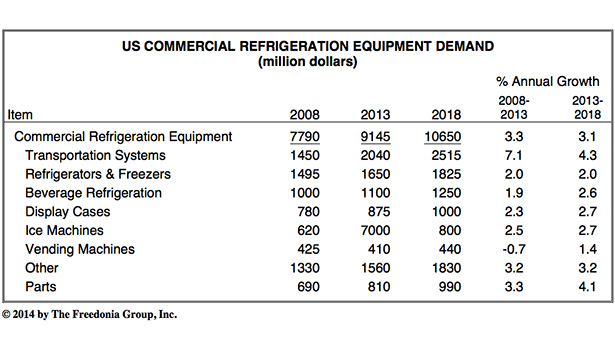

Contractors and service technicians involved in refrigeration work could be seeing a step up in business. In a report issued in mid-2014, a research company called The Freedonia Group (www.freedoniagroup.com) said that demand for commercial refrigeration equipment in the United States is expected to increase 3.1 percent per year through 2018 to $10.7 billion. But those strictly involved in stationary equipment should be aware that the largest growth, according to the report, will be in transport refrigeration.

According to the report, “Advances will be driven by an improving capital investment climate and expected growth in the foodservice and food retail sectors.”

The report specifically quoted analyst Kyle Peters as saying, “Food industry participants will seek to reduce operating costs by improving the efficiency of their refrigeration equipment, helping to drive sales.”

Driving those improved efficiencies were said to be incorporation of proximity sensors and light-emitting diode (LED) systems and from increased use of enclosed equipment. (EDITOR’S NOTE: A five-part article series on retrofitting doors onto what were once open display cases as part of increasing energy efficiencies is available here.) The Freedonia report did contend that retrofitting practices could somewhat affect decisions to go with new equipment instead.

Environmental regulations regarding refrigerants play a key role in the commercial refrigeration industry, it said.

The Refrigerant Factor

The phase out of HCFC-22 also factored into the report, in noting the large amount of equipment built before 2010 still running on the refrigerant. Contractors will need to be sensitive to R-22 supplies if they wish to continue to service older equipment.

Transportation

The report sees transport refrigeration equipment — such as that used with shipping containers, trailers, and trucks — as “the largest commercial refrigeration equipment segment and will account for the largest share of growth through 2018. Sales gains for shipping containers will be spurred by increased opportunities for U.S.-based food producers in foreign markets. Additionally, ongoing warehouse consolidation, which extends the distance from warehouses to many consumers, will boost demand for refrigerated trucks and trailers. “

But the report also said, “Although transportation refrigeration equipment will achieve the fastest growth, most other categories will also post accelerated gains over the forecast period as the economic environment continues to improve.”

EDITOR’S NOTE: The report Commercial Refrigeration Equipment (published 05/2014, 262 pages) is available from The Freedonia Group, Inc. which may be contacted at www.freedoniagroup.com.

Report Abusive Comment