Mark Menzer, vice president of the Air Conditioning and Refrigeration Institute (ARI), Arlington, Va., offered the North American perspective. "The use of heat pumps has grown slowly but steadily in North America," he commented. "Recent natural gas price increases make the use of heat pumps more attractive. The pending increase in the minimum efficiency mandated by the federal government will result in a smaller variety but higher-efficiency units for sale."

That efficiency increase, plus the transition to HFC refrigerants, means that "significant redesign can be expected," he said, for efficiency enhancements, refrigerant changes, and refrigerant containment.

He also hinted at major technology shifts: "While vapor compression cycles using fluorocarbon refrigerants will continue to be the technology that is used to provide heat pumping, a variety of other technologies are being evaluated for long-term use."

Mature Technology

"Heat pump equipment represents a mature technology and a growing market in North America," Menzer said. Figure 1 shows that the number of unitary, central heat pump shipments in the United States has risen to almost 1.9 million annually."The reasons for this increase are a strong housing market, especially in regions where heat pumps are popular, as well as the growing replacement market for systems that were installed in the 1970s and 80s," Menzer said.

The southern United States in particular has been a strong market for heat pumps due to its new housing growth, large replacement market, and milder winter temperatures. "New, single-family homes are large and often use two and sometimes three heat pumps."

The market saturation for heating systems in North American homes is shown in Figure 2.

Reliability Issues

They may have gotten off to a rocky start in the 1950s and 60s, but "One of the greatest improvements in heat pumps has been their reliability," said Menzer. Advances in compressor technologies have had the most impact.Heat pump controls have improved as well, he said. "Demand defrost has virtually replaced timed defrost, so a heat pump only goes into defrost mode when it is necessary. Better refrigerant management within the cycle has also led to better performance and reliability."

A system can only perform as well as it is installed and serviced. "The HVAC industry in North America recognized the need to increase the level of competence of the technicians who install and service air conditioning and heating equipment. In 1997 they established NATE, North American Technician Excellence.

"NATE exams reflect a consensus opinion of what technicians need to know to effectively service and install today's sophisticated HVAC systems," Menzer pointed out. "There are over 21,000 NATE-certified technicians in the U.S. and elsewhere."

Economics

Air-to-air heat pump performance varies by climate. Energy prices vary throughout North America. The average price of residential electricity in the United States was 9.1 cents per kWh in September 2004, or $26.61 per MMBtu, Menzer said. The average price of residential natural gas at the same time was $13.27 MMBtu."For this typical example, it is considerably less expensive to heat a home using an electric heat pump," he stated.

"In spite of this, natural gas furnaces continue to be the equipment of choice in most of the U.S. This may stem from the early poor reputation of heat pumps."

Heats pumps also seem to enjoy more relative popularity in rural areas, where natural gas pipelines are not available. (See Figure 3.)

Efficiencies And HFCs

Historically, most unitary air conditioners and heat pumps shipped in North America used HCFC-22, Menzer pointed out. "HCFC-22 will be phased out as of January 2010, at which time it is expected that North American manufacturers will transition to HFC-410A."Manufacturers also are preparing to comply with new minimum efficiencies of 13 SEER for heat pumps in cooling mode, 7.7 HSPF in heating mode. "Manufacturers had hoped that these two transition dates would occur simultaneously or at least close to one another, so that the two changes, refrigerants and minimum efficiency, could be made at once," he said. "It is likely, however, that the refrigerant change will take longer to implement for most manufacturers."

In addition, due to the larger heat exchange area required for 13-SEER units (as compared to 10-SEER units), "more copper and aluminum will be required," Menzer said. "One manufacturer estimates that heat exchangers on 13-SEER units are 30 to 40 percent larger than on 10-SEER units.

"In a time of tight supplies of raw materials, this is expected to add considerable expense to new units. It is feared that some manufacturers may not have raw materials available and might have to cut back or even cancel production."

New Technologies

Research in advanced heat pump concepts is under way at a variety of institutions in North America, including the Air Conditioning and Refrigeration Technology Institute (ARTI).According to Menzer, "ARTI is conducting research or has recently completed research on flattened-tube heat exchangers, extruded-microchannel heat exchangers, and smart refrigerant distributors for evaporators.

"ARTI is also investigating other, less-traditional cycles for pumping heat, including thermo-acoustic cycles, magneto-caloric systems, absorption, water-vapor cycles, and transcritical carbon dioxide systems. Some of these cycles show long-term potential; however, significant technical barriers have to be overcome."

In short, "American industry is working on several initiatives to reduce emissions at each phase of the equipment's life," he said.

"While vapor compression using fluorocarbon refrigerants will continue to be the technology that is used to provide heat pumping, a variety of other technologies are being evaluated for long-term use."

European Trends

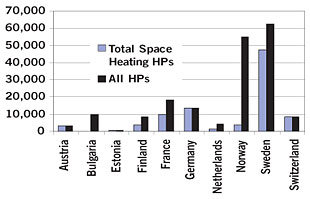

In Europe, heat pumping technology is widely applied in residential, commercial, and industrial buildings, according to Monica Axel and Fredrik Karlsson of the Swedish National Testing and Research Institute, Borås, Sweden. Heat pumps designed for space heating are more common in central and northern Europe, although interior heating is needed in all European countries."Although statistics show that conditions vary widely from one country to another, the overall trend of market growth of heat pumps in Europe is favorable," they said. Energy prices and each country's energy mix affect the conditions for heat pumps to be competitive with other alternatives, they explained.

Other important factors include "tradition" (e.g., people's comfort levels with the technology based on past experiences), knowledge, and the condition of existing and new buildings.

"Research and development, various types of political incentives, requirements for specific minimum levels of energy efficiency, and the dissemination of knowledge are all important instruments for encouraging growth of the heat pump market," they said.

"The fact that climate, the condition of building stock, experience of the use of heat pumps, and energy mix all vary widely from one country to another means that Europe is not a homogenous market.

"This has meant that everything from mature markets, through developing markets, to markets with little experience of heat pumping technology, can all be encountered within the boundaries of Europe."

Most of heat pumps sold in Europe are electrically driven. Half of all electricity production in the European Union (EU) is based on fossil fuels, one-third is based on nuclear power, and about 15 percent on hydropower. Some countries (such as Norway and Iceland) generate almost 100 percent hydro power, making their capacity climate-dependent, and which can result in energy shortages in dry years. "Reducing the risk of electricity shortages is one reason for improving the efficiency of energy use."

According to the European Heat Pump Association (EHPA), Europe has approximately 145 million dwellings, housing a total population of more than 370 million. "Heating is needed in all European countries, and hydronic systems dominate even in countries that also require cooling," said Axel and Karlsson. Fifty-three percent of dwellings have a central heating system, 11 percent are heated by electricity, and 10 percent are heated by gas.

Cooling is common in southern Europe in particular (southern France, Greece, Italy, and Spain). "In some countries (Norway, Finland, and Sweden, for example) there is a substantial proportion of residential buildings with direct electric heating, and this presents an obstacle to the installation of heat pumps, as it is not as easy to distribute the heat from them when the house has no duct distribution system to start with," they said.

Some countries (i.e., Holland, the U.K., and Germany) have extensive natural gas distribution networks. Germany, Sweden, Denmark, and other countries have district heating systems in urban areas that compete with small-scale heat pump technology.

Hydronic heating systems are the main type of heating systems in commercial buildings, with both air and water used for cooling.

Common heat sources for European heat pumps are air, ground source (surface, rock, geo-thermal), water (lakes, rivers, and groundwater), and waste heat.

"In general, most of the market growth for heat pumps is for use in new buildings with hydronic low-temperature heating systems," said Axel and Karlsson. "However, the major potential market is in existing building stock with high-temperature hydronic heating systems; unfortunately, the high temperature of operation is a technical obstacle to large-scale use of individual heat pumps."

East Asia And Oceania

Takeshi Yoshii of the Heat Pump & Thermal Storage Technology Center of Japan, Tokyo, presented the current overall picture of "heat pumping technologies" in Asia and the Pacific. "The most outstanding feature of this region is the increasing demand for air conditioning of residential and commercial buildings," he said. "The rapid proliferation of air conditioning has been the main cause for pushing up power demand, causing shortage in power supply and deterioration of power load factor."In order to provide some load leveling, Yoshii said cool storage systems and thermally driven cooling systems have been used quite a lot for air conditioning buildings. "On the other hand, heat pumping technologies for heating purposes have vigorously been exploited in this region for space heating, tap water heating, and industrial process heating.

"Considering the huge market potential for air conditioning and heating still left unexplored in this region," he continued, "and the resulting future impact on global environment, development of advanced energy-efficient and environmentally friendly technologies is of vital importance for sustainable development in the foreseeable future."

Space Conditioning

According to the world market survey by the Japan Refrigeration and Air Conditioning Industries Association (JRAIA), the market for residential and commercial unitary air conditioners and heat pumps in East Asia has been growing steadily over the last 10 to 20 years.Market trends from the seven regions of the world reveal that "the room air conditioner and heat pump (RAC) packaged air conditioner and heat pump (PAC) market in Asia and Oceania nearly tripled during the last 15 years, to about 28 million units in 2003 from 11 million units in 1989, and the share of Asia & Oceania of the gross world market increased to 57 percent in 2003 from 42 percent in 1989."

The largest increase in demand has come from China (18.0 million units/year) followed by Japan (7.2 million units/year), South Korea (1.5 million units/year) and India (1.0 million units/year).

Ductless split systems are "increasingly dominating the market," Yoshii said. In the residential sector, ductless mini-splits and heat pumps "are increasing their market share in place of window-type room air conditioners by their flexibility of installation, quiet operation, and other advantageous features."

Technological development that could expand heat pumps operating temperature to a lower ambient temperature "has been explored sporadically and is still ongoing," he said. "A commercial air-to-air heat pump that can be operated under cold climate conditions down to -20 degrees C is available in Japan."

He noted that "Asia has the largest demand for water/Lithium Bromide absorption machines of all capacity ranges, with the estimated world market share of more than 90 percent of the gross world market of about 10,000 units."

This market is concentrated in China, South Korea, India, and Japan. "They are mostly installed in small to large commercial buildings, district cooling plants, and in factories as steam- or gas-fired chillers."

Ice or water thermal (cool) storage systems, coupled with chillers or heat pumps, also have been used extensively in Japan, with more than 20,000 total cumulative system installations.

There also is growing demand for ice thermal storage systems in Korea and China, with an estimated total cumulative installation of about 1,000 systems. In addition, a ductless multi-split ice storage system was developed in the early 1990s, and the market has grown to about 10,000 units/year, Yoshii said.

Gas And Ground-Source Heat Pumps

Gas-engine heat pumps (engine-driven ductless multi-split heat pumps) were developed in Japan around 1990, Yoshii said, and successfully expanded the market to more than 40,000 units/year."They are mainly installed in light commercial and institutional buildings such as schools, supermarkets, and restaurants.

"The market development of ground-coupled heat pump systems has been rather slow in this region," he continued, "although ground water was, in the past, used extensively in Japan as heat source and sink, specifically before outdoor air came to be more commonly used as heat source and sink."

Australia seems to be leading in the market development of ground-coupled heat pumps for the region. In Canberra, for example, a ground-coupled system has been in operation since 1999. Its water loop system has 350 borehole heat exchangers and 220 water-to-air heat pumps.

"During the last couple of decades, we have seen a surge of air conditioning market expansion in Asian countries driven by economic growth in the region," Yoshii concluded. "Furthermore, there still is a huge air conditioning market potential left uncultivated which will, in due course, bring about increased demand for energy and refrigerants in the coming years.

"What we have to take into account today is to find a solution in achieving harmonious balance in economic growth, energy security, and environmental protection. Therefore, the main challenge imposed for heat pumping technology, in achieving sustainable development, is to develop and deploy advanced technologies for the enhancement of energy efficiency of equipment and systems and environmentally friendly refrigerants and systems."

Publication date: 07/11/2005

Report Abusive Comment