We need a new-look supply chain to tackle the big future challenges regarding building services.

We are starting to see the sum of the benefits of increased confidence in the economy feeding into our sector with small rises in investment and workloads. We are definitely on the right road again, but a full recovery is going to be a long haul. Building engineering service firms still have a lot of work to do to adapt the way we work and make sure we are fit for the challenges ahead.

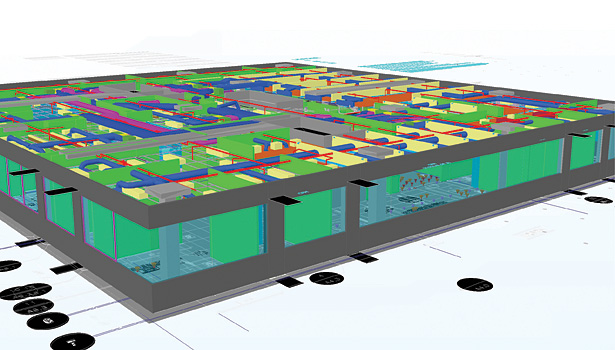

This is a very different looking industry from the one that went into the recession. New technologies and the growth of digital construction are being matched by new ways of working. The gradual adoption of building information modeling (BIM), which will become mandatory on [European] public sector contracts in less than three years’ time, is a case in point.

Reviewing the shape and structure of our workforce, to ensure that it remains fully in line with the needs of our industry and its clients, is an almost continual process, but it is necessary if we are to play our full part in the implementation of the industrial strategy for construction, which is key to all of our futures.

Business secretary Vince Cable gave us a glimpse of how that future might look when he launched the strategy during the summer. The government has also taken some positive steps to support it by committing over £100 billion of public investment to infrastructure projects, including the building or repair of 200,000 affordable homes up to 2020.

Catalyst

Cable anticipates 70 percent growth in the international construction market and reflected the government’s view that the U.K. construction market is a catalyst for a general economic recovery.

However, he also acknowledged that sustained growth will only be possible if the supply chain is substantially remodeled by embracing new approaches and improving risk allocation throughout the supply chain. That is crucial.

A code of fair payment has to be at the heart of any successful expansion of our industry and this is now firmly on the table. Unless contractors have the security of cash flow, the construction recovery will founder very quickly. If contractors are continually forced to battle for their rightful payments, there is always a negative consequence for end clients.

The strategy promises to champion the range of finance products available, including initiatives such as supply chain finance, project bank accounts (PBAs), and the enterprise finance guarantee. All of these things have long been argued for by B&ES and by its partners in the Specialist Engineering Contractors’ (SEC) Group.

A healthy and profitable supply chain can invest in the necessary skills and technologies to deliver the low-carbon and high-quality building stock we need — and export that expertise to growing international markets. However, that means the government has to play its part in reforming the construction procurement process in general, and its own in particular, to ensure the recovery is built on solid foundations.

We need to see PBAs being made the norm on all public sector construction as that will also encourage private sector clients to follow suit — particularly those who regularly procure. By reducing financial risk for all parties, clients will gain from the work of a fully integrated and motivated delivery team with everyone bought into the key decisions on design, risk, and cost. This is the best way to ensure a high-quality outcome and a building that meets the user’s needs and aspirations — with energy management an increasing priority.

The sheer scale of the potential building retrofit program is daunting, but we do have the expertise in this country to take it on — both on behalf of individual clients and for the benefit of the whole country.

Power regulator Ofgem believes that power cuts will be a regular occurrence in the U.K. by the middle of this decade. Spare electricity capacity will be just 2 percent by 2015, which means we have almost no margin for error during times of peak demand — particularly in winter.

The recession held back investment in new power generation capacity so that the first new nuclear power station will not be generating power until at least 2020 — possibly even later — and renewables still account for less than 10 percent of our energy mix. The government’s Green Deal and Renewable Heat Incentive (RHI) programs are laudable initiatives, but small steps like these will take decades to change our energy landscape.

Shale gas? Yes, there’s much excitement about that, but getting to our large reserves is problematic in such a densely populated island — we are not the U.S., where they have plenty of wilderness in which to drill.

So what’s left? Reducing demand has to be the focus. Not only is it achievable; it can be done quickly and much more cheaply than trying to build a completely new energy generation infrastructure. A massive program of very rapid energy efficiency can give us some breathing space while we wait for a new generation to catch up.

The building engineering services sector is best placed to deliver this energy efficiency on an industrial scale because we understand what is required technically. Unfortunately, we still tend to approach projects in pretty much the same way we always have and the traditional supply chain restricts us to just tweaking designs — finding replacement technologies that use marginally less energy when the urgency of the situation calls for something more radical. That is why a new-look supply chain is so crucial.

Simply doing things the same way we always have is reducing the potential for us to sell our expertise as building engineering specialists. Energy shortages represent a huge business opportunity for companies with the right competence and understanding of how to cut demand.

We need to stretch ourselves by designing for occupancy. That means finding out what the occupant intends to do with a new or refurbished building — we should also be designing our systems so they are easy to maintain. Too many “sustainable” solutions are extraordinarily complex and hard for nontechnical building occupants to understand.

We also have to monitor the actual performance of a building so clients can compare their results with best practice and industry benchmarks. After all, you can’t save what you can’t measure. That means revisiting completed projects and learning their lessons. The data produced by display energy certificates (DECs) proves that a large number of buildings simply do not live up to their promises.

BIM — which might more correctly be called “Better” Information Modeling — presents a vision of a new type of supply chain that has the design and installation professions working hand in glove with building owners and facility managers from the very outset. This allows us to explain and fine-tune the “energy hierarchy” of a building so we can start with basic, low-cost measures such as insulation and high-quality glazing. Tackling thermal gain with solar shading, for example, will reduce the need for mechanical cooling and allow greater use of passive solutions.

Adding intelligent controls systems and sensors to installed building services systems makes them operate more sensibly, including turning off automatically when not needed.

Only once these basic measures are complete should building managers consider replacement technologies and, even then, they should first look at introducing new pumps or variable-speed motors that do not significantly alter the set up of the system, but can make immediate improvements to running costs.

It’s this kind of strategic approach to buildings that will make all the difference to our collective futures, but it is only happening sporadically across our industry. We must take the chance during the current gradual recovery to bed in more integrated ways of working that ensure better outcomes and represent more sustainable business models for the future.

Content for the European Spotlight is provided courtesy of Refrigeration and Air Conditioning Magazine, London. For more information, visit www.racplus.com.

Publication date: 1/20/2014

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!

Report Abusive Comment