The respondents in the 2005 study are offering fewer benefits than the 2002 respondents. The reasons can be varied but perhaps the biggest reason is the increased payroll costs, i.e., insurance. As one respondent stated, "Health care is going through the roof."

Another reason? Contractors aren't charging enough for their service. One respondent summed up how contractors can afford to pay qualified technicians. "Our industry doesn't pay enough to our good people because we don't charge enough."

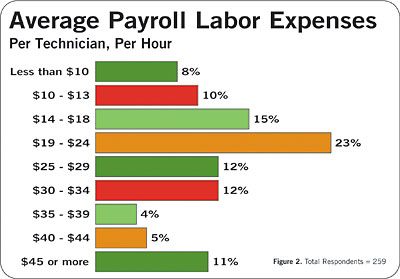

Labor Expenses

Respondents didn't indicate any significant increases in payroll labor expenses from 2002 to 2005. In 2002, 24 percent of respondents said that labor expenses cost between $19 and $24 per hour. In 2005 23 percent of respondents said the same thing (See Figure 2).In fact, when comparing the two surveys, the number of respondents who said that labor expenses made up between $25 an hour and over $45 an hour actually went down –– setting the stage for more questions than answers. If contractors don't see payroll costs as a detriment for offering the best benefits package, why are fewer doing just that?

Maybe it's because three years later, contractors are charging the same for their services. Some of the respondents said they can't raise rates because of their competition and their marketplace. Here are a couple of samples.

"We have had to reduce our service rates to remain competitive, while suppliers continue increasing prices and employees require larger services," said one respondent. Another added, "Most competition is way too low."

Rather than being proactive by increasing rates, some contractors seem to be playing a wait-and-see game, while competitors are hiring workers for lower paying positions. One respondent said, "It is tough to hire young [people] when they can make the same [wages] at Wal-Mart."

At the time of the 2002 study, 69 percent of the respondents felt that entry-level salaries in the HVAC trade were high enough to attract quality applicants. The number took a slight dip in the follow-up 2005 study (available at www.achrnews.com). Sixty-three percent of the latest respondents felt confident in the attractiveness of the entry-level salaries.

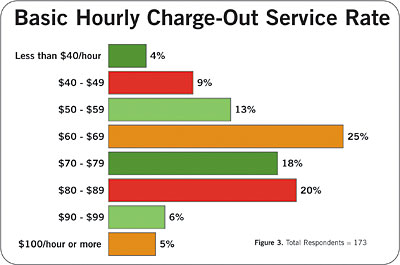

Turning The Charge-Out Rate Corner?

The replies from the 2005 study respondents indicate some trend toward higher service rates, although the majority of respondents still maintain "middle-of-the-road" rates. For example, in 2002, 29 percent of respondents said their charge-out service rate was between $60-$69 an hour. In 2005, 25 percent of respondents were still charging between $60-$69 an hour. (See Figure 3.)However, the numbers became a little more encouraging as the hourly rates went up. The number of contractors charging at least $70 an hour increased from 37 percent of respondents in 2002 to 49 percent of respondents in 2005. Clearly, some contractors are charging more for their services. In fact, the number of contractors charging over $100 an hour increased by 3 percent. The in-crease may seem small, but the significance is huge.

It appears from the study that some contractors are raising charge-out rates while at the same time they are not seeing significant increases in labor costs. However, they may not be paying techs and installers any more than they were paying them in 2002. Why?

A number of conclusions can be drawn from matching the statistics to this group of "price-raising contractors":

As one respondent put it, "Many A/C contractors are paying slightly above minimum wage for entry-level workers. This needs to change in order to attract new, younger workers into the [HVAC] workforce."

Still, the majority of respondents are not changing their rate structure. One noted that his situation is lose-lose. "We find the cost of gas, equipment, wages, and benefits keep going up, but we are unable to increase our pricing due to the economy."

Which Wages Are Higher This Year?

Based on comparison, responding contractors are paying their nonfield personnel a proportionately higher wage in 2005 compared to the 2002 study. In other words, an office manager stands a slightly better chance of income growth than an installer working for the same contractor.In 2002, 13 percent of installers earned over $50,000 per year compared to only 9 percent of office managers. In 2005, 17 percent of installers earned over $50,000 per year compared to 18 percent of office managers. (See Figure 4.)

The difference is less dramatic when comparing the wages of service technicians from 2002 to 2005. In the three years, the figures seemed to shift to a more "middle-of-the-road" salary. There were decreases in the number of service technicians earning over $50,000 per year but there were also decreases in the number of service technicians earning less than $25,000 per year.

Salespeople fared very well in the latest poll. In 2002, 18 percent earned over $70,000 per year while 29 percent enjoyed similar earnings in 2005. There were no dramatic shifts in any of the other job classifications, including company presidents, where there was only a 3 percent increase in presidents earning over $100,000 in 2005.

Although the sampling is a small representation of the total HVACR trade, it points out some interesting conclusions:

Is The "Face" Of The Business Changing?

Among the other topics covered in The NEWS' 2005 study were the following: flat rate pricing, service agreements, and online purchasing/service requests.For years the debate has gone on as to which is the better way to quote a job –– flat rate or time and materials. Some contractors believe that telling a customer the cost of a job upfront is more advantageous than quoting a job based on the actual time and labor used. Flat rate, a system to standardize pricing, is more characteristic of residential service and replacement; time and materials more prevalent in commercial service and replacement.

The 2005 study did show a slight decrease in the percentage of respondents who use the flat-rate system for pricing compared to 2002 (61 percent versus 67 percent). Of the 67 percent who said they used flat rate in 2002, 56 percent created their own flat rate pricing system. That number decreased to 53 percent in 2005.

One 2005 respondent noted, "If we as an industry would regulate and standardize installation practices we could charge more money for our services. Salaries could increase and customers would receive better quality service."

But another added, "Flat-rate pricing is unfair in most cases. While it does pay a good technician very well, I also think a poor technician gets paid too much. The margin for the owner is un-reasonably high."

The importance of service agreements barely moved when comparing the two studies. In fact, 41 percent said service agreements were "very important" to their business in both studies. The differences in "somewhat important" and "not at all important" only varied by 1 percent in each study.

In light of the previous finding that the importance placed on service agreements remains at about the same high levels, this next fact is somewhat perplexing.

In 2005, there was a marked increase in the number of respondents who said that service agreements accounted for only 0 to 5 percent of revenue: 39 percent compared to 25 percent in 2002. In addition, in 2005, only 4 percent of respondents said that service agreements make up over 50 percent of revenues. In 2002 that number was 8 percent.

It appears that though service agreements are highly regarded, there may be a fall-off in the number being sold by the respondents. (However, this would be consistent with other industry research that has shown fewer than 20 percent of homeowners have HVAC service agreements.)

Finally, the studies attempted to show a pattern of how the Internet has impacted the "very traditional" HVACR contracting trade. Apparently, according to responses, there has been little change in three years. While technology booms all around them, HVACR contractors are clinging to traditional means of purchasing from suppliers and communicating with customers.

In fact, the 2005 study showed only a slight increase in Internet purchases and service work from web site visits. In 2002, 93 percent of respondents said they purchased less than 10 percent of their supplies and equipment from manufacturers over the Internet. In 2005, the figure only shrunk to 89 percent of respondents. In 2002, 91 percent of respondents said they purchased less than 10 percent of their supplies and equipment from wholesalers over the Internet. In 2005, the figure moderately shrunk to 86 percent of respondents.

If contractors are supposedly making a "big leap" to making purchases over the Internet, they've only shown "small hops" in the two studies.

There has been some improvement in the percentage of service work that respondents derive from their Web sites.

In 2002, 43 percent of respondents said they got no service work from their Web sites. In 2005, the number shrunk to 32 percent. Still, that marks one-third of respondents who get no service work in 2005 as a result of their Web site.

The reason is too obvious: in 2005, 30 percent of respondents said they don't have a Web site. Oddly enough, only 21 percent of respondents in the 2002 study said they had no Web site.

Conclusions From The 2005 Study

The 2005 NEWS study, which surveyed 291 respondents, perhaps leaves more questions than answers. The HVACR contracting trade is facing challenges from all sides.On one side, there is serious competition for technicians and as one respondent said, "Those coming out of tech schools want the wages of a 10-12-year veteran without taking time to prove their worth."

On another side, competition is very keen across the United States and contractors seem to be wary of raising their service charge-out rates for fear of losing customers. As one respondent said, "The HVACR industry has a ways to go to achieve reasonable rates. They need to be higher."

On yet another side, contractors appear to be behind the technology curve and need help catching up. Yet, based on replies from respondents, they are consumed with putting out fires and keeping up with the competition - being reactive - rather than being proactive and taking a leadership role. Two industry-accepted keys for improving revenues - service agreements and Web sites - remained unimportant to a relatively large number of respondents.

The general tone of comments made by respondents to the 2005 study are negative, exemplified by this comment. "The market is depressed with too many unqualified contractors. Licensing agencies do not police this industry to bring ethics back to the marketplace."

But just when the whole picture looks muddled and bleak, one voice comes out that shows there are some optimistic contractors that have a positive outlook. One respondent said, "We are a small but very competitive company. Our callback ratio is less than 1 percent."

And another concluded, "If you provide enough value, you can charge high enough rates to hire the best. There is no labor shortage if you are the best company to work for."

Pessimism may be the key link between the 2002 and 2005 study. Optimism may be the key link between 2005 and future studies.

Publication date: 10/17/2005

Report Abusive Comment