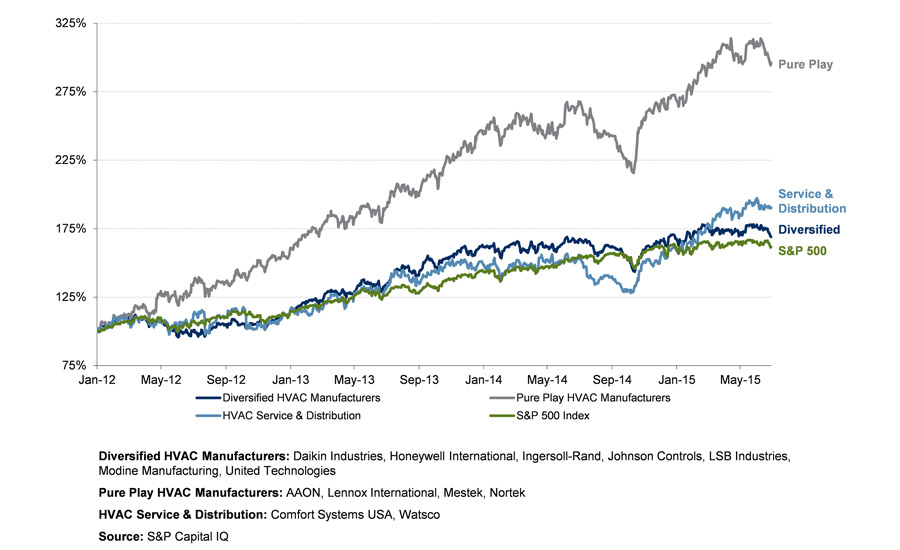

Within the HVAC universe, pure-play manufacturers, which include Aaon Heating and Cooling Products, Lennox Intl. Inc, Mestek Inc., and Nortek Global HVAC, have led the market since January 2012 with a cumulative return of 196 percent. HVAC service and distribution and diversified HVAC manufacturer stocks have also performed well, gaining 90 percent and 69 percent, respectively, outperforming the S&P 500 with a gain of 62 percent over the same period.

HVAC MARKET: STRONG AND GROWING

As the economy continues to strengthen, the U.S. market for commercial and residential HVAC systems is expected to continue to expand. According to a study conducted by the Freedonia Group, U.S. demand for HVAC equipment is expected to hit $17 billion by the end of the year. Leading indicators for the HVAC industry, including the U.S. private and public construction markets, are poised to expand as interest rates remain low and the economy continues to improve. The building construction market is forecast to grow at a compound annual growth rate (CAGR) of 9 percent through 2019, according to a study conducted by First Research. Another expected driver for growth in the HVAC market is pent-up demand, as companies had halted investment in newer, more efficient systems in anticipation of greater economic stability, which has continued to come to fruition.

Some key market trends that have begun to develop and have continued to become apparent throughout the year include continued government regulation, environmental awareness, and the evolution of the contractor with a consultative mentality.

ENDURING GOVERNMENT REGULATIONS

The U.S. Environmental Protection Agency (EPA) has continued to issue more stringent regulations and bans on chlorofluorocarbon (CFC) refrigerants, and the U.S. Department of Energy (DOE) has also issued new efficiency requirements. The previous 13-SEER national standard for air conditioning units rose to 14 SEER in most areas, and 13-SEER units are permitted for sale in some Northern regions. The more noteworthy change in 2015 may be the move from 13-SEER and 7.7-HSPF heat pumps to the new standard of 14 SEER and 8.2 HSPF for all regions. In summary, more stringent government regulations have left HVAC contractors uniquely positioned to reap the rewards of a growing replacement market.

GOING GREEN SAVES THE ‘GREEN’

A continuing trend among commercial and institutional building owners is new construction work being specified for Leadership in Energy and Environmental Design (LEED) certification. This designation can save a building owner substantial amounts of money with the reduction of energy expenses as well as through certain tax rebates and incentives offered to LEED-certified facilities. New and efficient HVAC systems not only save building owners money, but also aid in creating a more sustainable future for the environment.

CONTRACTORS: ADAPT, CHANGE, OR PERISH

Contractors around the country are adapting to more demanding consumers and more technologically advanced appliances. Some contractors have even begun to shift toward flat-rate job pricing. Consumers often prefer this method because it allows them to know from the beginning how much their maintenance or installation will cost. With this system, there are no hidden fees, hourly charges or “surprise” expensive replacement parts orders. While good for the consumer, flat-rate job pricing presents potential additional costs to contractors as they must now train employees to accurately quote maintenance and repair expenses, given the significantly decreased margin for error in price quoting. Contractors have also been forced to adapt to new technology in HVAC systems, including the addition of sensors, computer chips, and other high-tech parts that require additional knowledge and skill to be able to provide maintenance and installation services.

GEOTHERMAL, DUCTLESS, AND THE DEEP SOUTH

Despite the evolving landscape, there are many opportunities that industry players will be able to capitalize on. According to a study conducted by CMD Group, the Deep South of the U.S. accounts for 37 percent of the North American HVAC market while also consistently ranking as one of the fastest-growing regions in the country. HVAC business leaders should take note of additional opportunities spurred from a recent increase in the use of geothermal and ductless systems. Geothermal heat pumps are environmentally friendly and widely recognized for their ability to save end users on heating and cooling costs. The ductless market has seen tremendous growth since 2013 and is expected to continue well into the decade as consumers begin to better understand the advantages these products present. Advantages of ductless systems include heating and cooling in one appliance; easy, low-cost installation; cleaner, healthier air; and energy efficiency with incentive opportunities available.

CONNECTIVITY DRIVING REPLACEMENT

A trend we are particularly excited about, which is expected to promulgate rapidly in coming years, is the move toward smart and connected homes. An abundance of new products on the market allow homeowners to save on their energy bills while also providing innovative and user-friendly interfaces. Depending on geography, many of these products offer rebates, incentivizing consumers to purchase new energy-saving and smart thermostats. In 2014, Google acquired Nest Labs Inc., a designer and manufacturer of sensor-driven, Wi-Fi-compatible, self-learning, and programmable thermostats. A typical consumer can install a Nest thermostat in approximately 30 minutes, and the device can be easily connected to a smartphone using its Wi-Fi capabilities. Honeywell Intl. Inc.’s Lyric thermostat relies on a smartphone’s geofencing feature. This technology relays to the thermostat when the user is home or away. The user is able to set the geofencing feature’s range between 500 feet and 7 miles. This feature detects when the device leaves the established perimeter in order to scale down power use. When the smartphone crosses back into its range, it calls for the home to begin to reach the predetermined climate for instant comfort when the user arrives. Another new line of products known as smart vents also recently debuted in the marketplace. These devices provide room-by-room temperature control by monitoring temperature and air pressure in order to redirect air into certain rooms by opening and closing the vents. The system’s ability to monitor which rooms are most heavily trafficked or currently occupied ensures air conditioning or heating is only channeled to the necessary rooms. Notable players in this new sector include Keen Home and Ecovent Systems. As the younger generations become homeowners, expect the smart and connected home to begin to thrive.

UBER ALERT

As the Yellow Pages have almost fully been replaced by Google, traditional taxis now face head-to-head competition from Uber, and big-box retailers square off daily against Amazon, technology and change are evident everywhere. What will be the next step for HVAC contractors as technology continues to drive change? Evolving technology has been seen as creative destruction for markets across the world. Will an “Uber-like” HVAC contractor service model emerge? Don’t be left behind… and proactively plan for the future.

Raymond James & Associates actively covers the HVAC sector through its General Industrials investment banking group. For more information, contact Frank McGrew at 615-665-3626 or frank.mcgrew@raymondjames.com, or Michael Stockburger at 901-579-2705 or michael.stockburger@raymondjames.com.

Publication date: 8/10/2015

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!

Report Abusive Comment