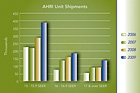

Figure 1. Annual unit shipments of 15, 16, and 17 SEER equipment from 2006 to 2009.

ARRA provided a federal tax credit for HVAC equipment that meets Consortium for Energy Efficiency (CEE) Tier 3 standards. Now that these tax credits have been available in our industry for over a year, we are in a position to analyze their impact and draw some conclusions about their impact on our industry. While this program has achieved some limited success, I hope it will continue to spur industry growth this year.

MINIMAL INDUSTRY GROWTH

One way to gauge the success of the ARRA program is to analyze unit shipments as reported to the Air-Conditioning, Heating, and Refrigeration Institute (AHRI). Figure 1 indicates that shipments of compressor-bearing equipment at the tax-credit SEER levels dramatically increased in 2009 over prior years. It’s worth noting that these increases took place during periods of overall market contraction. So, the HVAC industry (as measured by unit shipments) has gotten smaller on a year-over-year basis while these categories have expanded.As a percentage of the total market, higher-efficiency equipment has been growing steadily since 2006, while the overall market has been declining. As evidenced in Figure 2, this segment grew from 5 percent of the market in 2006 to 13.8 percent in 2009.

The current question, though, is: How much has the federal tax credit contributed to the industry growth in these SEER levels? It would be easy to conclude that the tax credit has had a significant impact since 2009 shipments are much higher than previous years. However, by analyzing the trend, we see that these SEER levels were increasing in the years preceding the tax credits.

Figure 2 indicates the total unit shipments for equipment 15 SEER and above for 2006 through 2009. For 2006 through 2008, the cumulative average growth rate was 23.2 percent, and from 2008 to 2009 this segment grew 32 percent. We can conclude, then, that these efficiency levels would have grown at least 23.2 percent without the federal tax credit and that the tax credit contributed 8.8 percent in unit growth for 2009.

That 8.8 percent is a significant number and represents 62,749 units. However, as a percentage of the total market, 62,749 units is only 1.2 percent. This means the tax credit accounted for just 1.2 percent of industry growth in 2009.

Given the excess capacity currently available in the industry, it’s unlikely that an incremental 62,749 units created any additional jobs. So, why did such a magnanimous credit only grow the industry 62,749 units, a relatively small number? There were a couple of factors that contributed to this low impact.

First, the tax credits were not available until February, so when comparing 2009 industry shipments to 2008 and previous years, it must be noted that there was one month in 2009 when no tax credit was available.

Next, when the legislation became law, it surprised the industry. Consequently, there was not a lot of qualifying equipment available in February 2009. Manufacturers had to scramble to redesign and re-rate a lot of equipment throughout the year to provide what the market was demanding.

By the end of 2009, most manufacturers had upgraded their product offerings, and almost all of the product gaps were filled. With the equipment now available, I think we will see an increase in the impact of this legislation in 2010.

Figure 2. Annual unit shipments of 15+ SEER equipment from 2006 to 2009.

AN EXCLUSIVE CREDIT

Even more significant than those factors, however, is the exclusive nature of the tax credits. Since its goal was to impact our industry and create jobs, the federal government may have missed the boat by making the tax credit too exclusive.In order to fully benefit from the tax credit, a homeowner must have a tax liability of least $1,500. According to estimates from the Tax Foundation, a nonpartisan tax research group based in Washington, D.C., roughly 43.4 million tax returns were not liable for any federal income tax in 2006. These 43.4 million tax returns represent approximately 91 million individuals who paid zero federal income tax. And there were another 15 million households that did not file a tax return at all. In total, there were roughly 121 million Americans - 41 percent of the U.S. population - outside of the federal income tax system in 2006.

For 2009, the Tax Foundation estimated that the number of tax returns paying zero federal income tax grew to 47 million, or 96 million individuals. And these numbers don’t include other Americans who have tax liabilities of less than $1,500. In essence, the government has excluded a large portion of the U.S. population by structuring the program as a non-refundable tax credit.

Additionally, by specifying CEE Tier 3 efficiency standards for eligible equipment, the government excluded even more Americans from utilizing the credit. Tier 3 requires 16 SEER air conditioners and 15 SEER heat pumps, and this equipment often utilizes advanced technologies such as variable-speed motors and two-stage compressors. This equipment is significantly more expensive than base systems and, to the average consumer, is often cost prohibitive even with a $1,500 tax credit.

For many Americans, the payback for these SEER levels is often many years beyond the time period they plan to remain in the home.

The $1,500 tax credit is an excellent selling tool for contractors because it makes higher-efficiency equipment more attractive to customers.

A NEW PROPOSAL

So what could we change to make this credit more effective? Here’s an idea: Instead of targeting higher-income Americans, open the credit to apply to a greater percentage of Americans. My proposal is to create a tax credit that encourages the replacement of existing less than 13 SEER equipment to at least 13 SEER equipment.How often do contractors replace leaking coils or failed compressors in older systems because the consumer is unable to afford a new 13 SEER system? The answer is probably more often than we like to think. A refundable tax credit of $500 for replacing a less than 13 SEER system that is at least 10 years old would make 13 SEER equipment more affordable and discourage consumers from repairing inefficient systems. Plus, the refundable credit would apply to a greater percentage of Americans, so this program would have the ability to grow the industry and, in turn, create jobs.

The industry has contracted from 8.6 million units in 2005 to 5.1 million units in 2009 - a 40 percent reduction. We need our government officials to develop programs that encourage upgrading the installed base. Simply raising efficiency standards or having programs that encourage the installation of the most efficient systems will not create jobs nor will it significantly impact energy usage. We need to encourage replacement, not repair.

A GOOD DEAL

Yet despite its shortcomings, this tax credit has been good for consumers and the world of HVAC. The tax credit encouraged the development of new higher-efficiency products and did contribute to some growth in the industry. Plus, the tax credit is an excellent selling tool for contractors because it encourages up-selling to higher-efficiency models.The $1,500 credit makes higher-efficiency equipment more attractive, and the realized energy savings provide an immediate impact on monthly utility bills. With a little restructuring, a greater industry impact could be realized by expanding the credit to apply to 13 SEER equipment. However, the next best thing is to sell the heck out of it and hope it gets extended.

Sidebar: How It Works

Clearly, the federal tax credit affects contractors by moving the mix to higher-SEER equipment, which can be more profitable. That one’s a given. But here are two less obvious ways the tax credit impacts everyday business for the HVAC contractor:•More manpower.Fifteen and 16 SEER equipment is significantly larger in size compared to 13 SEER equipment. This means the equipment often requires more handling and additional help to complete a job compared to installing 10 or 13 SEER equipment. Contractors must figure that extra manpower into every sale.

•Full-time HVAC contractor, part-time tax consultant.Contractors should be prepared to sell and install more tax-credit-eligible equipment in 2010 versus 2009. This means the contractor should also be prepared to properly counsel the consumer on what does and does not qualify for the tax credit. Most manufacturers have published tax credit certifications indentifying qualifying equipment. Another good - and user-friendly - source of information is the AHRI Website at www.ahrinet.org. Finally, contractors should have a basic understanding of how the tax credit works and be able to properly explain it to consumers.

For more information, see “Explaining the Federal Tax Credit” in the Oct. 12, 2009 issue ofThe NEWS.

Publication date:05/10/2010

Report Abusive Comment