It is not uncommon to see an HVAC service van parked outside the local Home Depot or Lowe's store on any given day. Some service techs - needing a part in a hurry or having an account with the store - often prefer the easiest and least expensive means of getting a part to complete a service or replacement task. It makes sense. But by doing this, are contractors taking business away from their traditional suppliers and handing it over to stores that often compete for their own customer base? It's a sensitive topic that has been debated for years since the emergence of powerhouse do-it-yourself big box stores.

The NEWS wanted to find out if HVAC contractors used big box stores to buy parts, and if these same contractors felt that big box stores were a competitive threat to their business.

Leading HVAC manufacturers Trane and Carrier offered their input, as well as Home Depot (see sidebar article below).

Larry M. Baratko, president of L.M. Baratko & Associates Inc., Cleveland, represented the majority of respondents when he said, "The big box does not affect my relationship with my regular suppliers at all. I may stop for the one or two quick fittings I may need, but find the quality better at my distributor."

NEWS' Distributor Panel member Joe Rettig of the Habeggar Corp. believes the market is fertile for the growth of big box retailers selling to contractors and end users. "I am assuming that, because of the challenge in finding new locations in the retail end of the business, all big box retailers will enter into the professional or contractor market more aggressively," he said.

"This could be a challenge for local distributors because of pricing issues with volume purchases. This should also make local distributors more focused on their customer base and refocusing on serving their customers at the highest service level."

Does that mean that there is now a competitive market between big box stores and traditional HVAC distributors, ultimately benefiting the end user? A spokesperson for Home Depot said, "The Home Depot Home Services HVAC program does not compete with distributors; we actively partner with Trane distributors to assist in managing the program and driving installation sales."

Carrier believes that the toughest competition may not be coming from the big box stores, but from the Internet. "We see far more attempts to sell via the Internet then we do at retail," said Rick Roetken, director of marketing for Carrier Residential and Light Commercial. "This is nearly always a local dealer launching an e-commerce effort for their business."

AND THE SURVEY SAID...

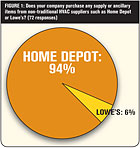

A total of 120 people responded to the online survey. The questions and answers are shown in Figures 1, 2, and 3. Sixty percent of the respondents said they did buy supplies from either Home Depot (94 percent) or Lowe's (6 percent). The remaining 40 percent replied no or did not answer the question.When asked if their company worked with a big box store on a referral or subcontract agreement, 92 percent of respondents replied no and 8 percent said yes.

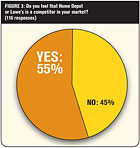

The majority of the 116 people who responded to the question of competition (55 percent) said they felt that Home Depot or Lowe's are competitors in their markets.

Competition doesn't stop one respondent from buying at the big box store. The reply was, "We buy from these suppliers when we need items on short notice and sometimes specialty items which other local supply houses may not stock. They also have more stores around town and are generally closer to more jobs than our suppliers."

Another person said there is one particular advantage to shopping at a big box store - less loitering. "A lot of time is spent at our supply houses, too much time," the respondent said. "The big box stores do have a good assortment of fasteners and no one at our local supply houses offer that. But that's where we end the supply buying."

Does this mean that traditional mom and pop distributors will fall victim to new buying trends at the big box stores? "I don't see the threat to be much at this time because the big boxes don't market their stuff to us much," said Bill Bradley of Airtronic Heating & Cooling, Redford, Mich.

"But if they got some good people out in the field to go after this business, it could be trouble for the little guy."

Marc Primus of Primus Heating and Air, Greenville, S.C., said smaller distributors only need to keep up with the changing trends of the HVAC trade to keep his business. "As long as the mom and pops stay competitive and provide technical savvy to us in the HVAC trade, we will continue to frequent them," he said.

If a customer were to see an HVAC contractor's truck parked at a Home Depot or Lowe's, would it make any difference to them? Overwhelmingly, contractors said no.

"When a customer hires you to do an HVAC installation for them the only questions generally asked is which brand of equipment are they getting or wanting?" said Eddie Barger of Custom Air Conditioning and Heating Co., Columbus, Ohio.

"The question of sheet metal, copper, flexible duct, condenser pads, etc. is almost never brought up. I would say that the customer has put their trust in us to use the best products for the best price regardless of who is selling it. The customers would not care where the materials used in their homes is purchased."

Will they care? Some might.

"But more importantly if they can buy those parts at a big box store for the same price as you then there will be issues on mark-up, which is already happening," said Andy Sievers of Arco Heating & Air Inc., West Paducah, Ky. "In addition to big distributors selling to the general public at dealer prices, it makes for a lot of ‘cost of doing business' explanations."

MANUFACTURERS SPEAK OUT

Carrier's Roetken and Trane's Randy Campbell, Home Depot program manager, talked about the traditional distributor-contractor relationship and if the presence of stores like Home Depot, Lowe's, and Sears has affected those relationships."We don't feel the relationship has been impacted to any extent today," said Roetken. "Through all of the threats in the ‘90s the independent contractor faced, including consolidation, retail, utilities, etc., the independent dealer has continued to thrive and be the leading source of HVAC sales and service. Retail can and will play a role in our industry, but it should not change the relationship between the distributor and contractor."

Campbell addressed the topic by talking about his company's relationship with Home Depot.

"For Trane, it's been a benefit for our distributors and contractors," he said. "We work with Home Depot by providing installed sales for Trane products through our distributors and dealers. The program generates appointments for the dealer from a new retail market segment."

Do these new relationships hurt the traditional HVAC distributors? Not so, according to Carrier and Trane.

"We have not seen big box retailers selling parts at discount prices," said Roetken. "We do see some equipment sold through Home Depot and Sears, but these are equipment-focused rather than parts-focused."

Campbell said it is win-win for dealers and distributors. "With Trane, the dealer's role in the process is not diminished but rather expanded to a retail environment not available to most HVAC contractors," he said. "From our customers, we hear that they value the partnership because when they combine their offering with the Trane and The Home Depot brands the result becomes a compelling value for homeowners."

DISTRIBUTORS SPEAK OUT

Several ofThe NEWS'Distributor Panel members voiced their opinions about big box buying. All respondents did not see a big impact on the distribution channel - just an opportunity to emphasize the difference between knowledgeable HVAC distributors and mass retailers whose market is mainly the do-it-yourselfers."The HVAC industry is well served by knowledgeable people in distribution," said Kent Kendricks of Dale Supply Co. "The big box retailers have not matched the knowledge and service we provide. They market and sell through local contractors, but most qualified contractors will not consider their offer because they are busy and can make more on their own."

David Williams of Gateway Supply Co., agrees. "I think dealers still need that personal service that is afforded them through independent distribution for their other supply needs," he said. "There are some sales lost to the do-it-yourselfer with regards to some duct pipe, tape, filters, and things like this, but from what we can tell this amount of lost business is limited. I think our trade is blessed by being quite technical and do-it-yourselfers should not be trying to install their own systems.

"Dealers need technical expertise and product knowledge and this is what independent distribution does and usually does well."

Some of the bigger names in the HVAC industry, i.e., Trane and Carrier, are also a topic of conversation among distributors. The ability of manufacturers to market their products to end users via big box stores does not go unnoticed by distributors. Ken Connell of Gemaire Group feels there could be the beginning of a new trend in the distribution channel - on a limited basis.

"So far, the effect of big box stores on the distribution channel has been minimal," Connell said. "The only ones that pursue them are the big manufacturers, Carrier and Trane. Trane is using Home Depot as a lead generator for dealers, with varying degrees of success. Carrier is using Sears like a big dealer, but I'm not sure of the success they are having.

"In the long term, manufacturers will refine the big box store concept and be more successful with it. But that concept alone will not eliminate the need for distributors. However, I am convinced that over the long term big manufacturers are trying to find ways to get closer to the end user."

"Home Depot has some effect in our market by offering Trane products installed by select Trane dealers," said Joe Rettig. "This has been a mixed review by certain Trane dealers. Some love the lead generation and others feel that the Home Depot commission structure makes them non-competitive. In our marketing area, Home Depot has gone from using a number of Trane dealers to one major Trane dealer. As you would expect, this has made one Trane dealer happy and others not so happy."

One distributor, Michael Senter of ABCO Refrigeration Supply Corp., likened the big box versus HVAC distributor dynamic as a "David and Goliath" scenario. And David needs to continue to do what it does best.

"We must utilize initiative, agility, and intensity to compete with the sheer magnitude of a Lowe's or a Home Depot," Senter said. "This means we must understand our customers more intimately and meet their needs more specifically, from providing high levels of technical customer service to maintaining specific inventories to meet their needs at any time of day or night.

"At ABCO Refrigeration, we remind ourselves constantly that our commitment to exceeding each customer's highest expectations must be marked by initiative, intelligence, intensity, and integrity: the only I's in successful teamwork. By treating each and every customer as a respected individual or entity, we earn the opportunities to compete with big box entities; we develop the opportunities to know our customers better and to fulfill their requirements more precisely and efficiently."

The future of the HVAC distribution channel comes down to service and knowledge, according to Doug Young of The Behler-Young Co. He feels that the HVAC industry has been impacted less than other trades such as plumbing and electrical. But that is no reason to deviate from the successful business model that his and other HVAC distributors need to follow.

"I think the HVAC contractor is looking for broader inventory and greater product knowledge than what the big box stores will provide," Young said. "I also think that the big box is required to generate a larger return on investment (profits) than what independent distributors have to, so we will be able and willing to do much more for the contractor's benefit than what the big box stores would. I am basing our company's future on this."

SUMMING IT UP

Most contractors said they will continue to shop their traditional supply houses because of the service, expertise, and quality of the products sold. Some are very adamant about not shopping at big box stores on principle - they don't like the service, competitive nature, or relationships that have affected the traditional distribution channel. Their loyalty is based on service and familiarity."Service will last long after a few pennies of cost are forgotten," said Aaron York of Aaron York's Quality A/C, Indianapolis, Ind. "The convenience and service of our local supply houses far exceeds anything we can get from the big box boys who are most impersonal."

But one contractor sent a clear message to traditional distributors: keep the business in-house. "Mom and pop distributors are sometimes their own worst enemy," said Mark Hunt of Comfort Home Technologies, Ballston Lake, N.Y. "On several occasions, we have been told to go to the big box by the supplier."

For the most part, contractors like Kenneth Viger of K&J Heating, Gray, Maine, feel a sense of loyalty to their suppliers and would prefer to stay away from brand names that are sold in big box stores. "We will not sell any heating equipment that is sold in the big box stores," he said.

But he added, "We have a supply house in our area that sells nearly wholesale to anybody. Their official policy is trade only, but the unofficial is sell, sell, sell. I refuse to do any business with this supplier."

The message? If distributors take care of their contractors and vice versa, there will be enough room for everyone in the competitive HVAC marketplace.

Sidebar: Supply Strategies

The NEWSasked spokespeople for the Home Depot about the company's retail HVAC strategies. The answers are provided in the following Q&A format.NEWS: Does Home Depot have a marketing strategy aimed at opening commercial accounts for HVAC contractors?

HOME DEPOT: Yes, the Home Depot's retail stores attract all types of contractors with special services, discounts, special events and promotions. Our Website has a special section just for contractors: http://contractorservices.homedepot.com. This site allows contractors to assemble their material lists for upcoming jobs, submit their order online to their preferred store for fulfillment, and arrange for convenient pickup or delivery. Contractors can also print their order and take it to the Contractor Services Desk in the retail store.

The SKU level detail we offer our commercial account holders is a very effective tool for helping our customers run their business.

Our HD Supply business is another way that we specifically target the needs of the professional customer. HD Supply offers professional customers access to all the products and value-added services to get all phases of a job done. Each of the businesses that fall under the HD Supply umbrella are owned by the Home Depot, but they are rooted in business-to-business operations.

For instance, APEX-Hughes Supply Plumbing/HVAC is a business of HD Supply. It is one of the nation's largest distributors of plumbing supplies, including plumbing fixtures, pipe, valves and fittings, pumps and tanks, water coolers, water heaters, parts, tools, and related accessories.

NEWS: Does Home Depot market directly to HVAC contractors?

HOME DEPOT: Yes, HVAC contractors are included in all outreach done by the Home Depot's retail stores, including direct mail promotions. Through HD Supply, we directly target HVAC contractors of all sizes with specialized business-to-business services as well as a wide array of products, e.g., Apex-Hughes Supply Plumbing/HVAC.

NEWS: Does Home Depot work with HVAC contractors on a referral basis for equipment installations and/or service?

HOME DEPOT: The Home Depot's Home Services does not work on a referral business. We have HVAC vendors that we have selected to be part of our nationwide network. The Home Depot Home Services business owns the relationship with the customer and is the interface with the vendor providing the service.

NEWS: What HVAC equipment does Home Depot sell directly to the public (brand name)? And is there HVAC equipment that Home Depot only sells to contractors?

HOME DEPOT: The Home Depot Home Service HVAC installation program only installs Trane equipment. We do not sell the equipment directly to the customer as a stand-alone product; rather we sell the installation, of which the equipment is a part of the overall installation product.

HD Supply's Plumbing/HVAC business maintains a diverse and substantial inventory for serving residential, commercial, institution, and government customers.

Publication date: 10/09/2006

Report Abusive Comment