce health care costs by 10 percent or more.Let's work with an example of a hypothetical company named ABC HVAC, a contractor with 24 employees. Through the company's current health care plan, the employees have a $250 deductible plus a 20 percent co-pay. (See Figure 1.) ABC HVAC has been in business for 10 years; during that time, 40 percent of the employees, on average, spent the entire deductible ($250) in a given year, while 60 percent of the employees did not fully meet the deductible.

The current plan has a group cost of $385,063.

The owner decides to consider other options, and he selects a high deductible plan with an HRA account. The selected plan has a $1,000 deductible. The owner knows that a high deductible would present a hardship for many of his employees. To avoid this negative situation, the owner places $750 into the HRA account for the covered employees.

During the plan year, health care claims from the employee would first be paid by the employees' $250 deductible. The next $750 in expenses would be paid by the company-funded HRA account allocated to the employee. Beyond that, the employee would be responsible for the co-pay with insurance coverage picking up the remaining expenses.

If the company experiences the average level of claims, it could realize a 15 percent reduction in the company's health care costs.

The first step is to determine what your company's claims history has been. There are some companies that we have worked with that had about 25 percent of their workforce that did submit claims that exceeded the $250 deductible. They implemented this approach, and saved that much more. Typically, we have seen companies in the 40 percent range, as illustrated in the example.

The contribution the company makes toward the HRA is tax deductible and can be applied to any medical-related expense. Employees do not have the right to receive cash or any benefits other than reimbursement of medical expenses from the HRA.

Health care reimbursement accounts are an excellent method for employers to reimburse employees for their medical-related expenses on a pretax basis. Unfortunately, HRAs are not well understood by the general public.

Steve Gerhardt is an investment advisor representative/financial planner with Sagemark Consulting/Lincoln Financial Advisors (member SIPC). He can be reached at sgerhardt@lnc.com or at 513-746-7006. This information should not be construed as legal or tax advice.

Publication date: 08/08/2005

Report Abusive Comment