|

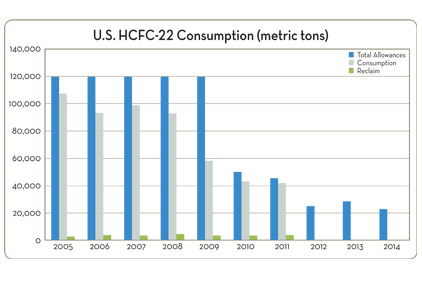

| This chart prepared by the U.S. Environmental Protection Agency (EPA) shoes measurements in metric tons rather than the more familiar pounds. But it demonstrates the continual reduction in R-22 allowances and — as indicated in 2010 and 2011 — how close demand is coming to supply. |

The U.S. Environmental Protection Agency (EPA) is going to allow 62.8 million pounds of HCFC-22 to be produced or imported in 2013. That's about a 13 percent increase over the 55 million pounds allowed in 2012, though the number is expected to drop off about 20 percent in 2014, to 51 million pounds.

EPA Final Adjustment Rule

The 62.8 million pounds was announced in the EPA’s Final Adjustment Rule, published April 3 in the Federal Register.

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!

The spike in production for 2013 comes, according to many in the industry, as the EPA attempts to meet demand for the refrigerant. The subsequent decline in 2014 is designed to keep EPA on track to meet a goal of eliminating production or importation of the refrigerant by 2020.

The EPA shared that this increase is anticipated to occur only once, evidenced by the anticipated decrease in 2014.

Mack McFarland, environmental fellow, DuPont, said the EPA is factoring a drawdown of inventoried R-22 held by producers, distributors, and end users, as well as a significant spike in reclamation in its determination of how much R-22 the industry needs. McFarland said the current reclamation amounts are approximately 8 million pounds a year, whereas the EPA is expecting about 44 million pounds will be needed to keep supplies and demand in balance. He said the EPA is trying to drive the industry to rely more heavily on reclamation to provide an adequate supply of R-22.

Uncertainty

Because of the EPA’s anticipated 2020 phase out, even the short-term availability and cost of R-22 remains uncertain.

Charlie McCrudden, vice president for government relations, Air Conditioning Contractors of America (ACCA) said, “Contractors may want to contact their wholesalers or gas distributors to inquire about any changes in pricing or sales policies in light of the 2013 Final Adjustment Rule. Despite the unexpected increase in the allocations for 2013, the market remains volatile and prices for R-22 may not respond adequately.”

A graph developed by the EPA (see above) demonstrates that the gap between production and use of R-22 has narrowed considerably the past few years. That is leading some in the industry to predict a shortfall, especially if reclamation efforts are not stepped up to the levels that the EPA is predicting.

On its website, Polar Technology expressed some concern as to how the 2013 spike may be viewed by contractors. “At this time, we are unable to predict the outcome from this action and we can only anticipate that the market will achieve some type of equilibrium. (But) the allocation increase has the potential to deflate the efforts being invested into conversions as well as decrease recovery and reclaim rates. Now, we are left with more questions than results.”

Polar Technology suggested that allocations for 2015 could be as low as 35 million pounds.

McFarland noted, “It is responsible for the industry to continue the move away from R-22. Contractors should continue to work with their customers in this transition.”

CLICK HERE to download a pdf of chart.

Publication date: 4/22/2013

Report Abusive Comment