Earlier this year, The U.S. Department of Labor (DOL) made waves when it announced the publication of a final rule updating overtime regulations. The new rule raises the salary threshold for overtime eligibility from $455 per week, or $23,660 per year, to $913 per week, or $47,476 per year. As a result, more than 4.2 million salaried workers across the country will now be eligible for overtime pay. Employers have until Dec. 1, when the rule becomes effective, to prepare for the changes.

The rule will also automatically update the salary threshold every three years based on wage growth over time, increasing predictability. Based on wage growth projections, the standard salary threshold is expected to rise to more than $51,000 with the first update on Jan. 1, 2020. Industry leaders predict the mandate will affect employees up and down the entire HVAC supply chain.

LIMITING OPPORTUNITIES

Many in the HVACR industry believe the new rule will have a negative impact on business. Jon Melchi, vice president, government affairs and business development, Heating, Air-conditioning & Refrigeration Distributors International (HARDI), spoke of the rule’s potential ramifications during HARDI’s Congressional Fly-In.

“If you think about the training our manufacturing partners provide, the events they attend, and the high-potential employees that are sent to those events that don’t make that [$47,476], now, guess what? They’re traveling, and that counts as time on the clock, so those costs have just risen,” Melchi noted. “That’s a problem. It’s going to limit opportunities for a lot of people. We commented that $23,660 was too low, so it was time [for an increase], but this was a big jump. This is going to impact a ton of people.

“You’ve got to convince [Congress] that this impacts your business; you have to tell them why and what it’s going to do to you,” he continued. “I think this is one of those rare opportunities where there may be some groundswell. Don’t think that delaying this until Dec. 1 [after the election] wasn’t done on purpose. The thing I love about our members is that you always send your staff to learn new things, and this is going to restrict that. The funny thing is, what do we hear about millennials all the time? They want flexibility. The fact is, they want more options, and this does nothing but restrict such options.”

Marianne O’Leary, human resources director at Meier Supply Co. Inc., said the new rule will force companies like Meier Supply to set limits on which employees may travel to attend training and development sessions when those events occur outside a normal 40-hour workweek.

“In the past, with more employees classified as exempt, the travel time was not an issue,” she said. “Now, we must compensate a new group of hourly personnel at the overtime premium rate. These additional labor costs will add up for all employers and may impact their bottom lines significantly. For small employers, it may even be cost-prohibitive, and such training and development activities will go away all together for those impacted. This is a negative for employees and employers.”

The rule will also change how Meier Supply manages its stores during the busy season, O’Leary noted. “Throughout the year, we have always been concerned about labor cost and minimizing unnecessary overtime. We have managed our labor costs partly by having the right mix of hourly and salaried personnel at each store. Now, with more employees eligible for overtime, it will definitely impact our bottom line. While we cannot yet quantify the additional cost, it will ultimately force us to modify product prices, which will impact our customers and the consumer in the end.

“There is also the intangible cost of negatively impacting employee morale,” she continued. “We believe there are employees who place value in being in salaried positions. These employees have been the ones who we rely on to do whatever it takes [including working longer hours] to service our customers. Under the new overtime rules, they must now punch a time clock and closely manage their hours so as not to incur unintentional overtime. This may ultimately result in them feeling they are taking a step backwards in their careers.”

Susan Kirkland, president of Packard Inc., agreed that switching a salaried employee to hourly could have a negative effect.

“This rule is bad simply because the limits have been set unreasonably high,” Kirkland said. “Where it is at now is too low, and I do agree there is an adjustment that needs to be made, but $47,476 is too high. In our company, I like to have a mix of seasoned managers as well as new managers in training. The ones coming up out of college do not necessarily start out at $50,000. I can’t start them out at a high rate and spend money to train them. If I have to make the choice of taking these young managers and increasing them to a level I don’t think is appropriate in their salaried positions or moving them to an hourly rate, I’m going to have to make them hourly. And, if I make them hourly, I won’t send them to educational and training opportunities because it will cost too much. Also, bumping a young manager back to hourly sends a negative message. I don’t think that’s a positive way to encourage our young managers getting started in the industry.”

Kirkland noted that out of Packard’s 74 employees, the new overtime rule will only impact four individuals. “I can justify bumping up three of them, but the other one I can’t, and I’m probably going to lose that employee because that person won’t feel it’s fair being put back on the clock. The millennial mindset says I should be able to arrive when I want, leave when I want, and not be held accountable to a time clock. So, having to go from a salary to an hourly rate is just a negative connotation in millennials’ minds; they feel as if they’re taking a step back in their careers if they have to revert to punching a time clock.”

The new rule will also impact how HVAC businesses hire new employees, Kirkland said.

“Most of the businesses in our industry are considered small businesses,” she said. “We have 74 employees, and we’re growing really quickly. I have one pot of money to spend on employee retention and benefits, and if the government continues to say, ‘You have to pay your people more, I’m going to tell you where to start them at, and I’m going to tell you where their health insurance needs to be or I’m going to penalize you,’ that really makes me think about the number of people I hire on a full-time basis. In the past, when an individual came to me and I recognized they had Packard DNA and talent, if I didn’t have an open position, I would create one for them because I wanted them on my team. I can’t do that today because there’s so much mandated overhead in the hiring process. Industrywide, I don’t think employee retention numbers will remain as high as they currently are.”

A CAREER KILLER

Steve Lauten, current ACCA chairman and president of Total Air & Heat Co. in Plano, Texas, said the overtime rule is being referred to as a ‘career killer’ for small businesses.

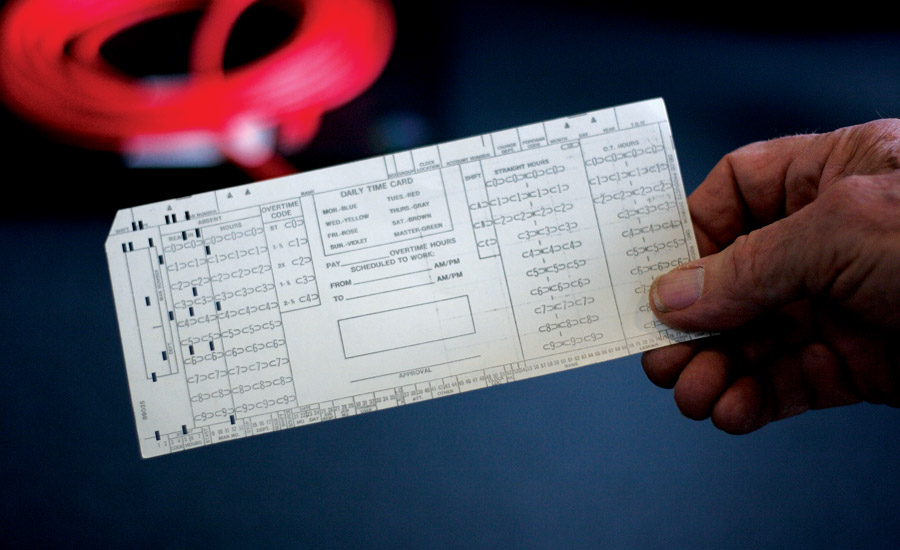

“This is just another tax on my small business that ultimately will impact my customers because, at the end of the day, the costs of doing business are passed on,” Lauten said. “However, what matters more to me than the additional paperwork/tracking and accounting work is the cost to the workers. In order for HVAC contractors to avoid the costly overtime pay, managers may get moved from their salaried positions to hourly jobs, will need to keep time cards, and may be prohibited from working overtime. This will be a burden on businesses that depend on managers and supervisors to work, when needed, in exchange for flexibility and other benefits. Worker morale will likely take a severe hit, as well. Low- to mid-level managers making less than the $47,476 oftentimes enjoy perks, such as flexibility of hours and health insurance benefits. Fewer salaried managerial positions would signal to employees that there is little opportunity for growth at that company. The DOL failed to understand the real-world impacts of this rule. An increase in overtime eligibility does not mean an increase in overtime pay. Whether we are talking about HVAC contractors or distributers, this impacts the careers and morale of employees.”

Total Air & Heat had very few salaried employees last year who were below the wage threshold, and for those who were, Lauten switched them to an hourly rate based on their current wages in preparation for this rule.

“Washington far too often forgets the rest of the country is very different than Washington, D.C., and urban areas,” Lauten noted. “The average median annual household income in the great state of Texas is just a few thousand dollars more than this new minimum wage. It’s unbelievable to me that Washington has the audacity to set a national minimum wage standard that almost equals the household average.”

Meanwhile, Butch Welsch, owner of Welsch Heating & Cooling Co. in St. Louis, believes the new overtime rule won’t have a significant impact on his company or the industry in general.

“To begin, a high percentage of those employed in our industry are hourly employees, and this overtime law does not impact them,” Welsch said. “An employer is still required to pay time and a half for all hours over 40 worked in a week, as has previously been the case. That’s the way it has been, and this does not change that process. Additionally, there are a number of exemptions that eliminate several groups of employees, such as sales personnel, administrative personnel, company officers, etc., from being affected by the regulations. Any one company may have one or two employees who fail to quality for the exemption, and they would be affected. If that is the case, the contractor could just pay the employee hourly, including time and a half for overtime hours, and regulate the total cost involved by regulating the number of hours that employee works each week.”

PREPARING FOR WHAT’S NEXT

The new overtime rule is scheduled to go into effect Dec. 1. However, a new bill, The Overtime Reform and Enhancement Act, introduced by four House Democrats — U.S. Reps. Kurt Schrader, Oregon; Jim Cooper, Tennessee; Henry Cuellar, Texas; and Collin Peterson, Minnesota — aims to slow down the ruling. If approved, the legislation would give small businesses, nonprofits, and universities more time to comply with the rule.

Others, like Kirkland, are hopeful the DOL will amend the wage threshold and lower the minimum amount from $47,476. In the meantime, industry organizations are taking steps to ensure their members are fully prepared for the coming changes.

The Plumbing-Heating-Cooling Contractors — National Association (PHCC) Educational Foundation recently hosted a member webinar where Bill Ford, president of SESCO Management Consultants and an industry partner of PHCC’s Quality Service Contractors, addressed wage-hour regulations, violations, the new overtime rule, and how contractors can prepare themselves for Dec. 1.

“Future profitability relies on understanding wage-hour regulations,” Ford said. “Wage-hour regulations, or noncompliance to hourly wages, have been the No. 1 financial issue or challenge for employers across the country in all industries. According to the DOL, the Wage Hour Division (WHD) found more than $246 million in back wages for more than 270,000 workers. The dragon is alive and well, and with the changes this year, we certainly expect more years of concern and liability for employers.”

Ford went on to say that the DOL finds some kind of violation in eight out of 10 investigations, and those violations average $9,000 per employee. He also warned the webinar audience to take caution when determining if their employees fall under one of the several white-collar exemptions for executive, administrative, and professional employees as well as outside sales employees and employees with certain computer-related job duties.

Ford also recommended that employers start keeping a time record before increasing employee salaries or putting employees on an hourly rate — and do it sooner rather than later. Employers may find a person is not exceeding 40 hours a week, which eliminates the concern of this new rule. Additionally, it’s good to have a time record to keep overtime hours in check if salaried positions are reclassified as hourly so time and a half is not abused.

“The first option — one I don’t recommend — is to do nothing,” Ford said. “I’ve audited clients for 28 years and, year after year, clients will tell me: ‘Bill, I understand what you’re saying, and while I want to pay this person a salary, I don’t want to pay them overtime. I will roll the dice, and if I get caught, I’ll worry about it then, but hopefully I won’t get caught.’ With how much attention this piece of legislation is getting in the media, I would be concerned, because your employees are out there on the internet. They’re reading the paper, watching the news, and if they haven’t been already, they’re going to be asking questions. So be careful in doing nothing.

“If the position requires the employee to work more than 40 hours on a regular basis, then you need to determine whether to increase the salary to the minimum requirement of $47,476. If that is not practical, another option is an hourly rate with time and a half for overtime. That’s an easy answer, but not always the best answer. Take me, for example. If I’ve been on a salary for a number of years, my family, my expenses, and my home is budgeted around this salary. Now, say you’re going to put me at an hourly rate. In my mind, nothing is guaranteed and my earnings are at risk. It’s a real shot to an employee and can be concerning. The other option is the nonexempt pay plan, or what we call the fluctuating-work-week method of payment. It’s a guaranteed salary for all hours worked. Your obligation for overtime is half time as opposed to time and a half.”

O’Leary said Meier Supply is busy reviewing all of its employees’ job descriptions to make sure they are properly classified as exempt or non-exempt. “We will likely need to reclassify some from exempt to nonexempt. For the time being, we are simply waiting for additional guidance from the government before we make final decisions on how to comply. In our minds, the gray areas include what compensation can safely be counted toward the salary threshold in terms of bonuses, incentives, etc. We would like every opportunity to understand the fine print and minimize changes to our workforce. With the deadline for implementation now Dec. 1, we are hopeful the guidance will be issued soon so we can finalize our compliance plan.”

SIDEBAR: Preparing for the Overtime Rule

ACCA created the following list of steps for contractors to take when considering the new overtime rule, which goes into effect Dec. 1:

1. Check state and federal regulations — Each state may enact wage and hour rules that differ from federal overtime requirements. Remember to follow whichever rule is more generous to employees.

2. Classify employees by salary — Make a list of salaried employees who make less than $47,476 because they may be entitled to receive overtime once the rule becomes effective. Employees making more than $47,476 may be exempt from overtime if their job duties primarily involve executive, administrative, or professional duties.

3. Consider changes to salaried employees — For employees who make less than the new salary threshold of $47,476, consider whether it makes sense to raise salaries to at least $47,476 if these employees typically work more than 40 hours per week. Alternatively, you could convert the previous salaried employees earning less than $47,476 to hourly employees and limit or prohibit overtime. Fair Labor Standards Act (FLSA) classifications can be tricky, so even though the job duties test remains unchanged, review the duties of all exempt employees and confirm that each qualifies as exempt from overtime pay.

4. Monitor overtime — For positions that often result in overtime pay, consider hiring more hourly full-time, part-time, and/or seasonal employees, or restructure jobs to offset expansion of overtime pay.

5. Audit payrolls — To determine which employees and positions that are currently classified as overtime-exempt are affected, you may want to audit your payroll.

6. Update payroll and time-tracking systems — This will allow a company to take into account impacted employees.

7. Train new non-exempt employees — Assist them on how to properly track and record their time to account for overtime hours.

8. Review your overtime policy — Make sure it is in compliance with FLSA regulations on overtime. Employers are permitted to prohibit or restrict an employee’s use of overtime but must generally pay any overtime worked, even if it violates the company’s overtime policy.

9. Create a plan to communicate and discuss the overtime rule — Clearly convey the company’s policy on what is and isn’t permissible with regard to earning overtime pay. Be forewarned that reclassifying positions, raising salaries to meet threshold minimums, changing job duties, or requiring employees to track their time where they formerly did not can have a big impact on company morale. Having a plan in place to communicate with employees is always a good idea. Continue to monitor the process and follow up with employees to ensure compliance.

Information courtesy of ACCA

Publication date: 8/8/2016

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!

Report Abusive Comment