Rising commodity prices, industry consolidation, financial pressure to reduce operating costs, and the beginning of the summer season all create a dynamic market for cooling.

Ongoing analysis of the industry by market research firm Ducker Worldwide indicates these pressures are likely to continue to occur simultaneously, thus creating radical effects on residential and commercial hvacr. The effects can be felt at every point in the value chain, including building owners, consumers, contractors, distributors, and manufacturers.

Given the state of the energy market, there is only one thing that is certain — change. Government policy will continue to drive energy efficiency in equipment, while the struggle between supply and demand for energy sources drives creativity and ingenuity by technology leaders and end users. Given the market structure of the commercial cooling market, industry participants are struggling with the future direction of energy, equipment, and more efficient cooling methods.

A Mature Chiller Market?

Over the past few years, market growth for central plant cooling products has remained relatively stable, expanding at traditional growth rates of less than 5%. Chillers represent nearly 75% of the installed cooling capacity and thus are the center of discussion.The total market can be classified as mature; however, significant fluctuations occur in certain product markets that indicate these segments are still evolving:

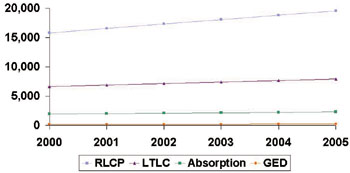

The chiller market is comprised of four major product categories: reciprocating liquid chiller package (RLCP), large-tonnage liquid-cooled chiller (LTLC), absorption, and gas engine driven (GED) units. Within each, different capacity ranges and operational advantages exist.

RLCP units capture the most market share (see Figure 1) due to their familiarity, operational success, and price point. In addition, they are best suited for large applications and most packages are sold in larger size ranges, over 160 tons. These chillers also can be segmented by condenser type.

Contractors need to be aware of the significant trends toward new air-cooled condenser technology. These innovations help solidify air-cooled technology preference in the market due to efficiency performance.

Ducker predicts RLCP will remain a leader in the large-capacity chiller market until more efficient units with desirable initial price points and operating costs are perfected. Chillers with multiple compressors have become popular based upon the capacity increments available and the changing needs of the end-use application. In addition, building owners are demanding closer temperature control, decreased power consumption, and extra standby capacity.

This may seem too much to ask of the industry; however, today’s regulatory, economic, and social pressures are relentless and likely will force the industry’s hand toward satisfying these demands simultaneously.

The good news: New components are being developed that provide software solutions for power management with smart sensors aimed at better utilization and output. An increase in installations of multiple condenser units with multiple refrigerant circuits will positively impact service contractors and owners. Multiple configuration allows for maintenance of one circuit while the unit is still operating, as well as providing an opportunity for decreasing cooling capacity during off-peak hours.

Revenue Leader

The LTLC is both an air conditioning and refrigeration machine that is the second-most installed central plant unit. Ducker’s study of building owners and contractors indicates its advantages are cooling power, multiple capacity range, easy adaptation to application, and comfort level achieved. While this type of chiller is second in unit volume, it is the leader in revenue in the U.S. market.Since the mid-1990s, water-cooled screw chillers have made major inroads against centrifugal chillers, particularly at the lower end of the capacity range (typically below 400 tons). In examining initial and lifecycle costs, decision-makers have often opted for water-cooled screw LTLC, as the initial price premium of 10% is easily offset by improved operating and maintenance costs.

But don’t count out centrifugal chillers quite yet. A key advantage that all systems are trying to replicate is the ability to vary capacity continuously to match a wide range or point-in-time load conditions with nearly proportionate changes in power consumption. This capability with a more energy-efficient water-cooled condenser keeps centrifugal chillers as a viable option for many applications.

As manufacturers continue with innovations in condensers, compressors, coolers, and motors, initial and lifecycle costs and benefits will change. Industry experts agree that the trades should continue to educate themselves on the differences in startup vs. lifetime costs of all equipment — but especially chillers.

A product that has yet to make significant inroads in the central plant market is the absorption chiller. Widely used internationally, installations for large-volume absorption chillers have fluctuated. In fact, in recent years they are beginning to bounce back from nearly a decade of low market penetration.

Market analysis indicates these units have found new interest among certain market segments due to the impact of electricity deregulation and positive supplies of natural gas. These chillers commonly use gas, steam, or water resources for operation.

Absorption chillers are also becoming an attractive alternative to standard chillers that use traditional refrigerants containing ozone-depleting substances. Natural refrigerants, such as ammonia, lithium bromide, and water, are used in absorption chillers, thus surpassing regulatory requirements.

As CFCs and HCFCs continue to be phased out, installations of absorption chillers are expected to substantially increase. In fact, the Air-Conditioning and Refrigera-tion Institue (ARI) estimates indicate that the industry has only completed half of the necessary replacement and conversion installations for noncompliant units.

GED cooling is still not considered a mainstream alternative for much of the industry’s needs. There are several operating advantages relating to efficiency and comfort, but unfamiliarity with technical aspects and cost structures drive decision-makers to other choices.

However, with the growth of distributed generation, new fuel cell technology, and sufficient gas supply, GED is positioned well for positive growth. In addition, several companies and associations are working aggressively to enhance its technical advantages and ease maintenance procedures, thus creating a more appealing product.

End-use applications where GED is found more frequently include institutional and public/military (see Figure 2).

DG/Fuel Cell Integration

Recent technology advances, coupled with successful test applications have bought distributed generation (DG) to the forefront of the hvacr industry. It is now a viable solution for business owners and communities across the country.Having smaller-scale electric power generation closer to the user provides great advantages in time, cost, and efficiency. This trend of BHCP (heating, cooling, and power generation by a single building) already has encouraged building owners to purchase gas turbines, engine generators, or fuel cells to link as the power source to their central cooling plant.

The electricity generated can be solely dedicated to the building, thus eliminating supply constraints. Extra capacity can be sold for profit. However, several barriers must be overcome for the benefits to be realized for mainstream applications.

The most obvious barriers are the utilities themselves. The structure of the industry — including supply, distribution, and contractual relationships — was established when monopoly conditions existed. With deregulation, mono-poly conditions have evaporated; however, most of the structure still exists. Much of the market must wait patiently as utilities examine how to participate and service a DG-oriented customer.

Another key challenge is technical compatibility of cooling products with DG equipment. Fuel cells, in particular, will require much analysis by equipment manufacturers. As successful fuel cell testing continues, manufacturers will look to promoting chiller compatibility as well as system performance with fuel cell technology. It is not too far off into the future when we will see facilities able to produce, consume, and recycle their own energy.

Recognizing that change is constant, forecasting becomes difficult in the long term. Many equipment advances and market pressures will only begin to impact the market in 2004, and thus significant change is less likely to occur in the short term. While the steadily increasing volume of RLCP units will drive the growth of the U.S. chiller market, the sales value of the LTLC segment will continue to lead the overall market value (see Figure 3).

Each of the four major market segments will experience growth of at least 3% annually through 2005 in terms of value and volume, primarily due to the increasing need for updating or replacing chillers to be compatible with alternative refrigerants. GED and large absorption chillers will experience higher-than-average growth as hybrid chiller systems and the use of natural gas power become more prevalent.

Fisher is a project consultant for Ducker Worldwide, Bloomfield Hills, MI. Ducker is a market research company that conducts syndicated and private client studies of the hvacr industry. For more information, contact Fisher at 800-929-0086; chrisf@ducker.com (e-mail).

Publication date: 07/02/2001

Report Abusive Comment